US Dollar Outlook: EUR/USD

EUR/USD consolidates following the kneejerk reaction to the US Non-Farm Payrolls (NFP) report, but the exchange rate may attempt to break out of the range bound price action as it holds above the monthly low (1.0877).

US Dollar Forecast: EUR/USD 2024 Opening Range Break in Focus

The opening range for January is in focus as EUR/USD approaches the weekly high (1.0979), and it remains to be seen if the update to the US Consumer Price Index (CPI) will sway foreign exchange markets as the Federal Reserve appears to be at the end of its hiking-cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

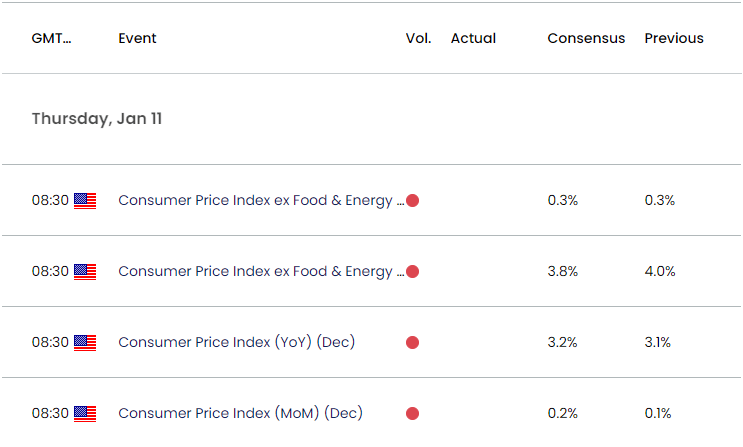

US Economic Calendar

Signs of sticky inflation may drag on EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to keep US interest rates higher for longer, but a softer-than-expected print for both the headline and core CPI may generate a bearish reaction in the US Dollar as it encourages the Fed to implement a rate-hike sooner rather than later.

In turn, the development may influence the near-term outlook for EUR/USD if triggers a break above or below the opening range for January, and the exchange rate may face increased volatility ahead of the Fed rate decision on January 31 amid speculation for a looming change in regime.

With that said, EUR/USD may try to track the positive slope in the 50-Day SMA (1.0846) should it clear the range bound price action from earlier this week, but the exchange rate may no longer respond to the moving average if it fails to defend the monthly low (1.0877).

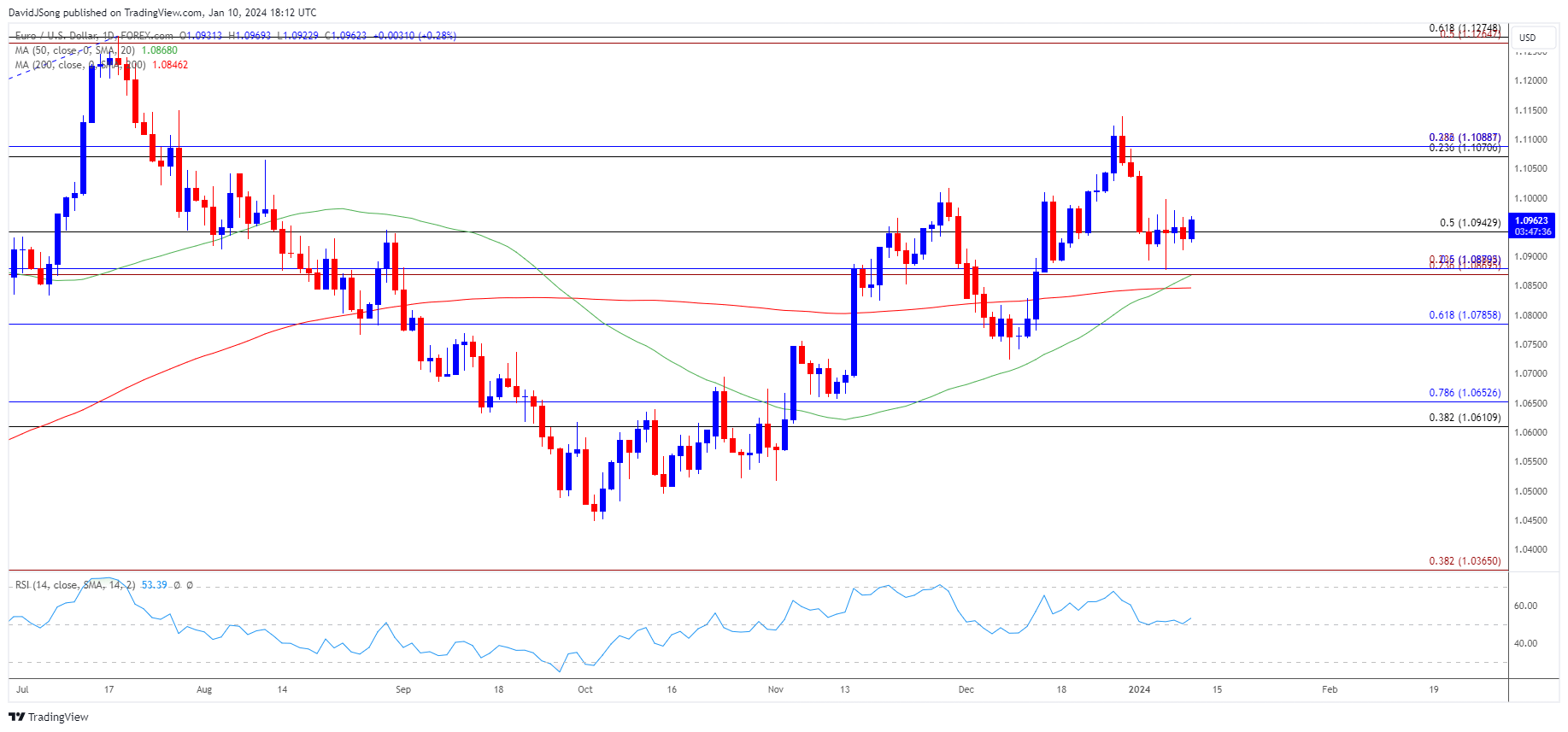

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- The 2024 opening range is in focus for EUR/USD as it holds above the 50-Day SMA (1.0846), and the exchange rate may attempt to retrace the decline from the monthly high (1.1046) should it track the positive slope in the moving average.

- A break/close above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (23.6% Fibonacci retracement) region raises the scope for a run at the December high (1.1140), but the exchange rate may no longer respond to the moving average if it fails to defend the monthly low (1.0877).

- A break/close below the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) area may push EUR/USD towards 1.0790 (61.8% Fibonacci retracement), with the next region of interest coming in around the December low (1.0724).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rebounds within Ascending Channel

US Dollar Forecast: AUD/USD Susceptible to Test of 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong