US Dollar Outlook: EUR/USD

EUR/USD continues to appreciate following the Federal Reserve interest rate decision as the European Central Bank (ECB) plans to reduce the Pandemic Emergency Purchase Program (PEPP) in the second half of 2024 by ‘EUR7.5 billon per month on average.’

US Dollar Forecast: EUR/USD Rally Persists Following Fed and ECB

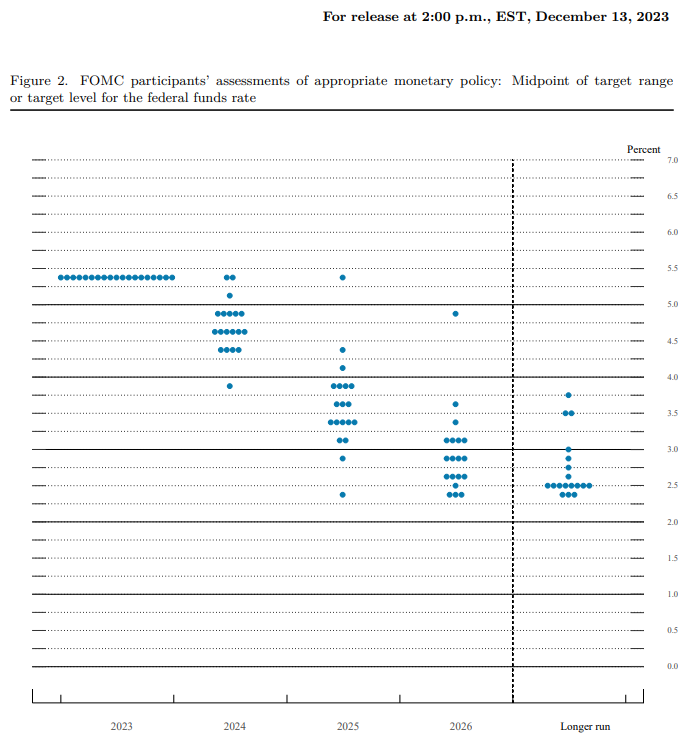

EUR/USD seems to have reversed ahead of the 50-Day SMA (1.0733) as it rallies to a fresh monthly high (1.1009), with the exchange rate approaching the November high (1.1017) as Fed officials forecast the ‘the federal funds rate will be 4.6 percent at the end of 2024.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Federal Reserve Summary of Economic Projections (SEP)

It seems as though the Federal Open Market Committee (FOMC) will switch gears in 2024 as Chairman Jerome Powell and Co. ‘believe that our policy rate is likely at or near its peak for this tightening cycle,’ and the Euro may outperform its US counterpart over the coming months as the ECB intends to ‘discontinue reinvestments under the PEPP at the end of 2024.’

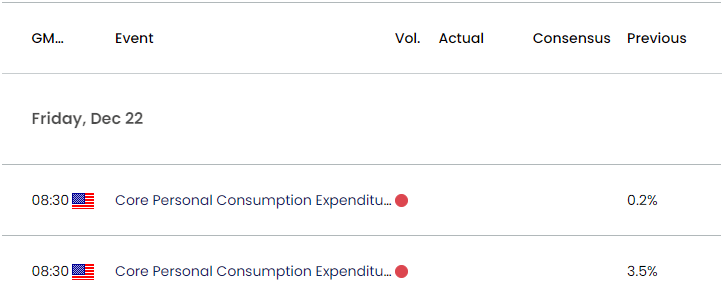

US Economic Calendar

In turn, EUR/USD may continue to carve a series of higher highs and lows ahead of the update to the US Personal Consumption Expenditure (PCE) Price Index, and evidence of easing inflation may generate a bearish reaction in the Greenback as it puts pressure on the FOMC to implement a rate-cut sooner rather than later.

However, a higher-than-expected reading for the core PCE, the Fed’s preferred gauge for inflation, may curb the recent advance in EUR/USD as it raises the central bank’s scope to keep US interest rates higher for longer.

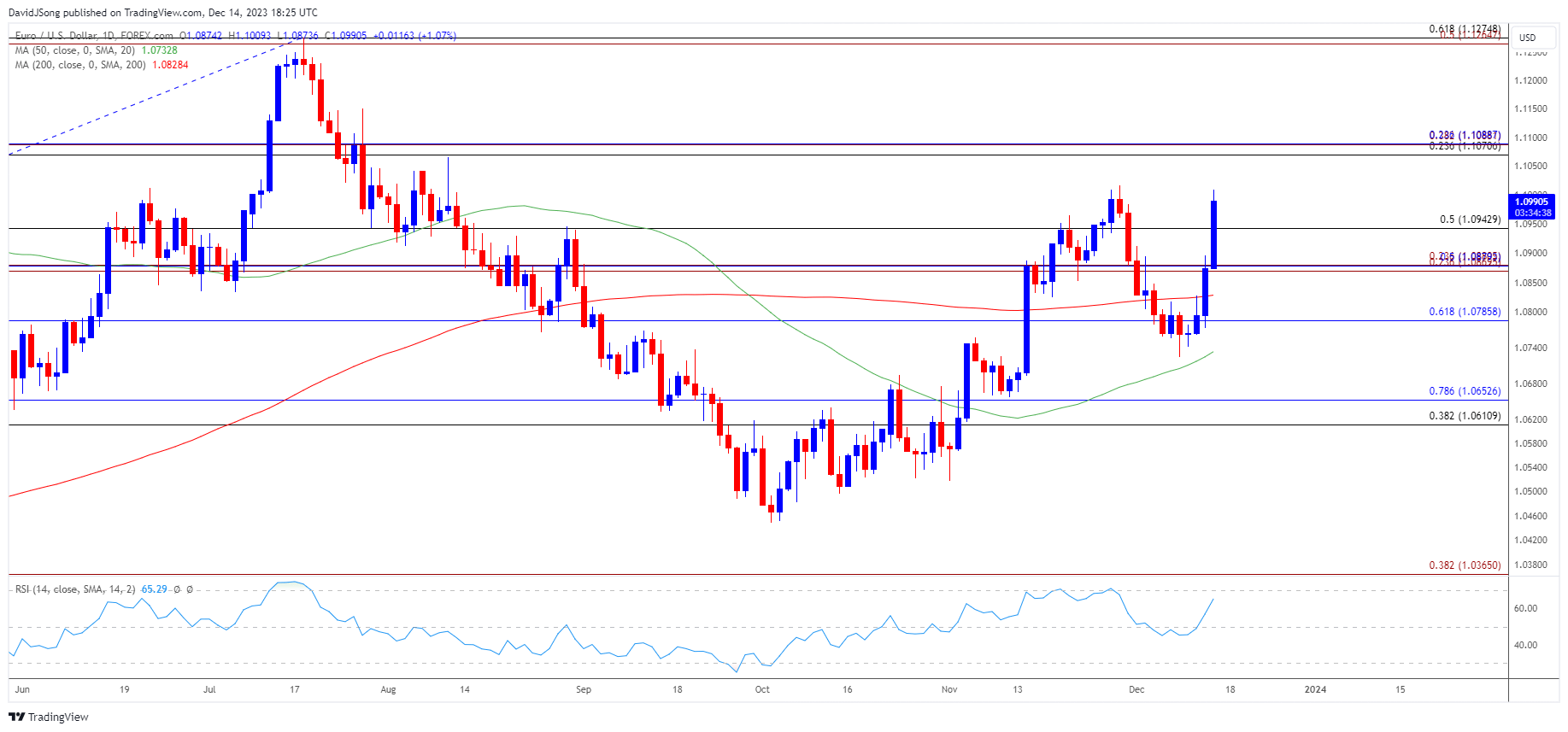

With that said, EUR/USD appears to be on track to test the November high (1.1017) as it extends the advance from the start of the week, and developments in the Relative Strength Index (RSI) may show the bullish momentum gathering pace as it approaches overbought territory.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD bounced back ahead of the 50-Day SMA (1.0733) to clear the opening range for December, and the exchange rate may track the positive slope in the moving average as it approaches the November high (1.1017).

- Will keep a close eye on the Relative Strength Index (RSI) as the recent rally in EUR/USD pushes the oscillator towards overbought territory, with a move above 70 in the indicator likely to be accompanied by a further advance in the exchange rate like the price action from earlier this year.

- Next area of interest comes in around the August high (1.1065), with a break/close above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (23.6% Fibonacci retracement) region opening up the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) area, which incorporates the yearly high (1.1276).

- However, lack of momentum to break/close above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (23.6% Fibonacci retracement) region may curb the bullish price series in EUR/USD, with a move below 1.0940 (50% Fibonacci retracement) bringing the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) area back on the radar.

Additional Market Outlooks

US Dollar Forecast: AUD/USD Post-RBA Weakness Persists Ahead of Fed

US Dollar Forecast: GBP/USD Falls Toward Channel Support

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong