US Dollar Outlook: EUR/USD

EUR/USD appears to be defending the opening range for March as it holds above the monthly low (1.0798), but the exchange rate may track the negative slope in the 50-Day SMA (1.0840) as it struggles to trade back above the moving average.

US Dollar Forecast: EUR/USD Defends March Opening Range for Now

EUR/USD may consolidate over the remainder of the month as market participation is likely to wane going into the Easter holiday, with the opening range for April is in focus as the exchange rate struggles to retain the advance from the start of the week.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

However, developments coming out of the US economy may influence EUR/USD as the Federal Reserve endorses a data dependent approach in managing monetary policy, and the US Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, may sway the exchange rate as the update is anticipated to show sticky inflation.

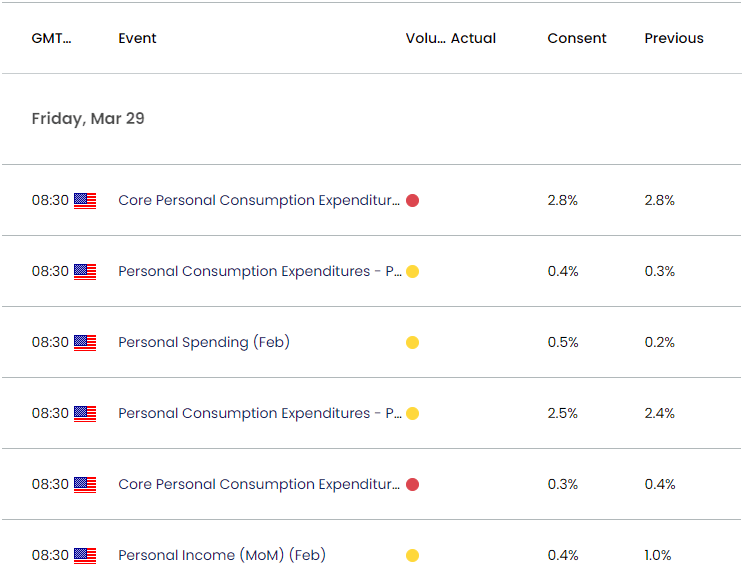

US Economic Calendar

The headline PCE index is projected to increase to 2.5% in February from 2.4% the month prior while the core rate is expected to hold steady during the same period, and evidence of persistent inflation may spark a bullish reaction in the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to keep US interest rates higher for longer.

At the same time, an unexpected slowdown in the PCE index may keep EUR/USD within the March range as it encourages Chairman Jerome Powell and Co. to implement a rate cut sooner rather than later.

With that said, EUR/USD may face range bound conditions over the coming days should it continue to hold above the monthly low (1.0798), but the exchange rate may track the negative slope in the 50-Day SMA (1.0840) as it struggles to trade back above the moving average.

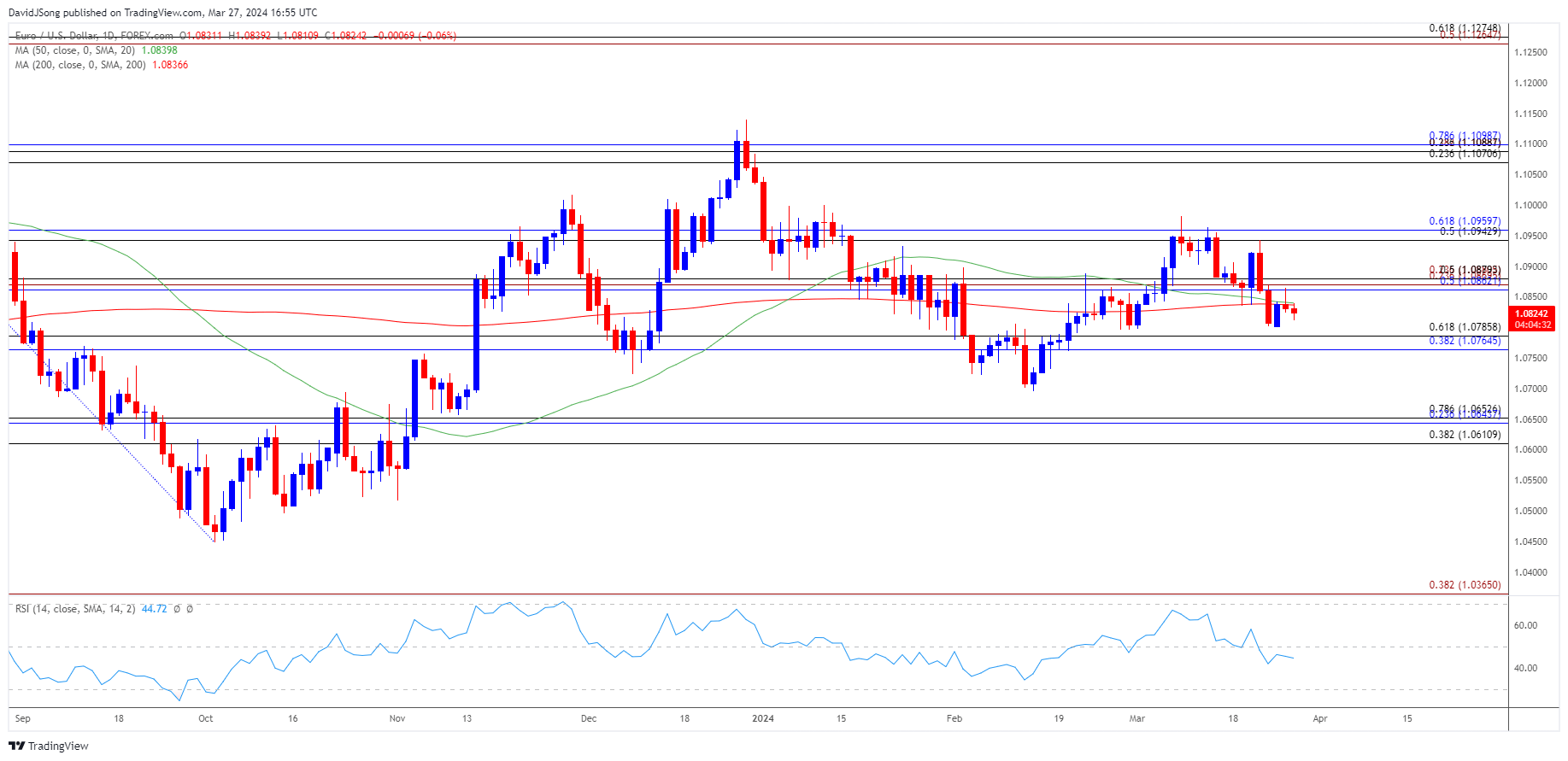

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may trade within the confines of the March range as it appears to be defending the monthly low (1.0798), with a move above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region bringing the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area back on the radar.

- Next area of interest comes in around the monthly high (1.0981), but EUR/USD may track the negative slope in the 50-Day SMA (1.0840) as it struggles to trade back above the moving average.

- Failure to defend the monthly low (1.0798) may push EUR/USD towards the 1.0770 (38.2% Fibonacci retracement) to 1.0790 (61.8% Fibonacci retracement) region, with the next area of interest coming in around the February low (1.0695).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Pulls Back Ahead of December High

US Dollar Forecast: USD/JPY Struggles to Test November High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong