US Dollar Outlook: EUR/USD

EUR/USD bounces back ahead of the February low (1.0695) to clear the series of lower highs and lows carried over from last week, but the exchange rate may track the negative slope in the 50-Day SMA (1.0829) if it continues to close below the indicator.

US Dollar Forecast: EUR/USD Bounces Back Ahead of February Low

Keep in mind, EUR/USD failed to defend the March low (1.0798) after struggling to trade back above the moving average, and speculation surrounding Federal Reserve policy may continue to influence the exchange rate as Cleveland Fed President Loretta Mester, who votes on the Federal Open Market Committee (FOMC) in 2024, expects ‘further progress on inflation but at a slower pace than we saw last year.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Mester acknowledged that ‘it will be appropriate for the FOMC to begin reducing the fed funds rate later this year,’ but went onto say that ‘I have also raised my estimate of the longer-run federal funds rate to 3 percent compared with 2.5 percent’ while speaking at the National Association for Business Economics.

The comments suggest the FOMC is in no rush to pursue a rate-cutting cycle as the core US Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, holds steady at 2.8% per annum in February, and the Non-Farm Payrolls (NFP) Report may keep the central bank on the sidelines as the update is anticipated to show another rise in employment.

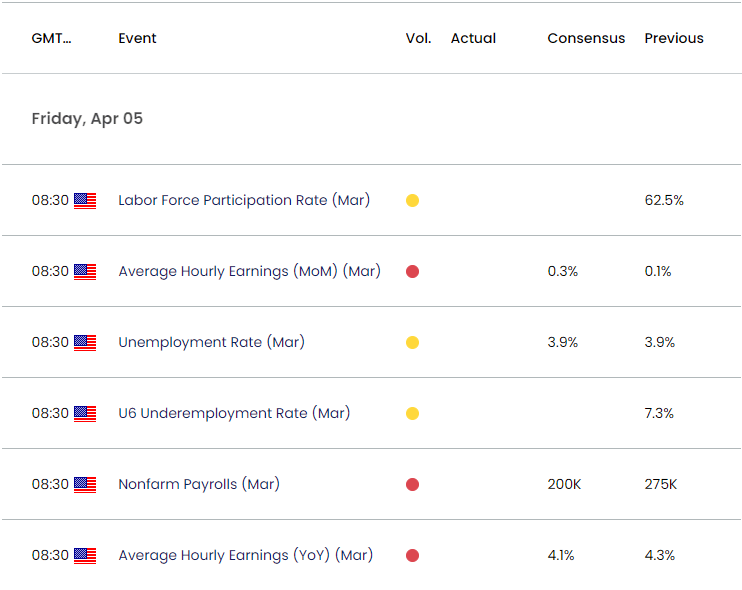

US Economic Calendar

The US is projected to add 200K jobs in March while the Unemployment Rate is expected to hold steady at 3.9% during the same period, and signs of a robust labor market may curb the recent advance in EUR/USD as it raises the Fed’s scope to further combat inflation.

However, a lower-than-expected NFP print may keep EUR/USD afloat as it puts pressure on the FOMC to switch gears sooner rather than later, and the exchange rate attempt to further retrace the decline from the March high (1.0981) as it clears the series of lower highs and lows carried over from last week.

With that said, EUR/USD may stage a larger recovery over the coming days as it defends the February low (1.0695), but the exchange rate may track the negative slope in the 50-Day SMA (1.0830) if it continues to close below the moving average.

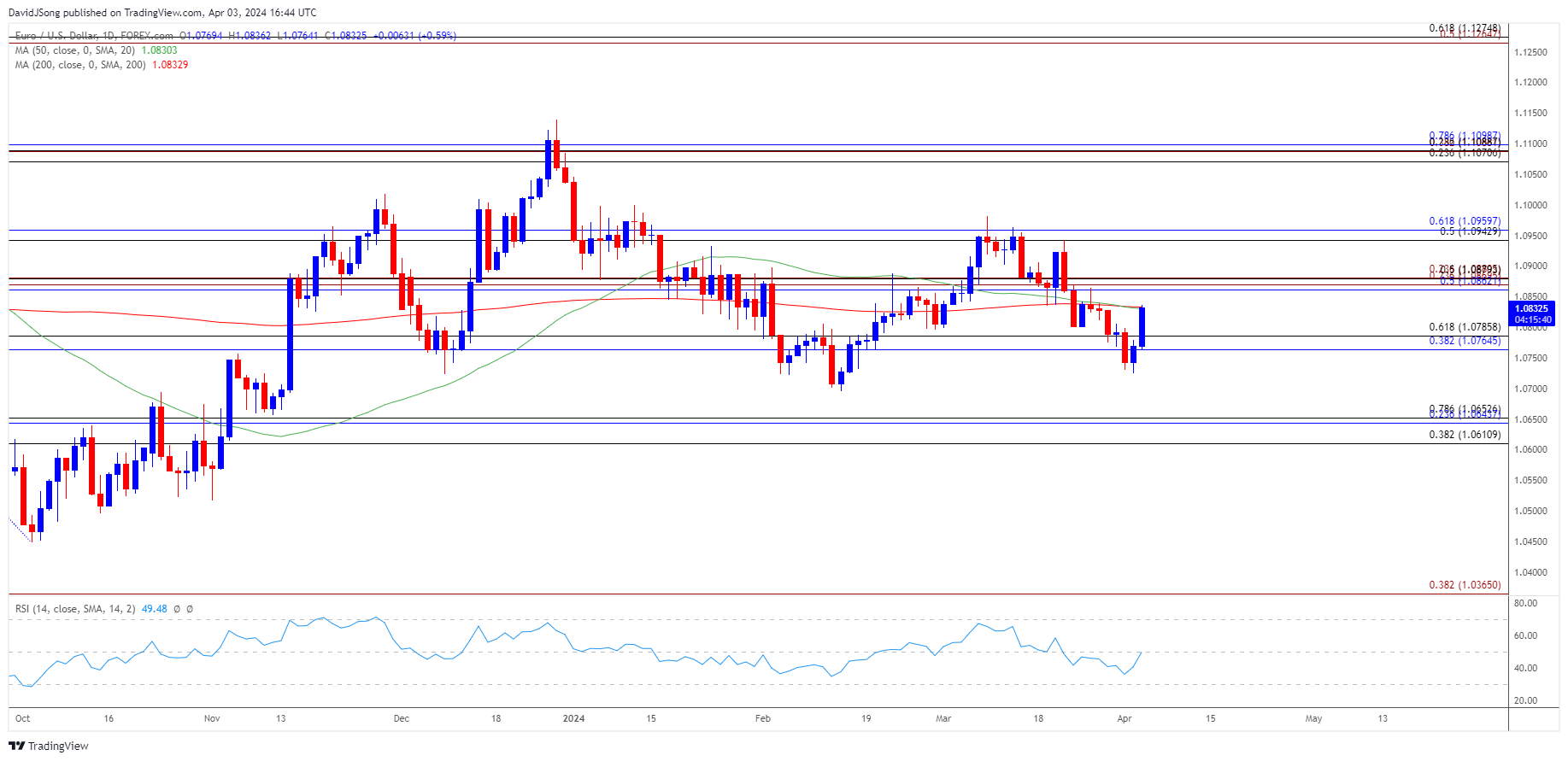

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD rebounds ahead of the February low (1.0695) to register a fresh weekly high (1.0824), with a move above the 50-Day SMA (1.0830) raising the scope for a move towards the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region.

- Need a break/close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area to bring the March high (1.0981) on the radar, but EUR/USD may track the negative slope in the moving average if it continues to close below the indicator.

- Failure to hold above the 1.0770 (38.2% Fibonacci retracement) to 1.0790 (61.8% Fibonacci retracement) region may lead to another test of the February low (1.0695), with the next area of interest coming in around 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Attempts to Defend March Low

US Dollar Forecast: GBP/USD Clears March Low Ahead of US NFP Report

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong