US Dollar Outlook: AUD/USD

AUD/USD climbs to a fresh weekly high (0.6490) as data prints coming out of the US warn of a slowing economy, and the update to Australia’s Consumer Price Index (CPI) may keep the exchange rate afloat should the report reveal sticky inflation.

US Dollar Forecast: AUD/USD Rebound Persists Ahead of Australia CPI

Keep in mind, AUD/USD failed to defend the February low (0.6443) as Federal Reserve officials saw little progress in achieving the 2% target for inflation, and it remains to be seen if the central bank will respond to the S&P Global Purchasing Managers Index (PMI) as the gauge for manufacturing prints at 49.9 in April to indicate a contraction for the sector.

At the same time, the PMI for service-based activity narrowed to 50.9 from 51.7 in March, and signs of a slowing economy may keep the Federal Open Market Committee (FOMC) on track to implement lower interest rates in 2024 even as the International Monetary Fund (IMF) raises its growth forecast for the US.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Meanwhile, the Reserve Bank of Australia (RBA) may continue to endorse a wait-and-see approach in managing monetary policy as ‘returning inflation to target remained the Board’s highest priority,’ and it seems as though the central bank will retain the current policy at its next meeting on May 7 as the ‘Board expects that it will be some time yet before inflation is sustainably in the target range.’

Australia Economic Calendar

Until then, Australia’s CPI may sway AUD/USD as the monthly update is anticipated to show the headline reading holding steady at 3.4% in March, and signs of persistent price growth may fuel the recent recovery in the exchange rate as it puts pressure on the RBA to further combat inflation.

However, a downtick in Australia’s CPI may drag on AUD/USD as it raises the RBA’s scope to pursue a less restrictive policy, and Governor Michele Bullock and Co. may further adjust their forward guidance over the coming months as ‘members noted the importance of preserving as many of the gains in the labour market as possible.’

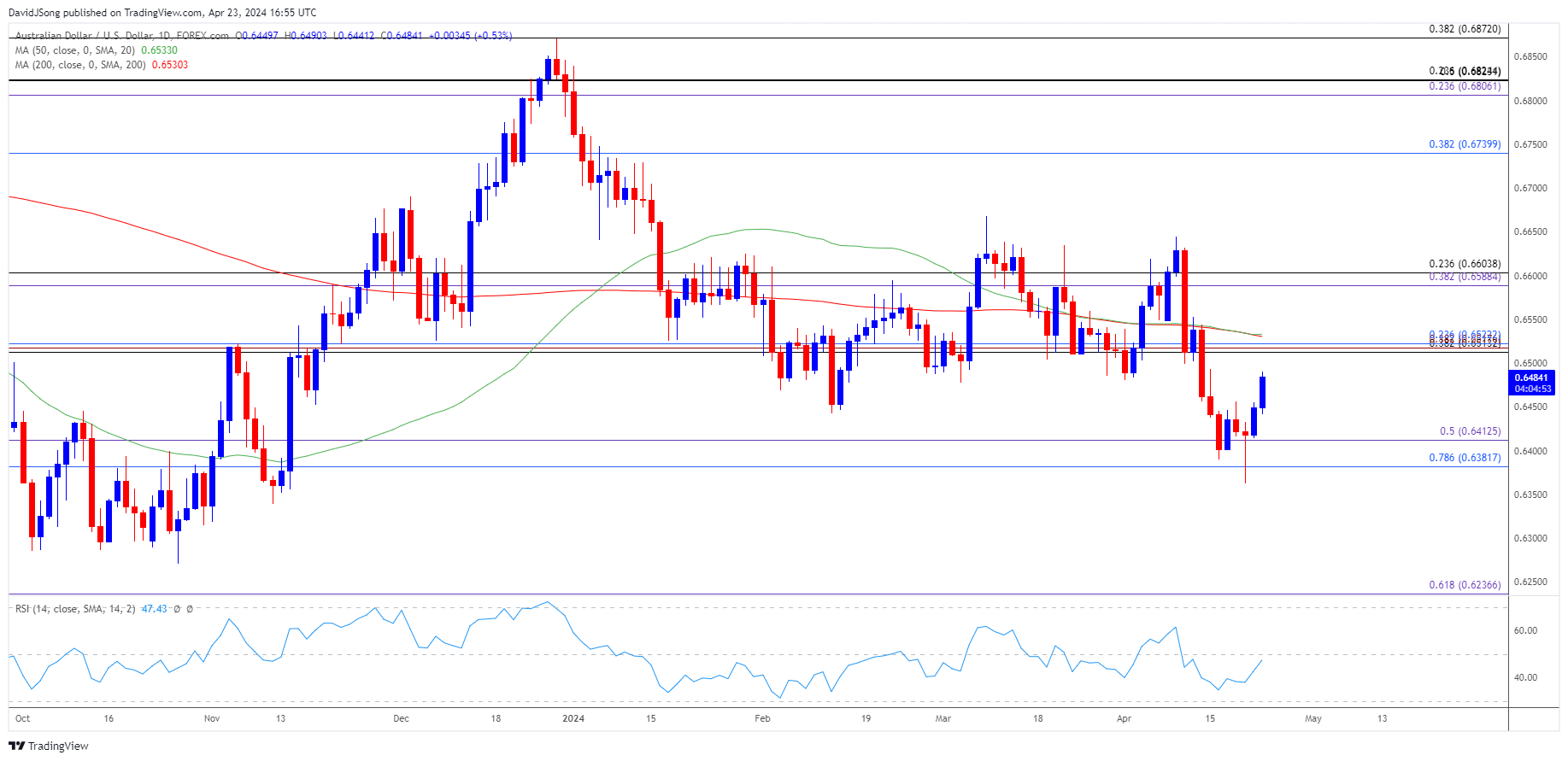

With that said, the failed attempt to test the November low (0.6318) may lead to a larger recovery in AUD/USD as it carves a series of higher highs and lows, but the exchange rate may track the negative slope in the 50-Day SMA (0.6533) if it struggles to retain the rebound from the monthly low (0.6362).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD carves a series of higher highs and lows following the failed attempt to test the November low (0.6318), with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region raising the scope for a move towards the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area.

- Next region of interest comes in around the monthly high (0.6645), but AUD/USD may track the negative slope in the 50-Day SMA (0.6533) if it struggles to retain the rebound from the monthly low (0.6362).

- Need a close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region to bring the November low (0.6318) back on the radar, with the next area of interest coming in around the 2023 low (0.6270).

Additional Market Outlooks

USD/JPY Forecast: RSI Holds in Overbought Zone Ahead of BoJ Meeting

US Dollar Forecast: USD/CAD Reverses Ahead of November High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong