US Dollar Outlook: EUR/USD

EUR/USD failed to defend the opening range for August after struggling to hold above the 50-Day SMA (1.0975), and the exchange rate may no longer track the positive slope in the moving average if it breaches the July low (1.0834).

US Dollar Forecast: EUR/USD on Cusp of Testing July Low

EUR/USD continues to register a fresh weekly low (1.0862) as the Federal Open Market Committee (FOMC) Minutes reveal a hawkish forward guidance, and the central bank may take additional steps to combat inflation as ‘the staff no longer judged that the economy would enter a mild recession toward the end of the year.’

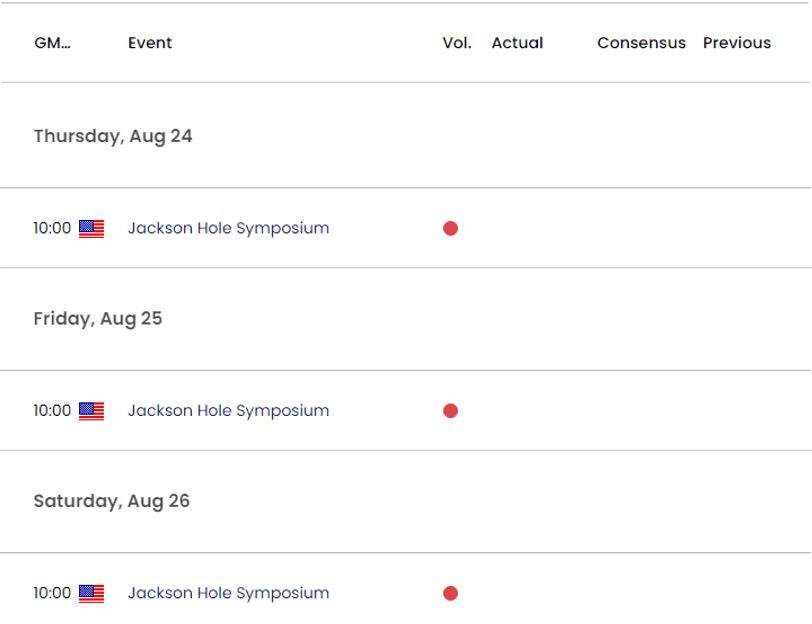

It seems as though the FOMC will keep the door open to implement higher interest rates as the committee needs ‘further signs that aggregate demand and aggregate supply were moving into better balance to be confident that inflation pressures were abating,’ and it remains to be seen if Chairman Jerome Powell and Co. will disclose new information at the Kansas City Economic Symposium in Jackson Hole, Wyoming amid the ‘Committee's data-dependent approach to policy.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Until then, speculation surrounding Fed policy may sway EUR/USD as Fed officials are slated to update the Summary of Economic Projections (SEP) at the September meeting, but failure to defend the opening range for August may lead to a further decline in the exchange rate as it initiates a series of lower highs and lows.

With that said, EUR/USD may no longer track the positive slope in the 50-Day SMA (1.0975) as struggles to trade back above the moving average, but the exchange rate may face range bound conditions if it fails to breach the July low (1.0834).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD failed to defend the opening range for August after struggling to hold above the 50-Day SMA (1.0975), and the exchange rate may no longer track the positive slope in the moving average as it carves a series of lower highs and lows.

- A breach below the July low (1.0834) may push EUR/USD towards the 200-Day SMA (1.0789), with a break/close below 1.0790 (61.8% Fibonacci retracement) bringing the June low (1.0662) on the radar.

- Nevertheless, failure to close below the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region may keep EUR/USD above the July low (1.0834), with a move above the 50-Day SMA (1.0975) bringing the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area back on the radar.

Additional Market Outlooks

GBP/USD Outlook Mired by Failure to Defend Monthly Opening Range

USD/JPY Breaks Above Monthly Opening Range to Eye Yearly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong