US Dollar Outlook: EUR/USD

EUR/USD approaches the monthly high (1.0617) as it gives back the reaction to the 336K rise in US Non-Farm Payrolls (NFP), and the exchange rate may attempt to break out of the opening range for October as it bounces back ahead of the December 2022 low (1.0393).

US Dollar Forecast: EUR/USD Rebound Emerges Ahead of December 2022 Low

EUR/USD extends the rebound from the monthly low (1.0448) to stage a three-day rally, but the ongoing rise in US employment may encourage the Federal Reserve to further combat inflation as the economy shows little signs of a recession.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

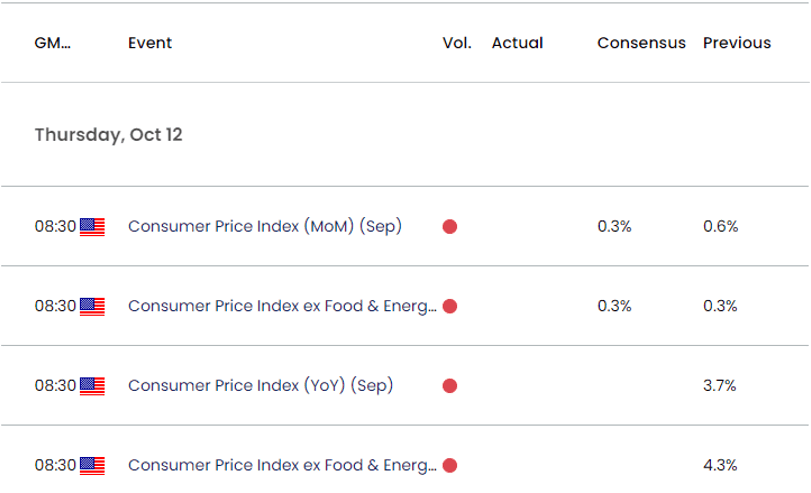

US Economic Calendar

As a result, the US Consumer Price Index (CPI) may put pressure on the Federal Open Market Committee (FOMC) to carry out a more restrictive policy should the update reveal sticky inflation, but a weaker-than-expected report may produce headwinds for the US Dollar as Fed Vice-Chair Michael Barr warns that the ‘full effects of past tightening are yet to come.’

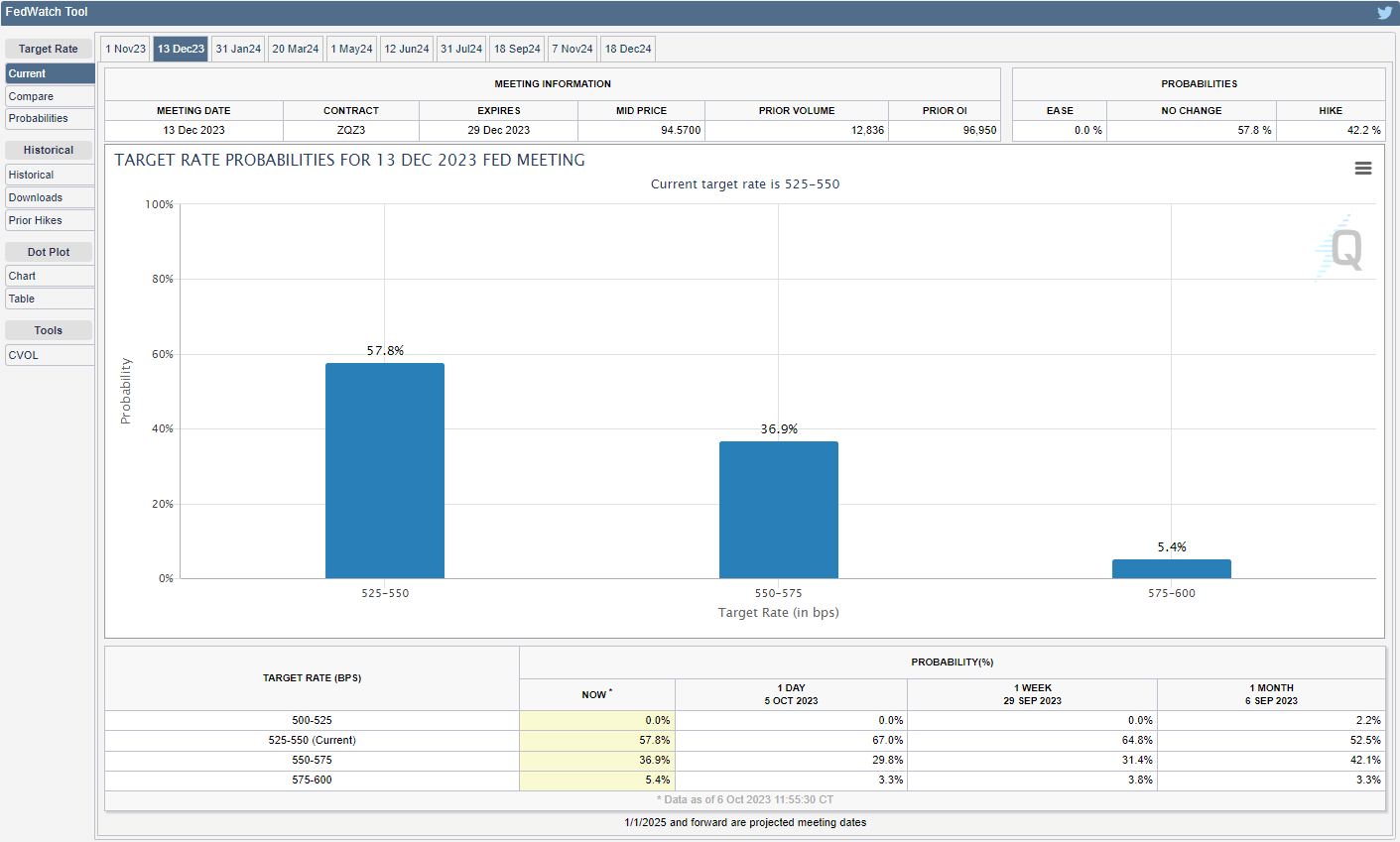

CME FedWatch Tool

In turn, speculation surrounding Fed policy may sway EUR/USD as the CME FedWatch Tool reflects a greater than 50% probability of seeing US interest rates unchanged over the remainder of the year, but the failed attempt to test the December 2022 low (1.0393) may keep the exchange rate afloat as it extends the rebound from the monthly low (1.0448).

With that said, EUR/USD may attempt to break out of the opening range for October as the Relative Strength Index (RSI) continues to move away from oversold territory, but the exchange rate may track the negative slope in the 50-Day SMA (1.0771) if it fails to clear the monthly high (1.0617).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD stages a three-day rally to keep the Relative Strength Index (RSI) above 30, and the oscillator may continue to show the bearish momentum abating as it moves away from oversold territory.

- A break/close above the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region may push EUR/USD towards the 50-Day SMA (1.0771), with the next area of interest coming in around 1.0790 (61.8% Fibonacci retracement).

- However, EUR/USD may track the negative slope in the moving average if it fails to breakout of the opening range for October, with a breach below the monthly low (1.0448) bringing the December 2022 low (1.0393) back on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/CAD RSI Flirts with Overbought Zone

GBP/USD Forecast: RSI Recovers from Oversold Territory

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong