US Dollar Outlook: EUR/USD

EUR/USD registers a fresh monthly high (1.0895) even though it fails to extend the recent series of higher highs and lows, and a move above 70 in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in the exchange rate like the price action from earlier this year.

US Dollar Forecast: EUR/USD Rally Susceptible to Overbought RSI Signal

EUR/USD cleared the September high (1.0882) following the softer-than-expected US Consumer Price Index (CPI), and the exchange rate may continue to retrace the decline from the August high (1.1065) amid waning expectations for higher US interest rates.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

CME FedWatch Tool

Source: CME

The CME FedWatch Tool currently reflects a greater than 90% probability of seeing the Federal Reserve retain the status quo at it last meeting for 2023, and speculation for a looming change in regime may keep EUR/USD afloat as the central bank seems to be at or nearing the end of its hiking-cycle.

US Economic Calendar

As a result, it remains to be seen if the Federal Open Market Committee (FOMC) Minutes will sway EUR/USD as Chairman Jerome Powell keeps the door open to further combat inflation, and the transcript may generate bullish reaction in the Greenback should Fed officials prepare US households and businesses for a more restrictive policy.

However, more of the same from the FOMC may spur a limited reaction as the committee plans to ‘make our decisions meeting by meeting,’ and EUR/USD may attempt to retrace the decline from the August high (1.1065) as it extends the advance from the start of the month.

With that said, an overbought reading in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in EUR/USD like the price action from earlier this year, but the oscillator may show the bullish momentum abating if it fails to push above 70.

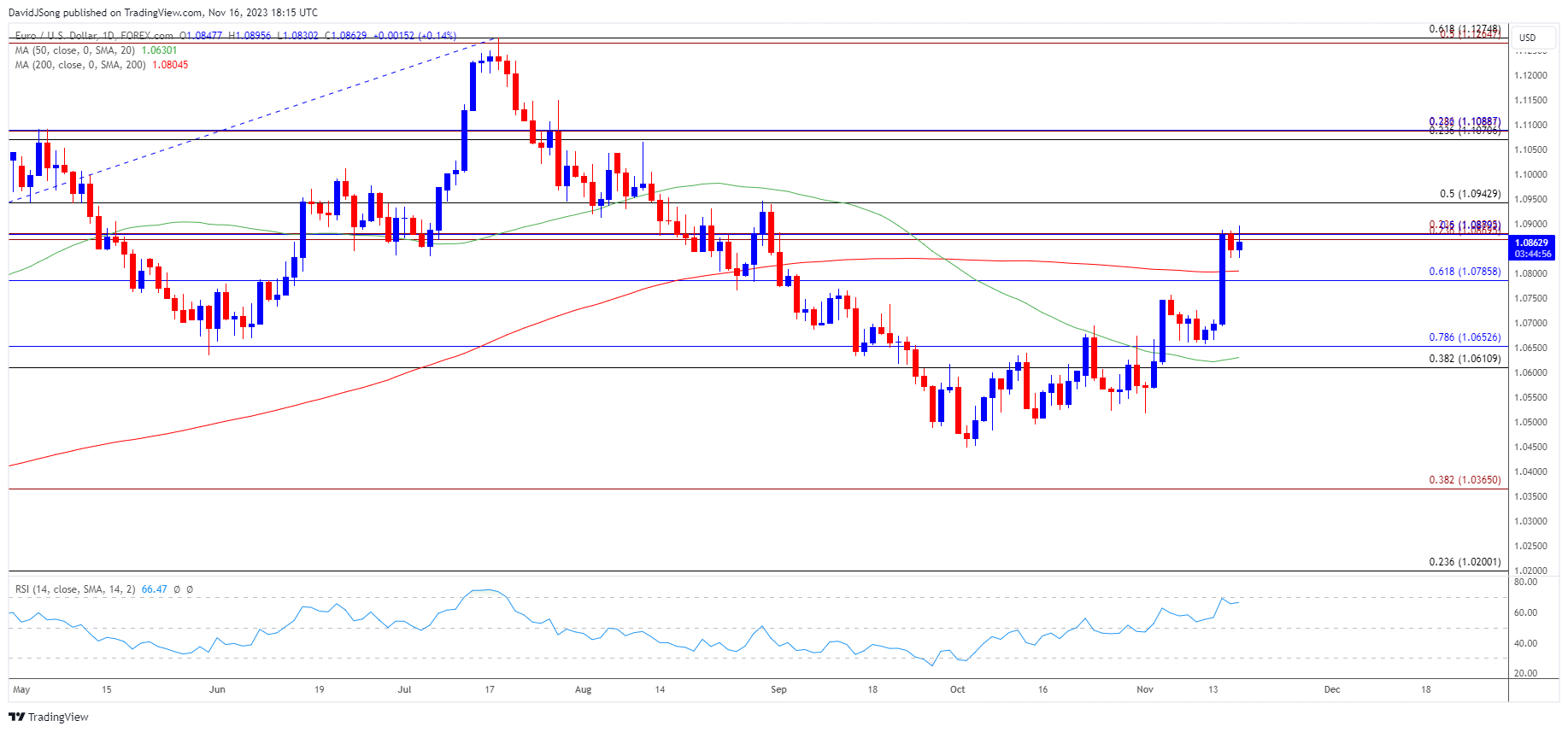

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD trades to a fresh monthly high (1.0896) after clearing the September high (1.0882), with a close above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region raising the scope for a move towards 1.0940 (50% Fibonacci retracement).

- At the same time, a move above 70 in the Relative Strength Index (RSI) is likely to be accompanied by a further rise in EUR/USD like the price action from earlier this year, with the next area of interest coming in around the August high (1.1065).

- However, the RSI may show the bullish momentum abating if it fails to cross into overbought territory, and lack of momentum to close above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region may push EUR/USD back towards 1.0790 (61.8% Fibonacci retracement).

- Next area of interest comes in around 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement), with a breach of the monthly low (1.0517) opening up the yearly low (1.0448).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rally Stalls to Keep RSI Below 70

USD/CAD Forecast: November High in Focus Following Test of 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong