US Dollar Outlook: EUR/USD

EUR/USD retraces the decline from the monthly high (1.1009) following the larger-than-expected slowdown in the US Producer Price Index (PPI), but the exchange rate may struggle to retain the advance from earlier this month should it stage another failed attempt to test the January high (1.1046).

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

EUR/USD trades to a fresh weekly high (1.0947) as the US PPI prints at 2.2% in July versus forecasts for a 2.3% reading, with the core rate reflecting a similar dynamic as the figure narrows to 2.4% from 3.0% per annum the month prior.

In turn, the US Dollar may continue to face headwinds ahead of the Federal Reserve interest rate decision on September 18 as the US Consumer Price Index (CPI) is also anticipated to show a slowdown in July, but signs of sticky inflation may curb the recent advance in EUR/USD as it puts pressure on the Fed to retain a restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

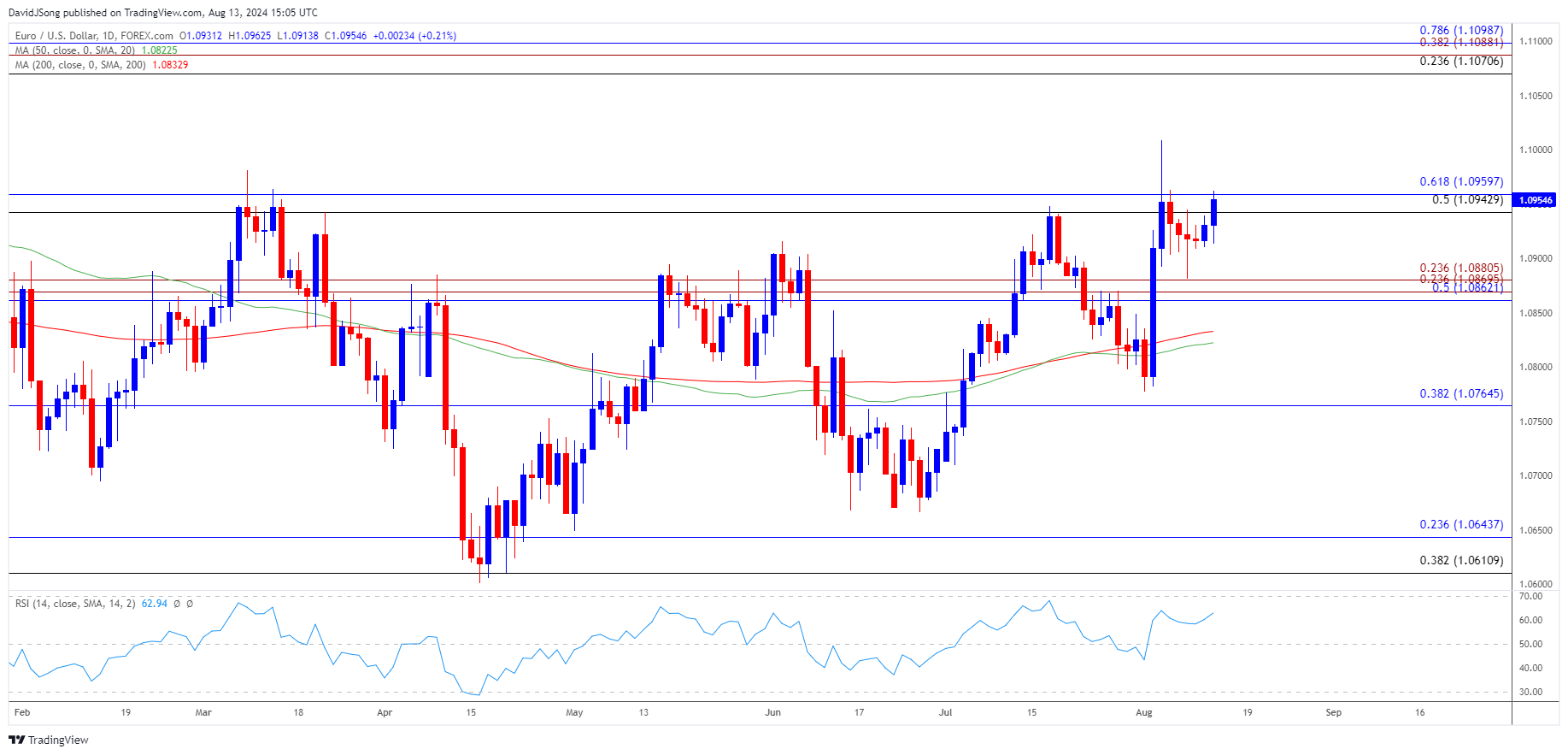

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may stage a further advance as initiates a series of higher highs and lows but need a close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) region to bring the monthly high (1.1009) on the radar.

- A breach above the January high (1.1046) opens up the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) area, with the next region of interest coming in around the December high (1.1140).

- At the same time, failure to close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) region may push EUR/USD back towards the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) zone, with the next area of interest coming in around the monthly low (1.0778).

Additional Market Outlooks

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

Canadian Dollar Forecast: USD/CAD Flirts with 50-Day SMA

US Dollar Forecast: USD/JPY Continues to Defend January Low

Gold Price to Eye Monthly High on Failure to Close Below 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong