US Dollar Outlook: EUR/USD

EUR/USD stages a five-day advance after negating a bear-flag formation, but the exchange rate may track the negative slope in the 50-Day SMA (1.0793) as it struggles to close above the moving average.

US Dollar Forecast: EUR/USD Negates Bear Flag Formation

EUR/USD may further retrace the decline from the April high (1.0885) as it retains the advance following the weaker-than-expected US Non-Farm Payrolls (NFP) report, and developments coming out of the US may continue to sway the exchange rate as Chairman Jerome Powell warns that ‘it's unlikely that the next policy rate move will be a hike.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It seems as though the Federal Open Market Committee (FOMC) will gradually change gears as the central bank plans to ‘slow the pace of decline in our securities holdings,’ and Chairman Powell and Co. may continue to prepare US households and businesses for a less restrictive policy as the Fed is ‘prepared to respond to an unexpected weakening in the labor market.’

US Economic Calendar

In turn, other Fed officials may strike a similar tone as Richmond Fed President Thomas Barkin, who votes on the FOMC this year, reveals that he is ‘optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target,’ and the slew of schedule speeches may produce headwinds for the US Dollar should the central bank keep the door open to implement lower interest rates in 2024.

However, Fed officials may offer dissenting views as Chairman Powell and Co. ‘do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent,’ and a batch of hawkish comments may curb the recent advance in EUR/USD as market participants push out bets for a rate-cut.

With that said, EUR/USD may further retrace the decline from the April high (1.0885) as it negates a bear-flag formation, but the exchange rate may track the negative slope in the 50-Day SMA (1.0793) as it struggles to close above the moving average.

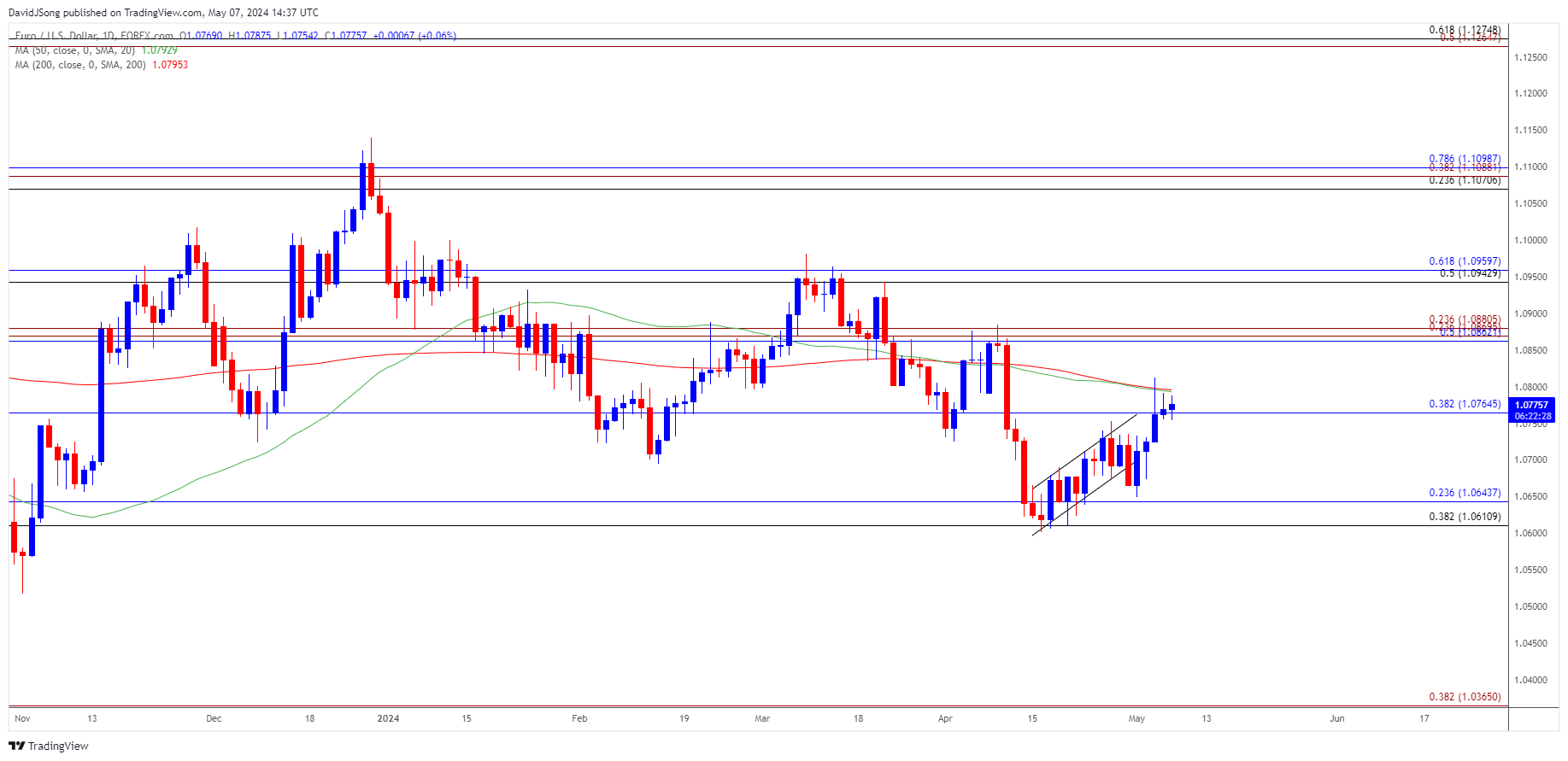

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD trades near the 50-Day SMA (1.0793) after negating a bear-flag formation, with a close above the moving average raising the scope for a move towards the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region.

- A breach above the April high (1.0885) opens up the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area, but the exchange rate may track the negative slope in the moving average as it struggles to close above the indicator.

- Lack of momentum to hold above 1.0770 (38.2% Fibonacci retracement) may push EUR/USD back towards the monthly low (1.0650), with a break/close below the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region opening up the November low (1.0517).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Ascending Channel Remains Intact

US Dollar Forecast: AUD/USD Post-Fed Recovery Faces US NFP Report

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong