US Dollar Outlook: EUR/USD

EUR/USD pulls back ahead of the March high (1.0981) to keep the Relative Strength Index (RSI) out of overbought territory, but data prints coming out of the US may curb the recent weakness in the exchange rate as the Personal Consumption Expenditure (PCE) Price Index is anticipated to show slowing inflation.

US Dollar Forecast: EUR/USD Rally Fizzles Ahead of March High

EUR/USD remains under pressure following the European Central Bank (ECB) meeting even though the Governing Council kept Euro Area interest rates on hold, and the exchange rate may continue to give back the advance from the monthly low (1.0710) as it initiates a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, data prints coming out of the US may sway EUR/USD ahead of the Federal Reserve rate decision on July 31 as Chairman Jerome Powell favors a data-dependent approach in managing monetary policy, and the Personal Consumption Expenditure (PCE) Price Index may push the central bank to adjust the forward guidance as the update is anticipated to show further progress in bringing down inflation towards the Fed’s 2% target.

US Economic Calendar

The core PCE, the Fed’s preferred gauge for inflation, is seen narrowing to 2.5% in June from 2.6% per annum the month prior, and evidence of easing price growth may produce headwinds for the US Dollar as it puts pressure on the Federal Open Market Committee (FOMC) to implement lower interest rates.

However, a higher-than-expected PCE print may force the Fed to further combat inflation, and EUR/USD may continue to pullback from the monthly high (1.0948) on the back of waning speculation for an imminent Fed rate-cut.

With that said, EUR/USD may further retrace the advance from the monthly low (1.0710) amid the failed attempt to test the March high (1.0981), but the exchange rate may hold within the range from earlier this year as the 50-Day SMA (1.0814) starts to reflect a positive slope.

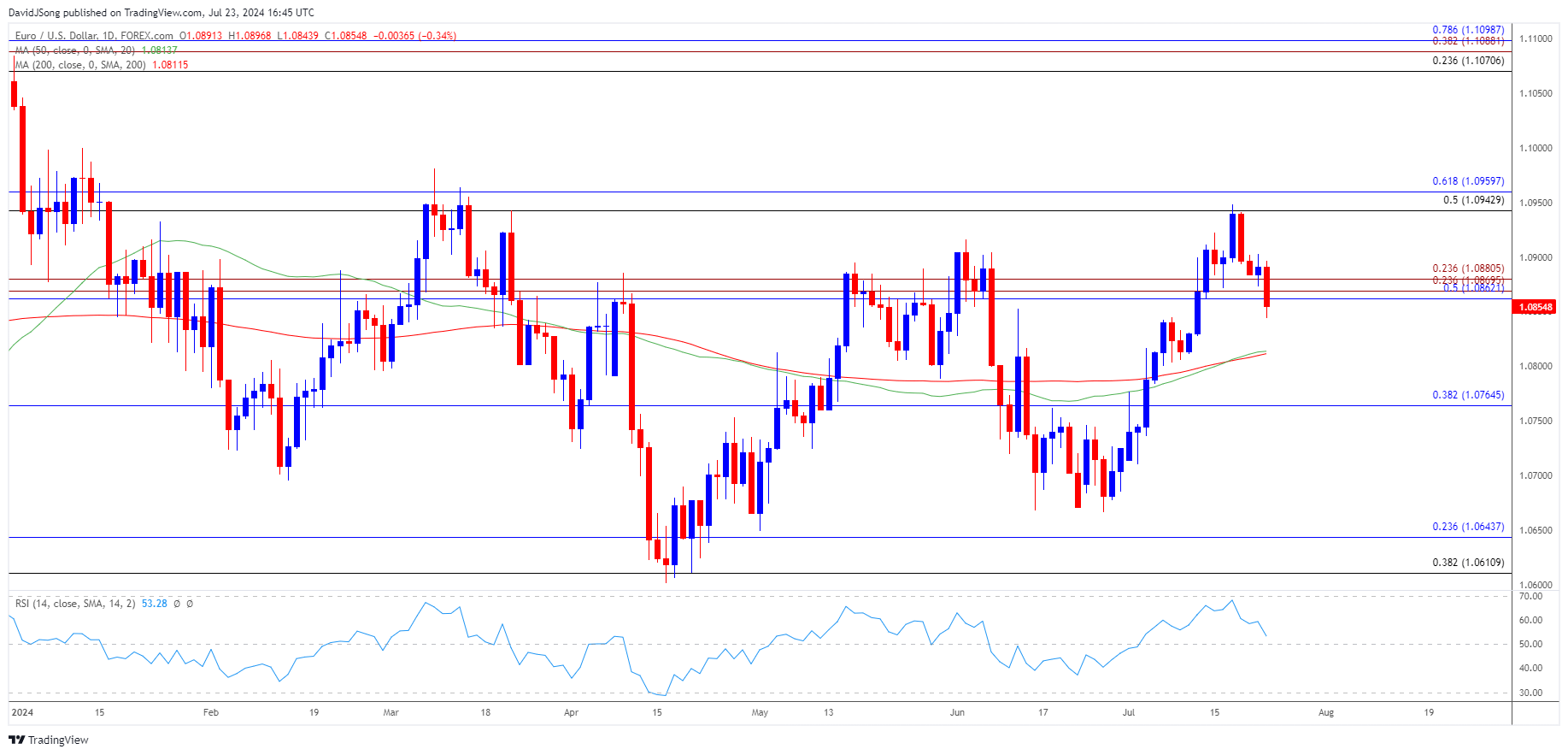

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD reversed ahead of the March high (1.0981) to keep the Relative Strength Index (RSI) below 70, and lack of momentum to hold above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region may push the exchange rate back towards 1.0770 (38.2% Fibonacci retracement).

- Failure to defend the monthly low (1.0710) may lead to a test of the June low (1.0666) but EUR/USD may hold within the range from earlier this year as the 50-Day SMA (1.0814) develops a positive slope.

- Need a move back above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region to bring the monthly high (1.0948) on the radar, with a breach above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone opening up the March high (1.0981).

Additional Market Outlooks

USD/JPY Reverses Ahead of 50-Day SMA to Approach Monthly Low

Canadian Dollar Forecast: USD/CAD Eyes Monthly High Ahead of BoC

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong