US Dollar Outlook: EUR/USD

EUR/USD slips to a fresh weekly low (1.0778) ahead of the US Non-Farm Payrolls (NFP) report with the opening range for August in focus as the exchange rate extends the decline from the July high (1.0948).

US Dollar Forecast: EUR/USD Opening Range for August in Focus

Keep in mind, the recent weakness in EUR/USD emerged following the failed attempt to test the March high (1.0981), but the exchange rate may track the range from the first half of 2024 amid the flattening slope in the 50-Day SMA (1.0810).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

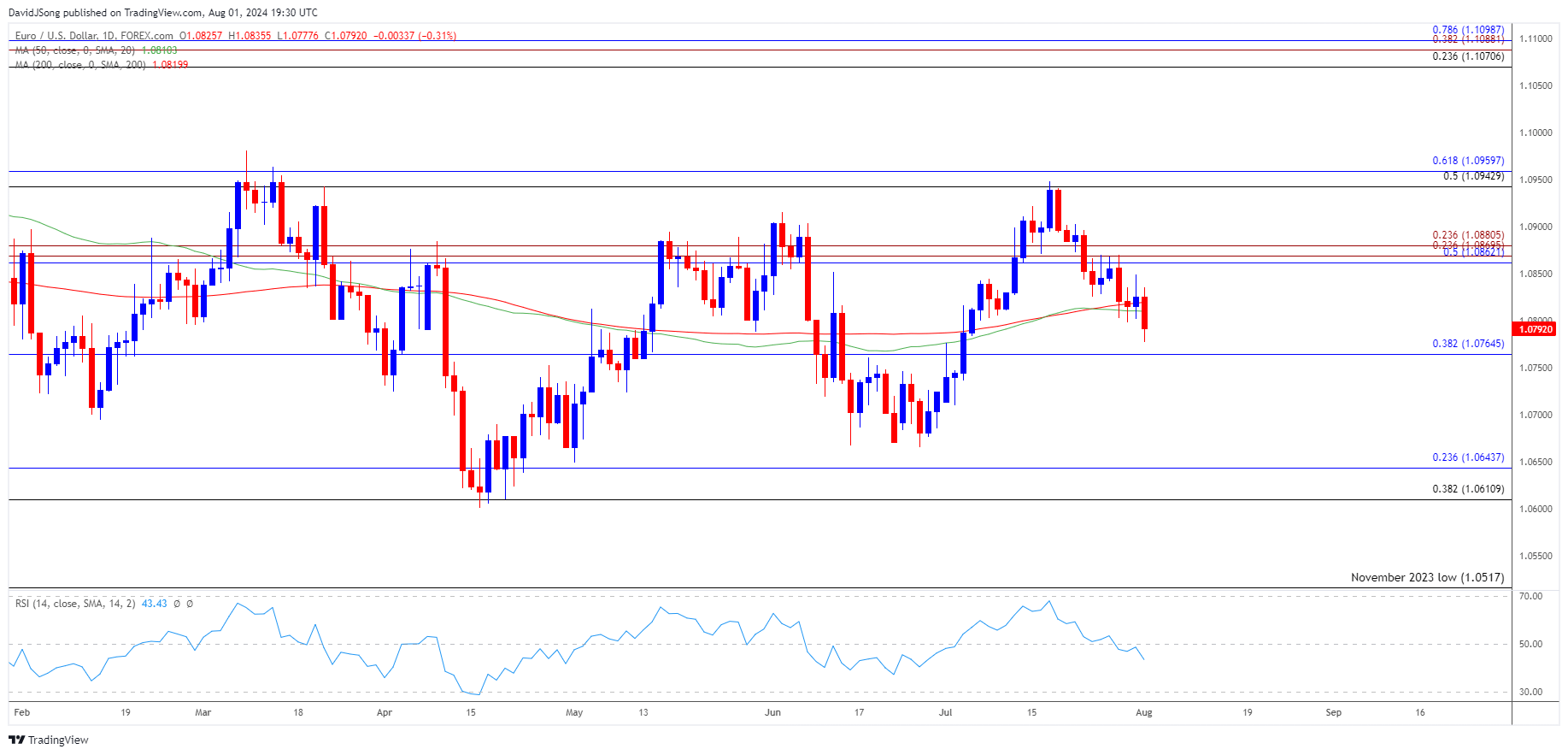

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD gives back the rebound from earlier this week to initiate a series of lower highs and lows, with a break/close below 1.0770 (38.2% Fibonacci retracement) opening up the July low (1.0710).

- Next area of interest comes in around the June low (1.0666) with a breach below the May low (1.0650) raising the scope for a move towards the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region.

- Nevertheless, EUR/USD may trade within the range from earlier this year should it track the flattening slope in the 50-Day SMA (1.0810) but need a break/close above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) zone to bring the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

USD/JPY Reverses Ahead of 50-Day SMA to Approach Monthly Low

Canadian Dollar Forecast: USD/CAD Eyes Monthly High Ahead of BoC

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong