US Dollar Outlook: EUR/USD

EUR/USD remains under pressure following the update to the US Consumer Price Index (CPI), and the exchange rate may continue to give back the rebound from the monthly low (1.0448) as it fails to trade back above the former support zone around the May low (1.0635).

US Dollar Forecast: EUR/USD Rebound Stalls at Former Support Zone

EUR/USD appears to be reversing ahead of the 50-Day SMA (1.0729) as it continues to pullback from a fresh monthly high (1.0640), and the US Dollar may outperform its European counterpart ahead of the Federal Reserve interest rate decision on November 1 as the stickiness in the CPI puts pressure on the central bank to further combat inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Until then, EUR/USD may struggle to retain the rebound from the yearly low (1.0445) should it track the negative slope in the moving average, and developments coming out of the US may sway the exchange rate as the Retail Sales report is anticipated to another rise in household consumption.

US Economic Calendar

US Retail Sales are projected to increase 0.3% in September following the 0.6% expansion the month prior, and little signs of a looming recession may spark a bullish reaction in the Dollar as it raises the Fed’s scope to pursue a more restrictive policy.

However, a weaker-than-expected Retail Sales report may drag on the Greenback as it encourages the Federal Open Market Committee (FOMC) to keep US interest rates on hold, and indications of a slowing economy may fuel speculation for a looming change in regime as the central bank seems to be at or nearing the end of its hiking-cycle.

With that said, the failed attempt to trade back above the former support zone around the May low (1.0635) may lead to a further decline in EUR/USD as it carves a series of lower highs and lows, and the exchange rate may struggle to retain the rebound from the monthly low (1.0448) should it track the negative slope in the 50-Day SMA (1.0729).

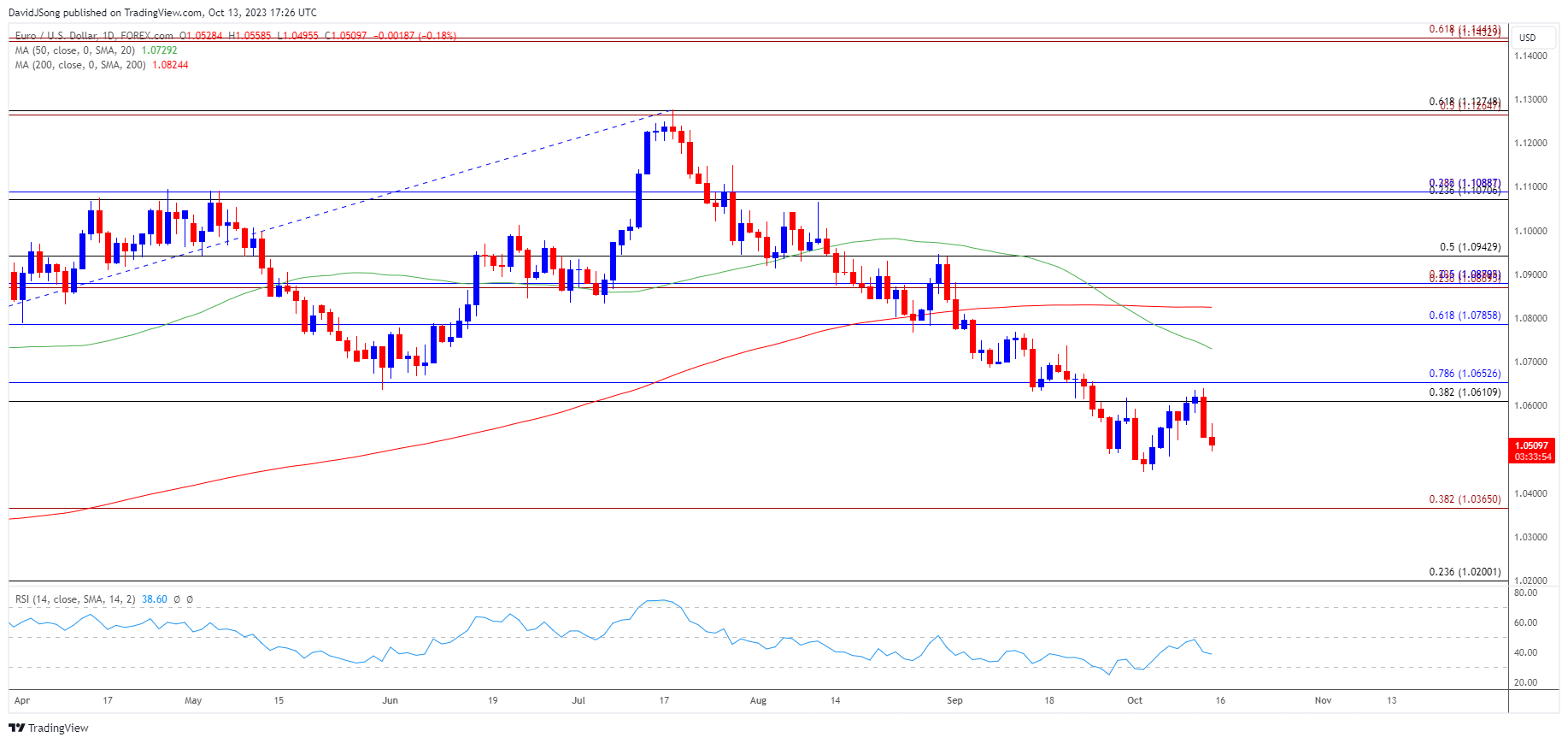

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD continues to fall back from a fresh monthly high (1.0640) after testing the former support zone around the May low (1.0635), and the exchange rate may continue to give back the advance from the monthly low (1.0448) as it initiates a series of lower highs and lows.

- In turn, EUR/USD may track the negative slope in the 50-Day SMA (1.0729) amid the lack of momentum to break/close above the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region, and failure to defend the October range may spur a run at the December 2022 low (1.0393).

- Next area of interest comes in around 1.0370 (38.2% Fibonacci extension), but EUR/USD may trade within a defined range if it holds above the monthly low (1.0448).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Defends Monthly Low Ahead of US CPI

GBP/USD Forecast: Test of Former Support Zone Looms

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong