US Dollar Outlook: EUR/USD

EUR/USD registers a fresh monthly high (1.0981) as the US Non-Farm Payrolls (NFP) report shows the Unemployment Rate unexpectedly climbing to 3.9% in February from 3.7% the month prior, and the exchange rate may attempt to test the January high (1.1046) as it carves a series of higher highs and lows.

US Dollar Forecast: EUR/USD Rally Brings January High on Radar

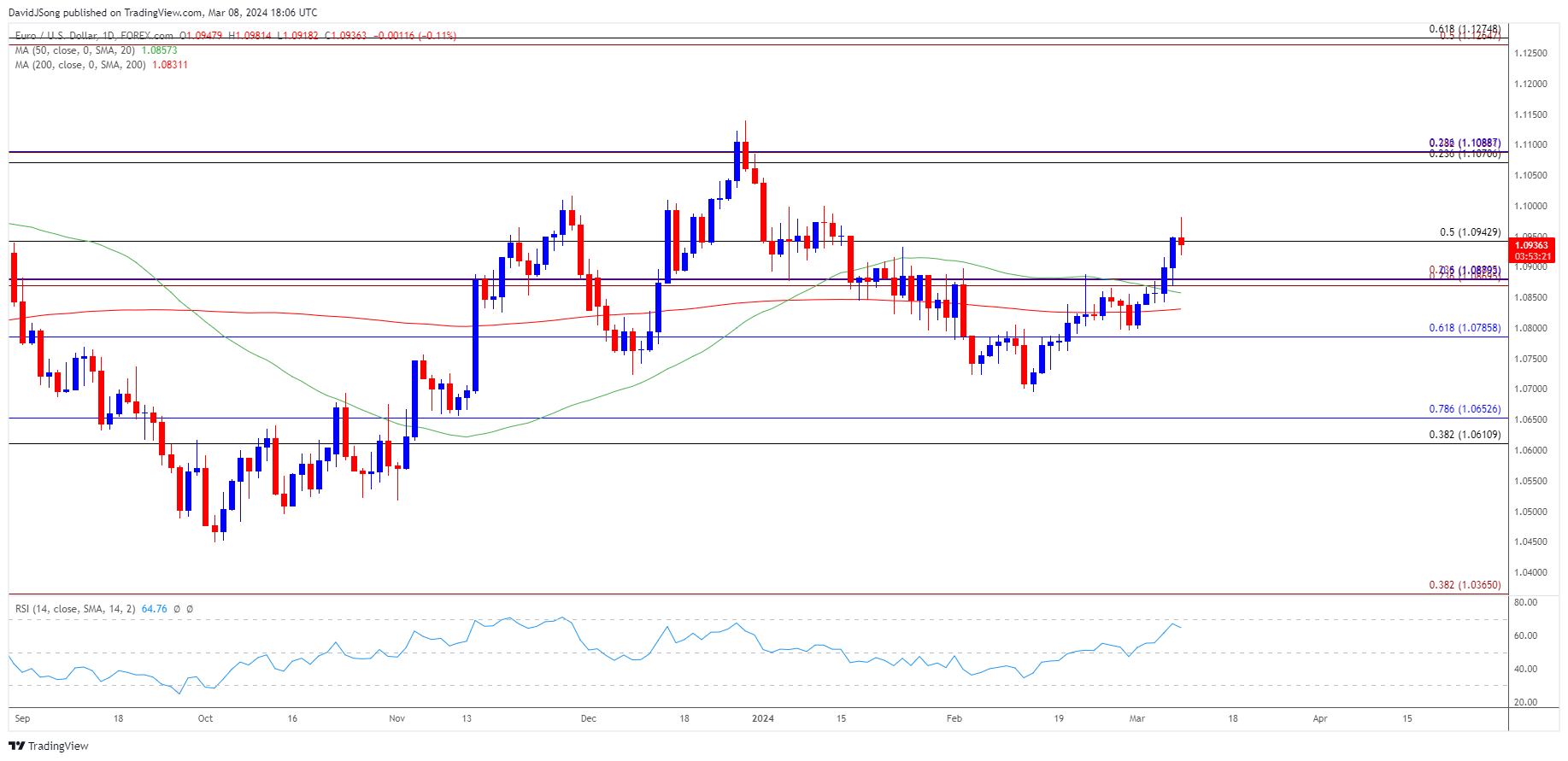

Keep in mind, EUR/USD pushed above the 50-Day SMA (1.0858) following the semi-annual testimony from Federal Reserve Chairman Jerome Powell, and it seems as though the exchange rate will no longer respond to the negative slope in the moving average as it extends the advance from the start of the month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

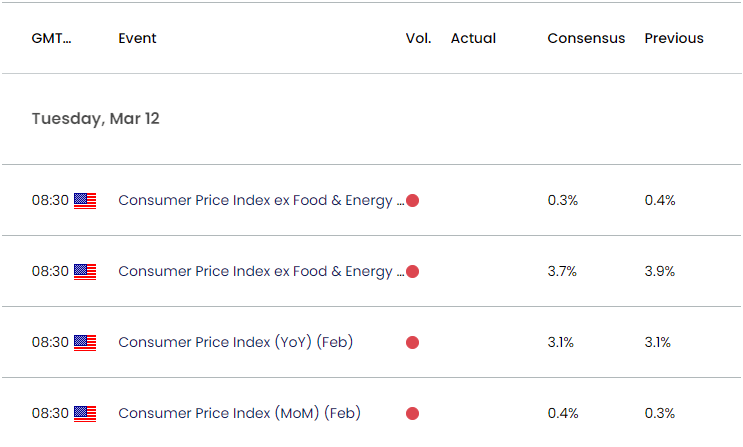

US Economic Calendar

Looking ahead, the update to the US Consumer Price Index (CPI) may keep EUR/USD afloat should the report show slowing inflation, but signs of sticky price growth may force the Federal Open Market Committee (FOMC) to retain a hawkish forward guidance at its next interest rate decision on March 20 as the ‘Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.’

Until then, data prints coming out of the US may sway EUR/USD as the Fed carries out a data dependent approach in managing monetary policy, but the exchange rate may attempt to retrace the decline from the January high (1.1046) as it extends the advance from the start of the month.

With that said, EUR/USD may continue to carve a series of higher highs and lows as it no longer responds to the negative slope in the 50-Day SMA (1.0859), but the Relative Strength Index (RSI) may show the bullish momentum abating as it struggles to push into overbought territory.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD extends the advance from the start of March to register a fresh monthly high (1.0981), and the exchange rate may attempt to test the January high (1.1046) as it carves a series of higher highs and lows.

- A move above 70 in the Relative Strength Index (RSI) likely to be accompanied by a further advance in EUR/USD like the price action from last year, with a break/close above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (23.6% Fibonacci retracement) region opening up the December high (1.1140).

- However, the RSI may show the bullish momentum abating should if fail to push into overbought territory, with a break/close below the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) bringing the monthly low (1.0798) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rally Eyes December High

US Dollar Forecast: AUD/USD Faces Negative Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong