US Dollar Outlook: EUR/USD

EUR/USD continues to pullback from the December high (1.1140) on the back of US Dollar strength, but the recent decline in the exchange rate may end up being short lived should it track the positive slope in the 50-Day SMA (1.0827).

US Dollar Forecast: EUR/USD Eyes Positive Slope in 50-Day SMA

EUR/USD carves a series of lower highs and lows as it depreciates for the third consecutive day, and the exchange rate may struggle to retain the rebound from the December low (1.0724) as the US Non-Farm Payrolls (NFP) report is anticipated to show another rise in employment.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

The US economy is projected to add 168K jobs in December following the 199K expansion the month prior, and signs of a resilient labor market may generate a bullish reaction in the Greenback as it raises the Federal Reserve’s scope to keep interest rates higher for longer.

In turn, EUR/USD may face headwinds ahead of the Fed rate decision on January 31 as Chairman Jerome Powell and Co. are ‘strongly committed to returning inflation to our 2 percent objective,’ but a weaker-than-expected NFP print may drag on the US Dollar as it puts pressure on the Federal Open Market Committee (FOMC) to deliver a rate-cut sooner rather than later.

With that said, the bearish price action in EUR/USD may persist ahead of the US NFP report as the Relative Strength Index (RSI) moves away from overbought territory, but the exchange rate may continue to hold above the 50-Day SMA (1.0827) if it responds to the positive slope in the moving average.

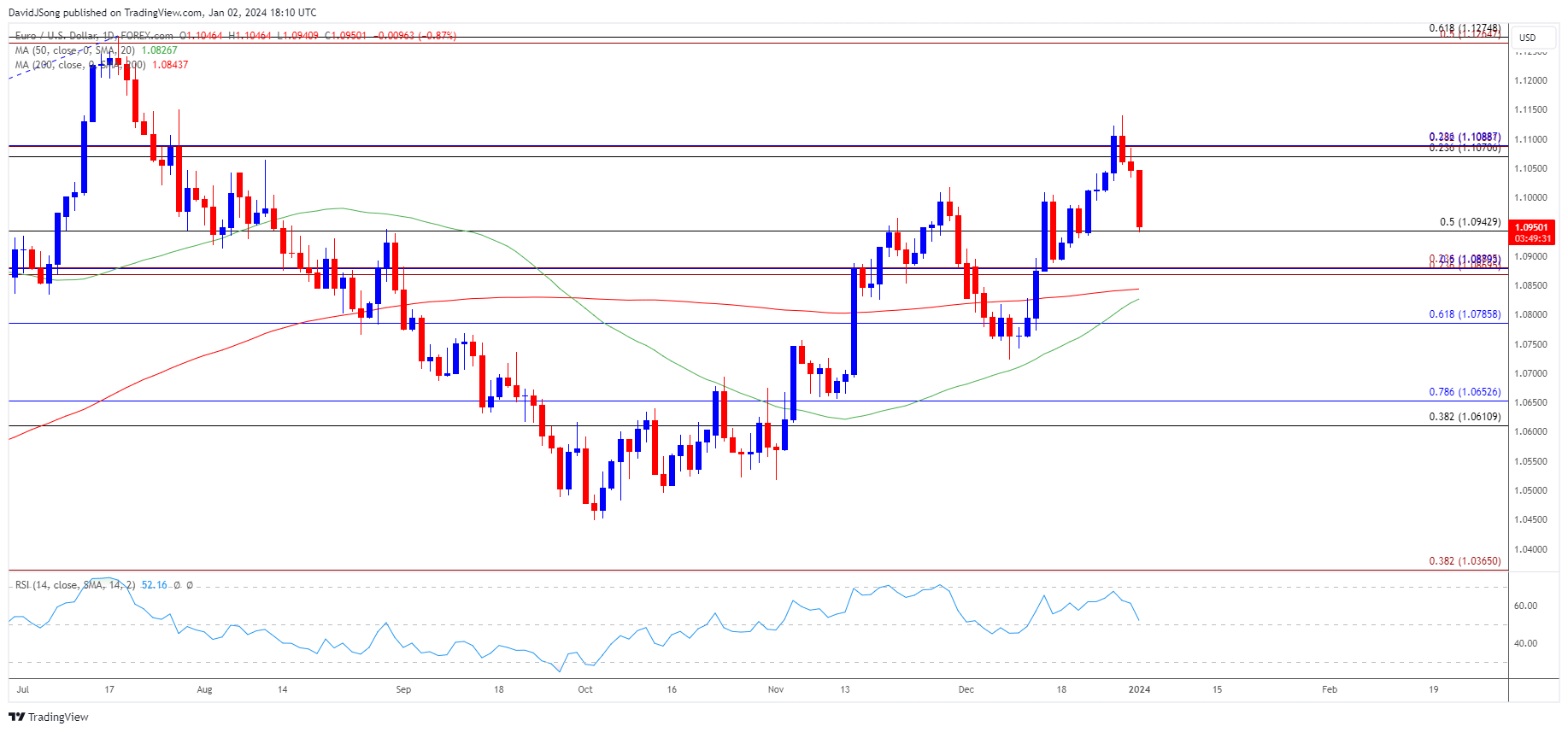

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD carves a series of lower highs and lows after taking out the August high (1.1065), and the Relative Strength Index (RSI) may show the bullish momentum abating as it reverses ahead of 70.

- Failure to hold above 1.0940 (50% Fibonacci retracement) may push EUR/USD towards the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) area, with the next region of interest coming in around 1.0790 (61.8% Fibonacci retracement).

- Nevertheless, EUR/USD may hold above the 50-Day SMA (1.0827) should it continue to track the positive slope in the moving average, with a move back above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (23.6% Fibonacci retracement) region bringing the December high (1.1140) on the radar.

Additional Market Outlooks

Central Bank 2024 Outlook Preview

US Dollar Forecast: GBP/USD Ascending Channel Remains Intact

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong