US Dollar Outlook: EUR/USD

EUR/USD fails to hold above the opening range for January as it trades below the 50-Day SMA (1.0896) for the first time since November, and the exchange rate may continue to give back the advance from the December low (1.0724) as it no longer responds to the positive slope in the moving average.

US Dollar Forecast: EUR/USD Fails to Hold Above January Opening Range

EUR/USD registers a fresh monthly low (1.0845) as the US Retail Sales report shows a 0.6% rise in December versus forecasts for a 0.4% print, and signs of a resilient economy may increase the Federal Reserve’s flexibility in retaining a restrictive policy as the central bank continues to combat inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, the Federal Open Market Committee (FOMC) may stick to the sidelines at its next interest rate decision on January 31 as Fed Governor Christopher Waller insists that ‘the timing and number of rate cuts will be driven by the incoming data’ and the European Central Bank (ECB) may follow a similar path in managing monetary policy as the Governing Council pledges to ‘follow a data-dependent approach to determining the appropriate level and duration of restriction.’

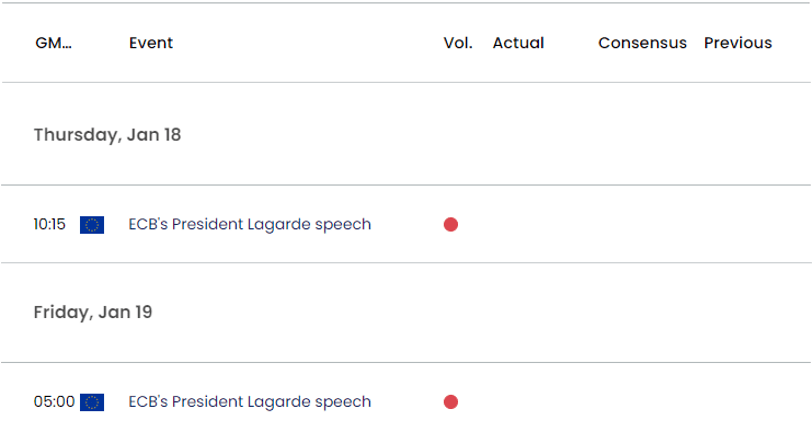

Euro Area Economic Calendar

In turn, upcoming remarks from ECB President Christine Lagarde may sway EUR/USD ahead of the ECB meeting on January 25 as she’s scheduled to speak at the World Economic Forum in Davos, Switzerland, but the speeches may do little to sway the exchange rate as the Governing Council pledges to keep Euro Area interest rates ‘at sufficiently restrictive levels for as long as necessary.’

With that said, failure to defend the opening range for January may lead to a further decline in EUR/USD as it trades below the 50-Day SMA (1.0896) for the first time since November, and the exchange rate may struggle to retain the advance from the December low (1.0724) as it no longer responds to the positive slope in the moving average.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD extends the decline from the start of the month to push the Relative Strength Index (RSI) to its lowest level since October, with the recent series of lower highs and lows pushing the exchange rate up against the 200-Day SMA (1.0847).

- A close below the long-term moving average may push EUR/USD towards 1.0790 (61.8% Fibonacci retracement), with the next area of interest coming in around the December low (1.0724).

- Nevertheless, EUR/USD may hold within the December range if it continues to bounce along the long-term moving average but need a break/close above 1.0940 (50% Fibonacci retracement) to bring the monthly high (1.1046) on the radar.

Additional Market Outlooks

GBP/USD Forecast: Ascending Channel Remains Intact Ahead of UK CPI

US Dollar Forecast: USD/CAD Rallies as US CPI Reveals Sticky Inflation

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong