US Dollar Outlook: AUD/USD

AUD/USD attempts to retrace the decline following the US Non-Farm Payrolls (NFP) report as the Reserve Bank of Australia (RBA) warns that ‘a further increase in interest rates cannot be ruled out,’ but the exchange rate may struggle to retain the advance from the November low (0.6390) as the 50-Day SMA (0.6650) no longer reflects a positive slope.

US Dollar Forecast: AUD/USD Rebound Emerges Following Hawkish RBA

AUD/USD no longer carves a series of lower highs and lows even as the RBA keeps the official cash rate (OCR) at 4.35%, and it seems as though the central bank will keep the door open to pursue a more restrictive policy as ‘it will be some time yet before inflation is sustainably in the target range.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Australia Economic Calendar

In turn, Governor Michele Bullock may continue to tame speculation for a change in regime as the ‘central forecasts are for inflation to return to the target range of 2–3 per cent in 2025,’ and it remains to be seen if the Federal Reserve will switch gears ahead of its Australian counterpart as Chairman Jerome Powell rules out a rate cut at the next interest rate decision on March 20.

With that said, the reaction to the RBA meeting raises the scope for a near-term rebound in AUD/USD as it no longer carves a series of lower highs and lows, but the exchange rate may struggle to retain the advance from the November low (0.6390) as it no longer tracks the positive slope in the 50-Day SMA (0.6649).

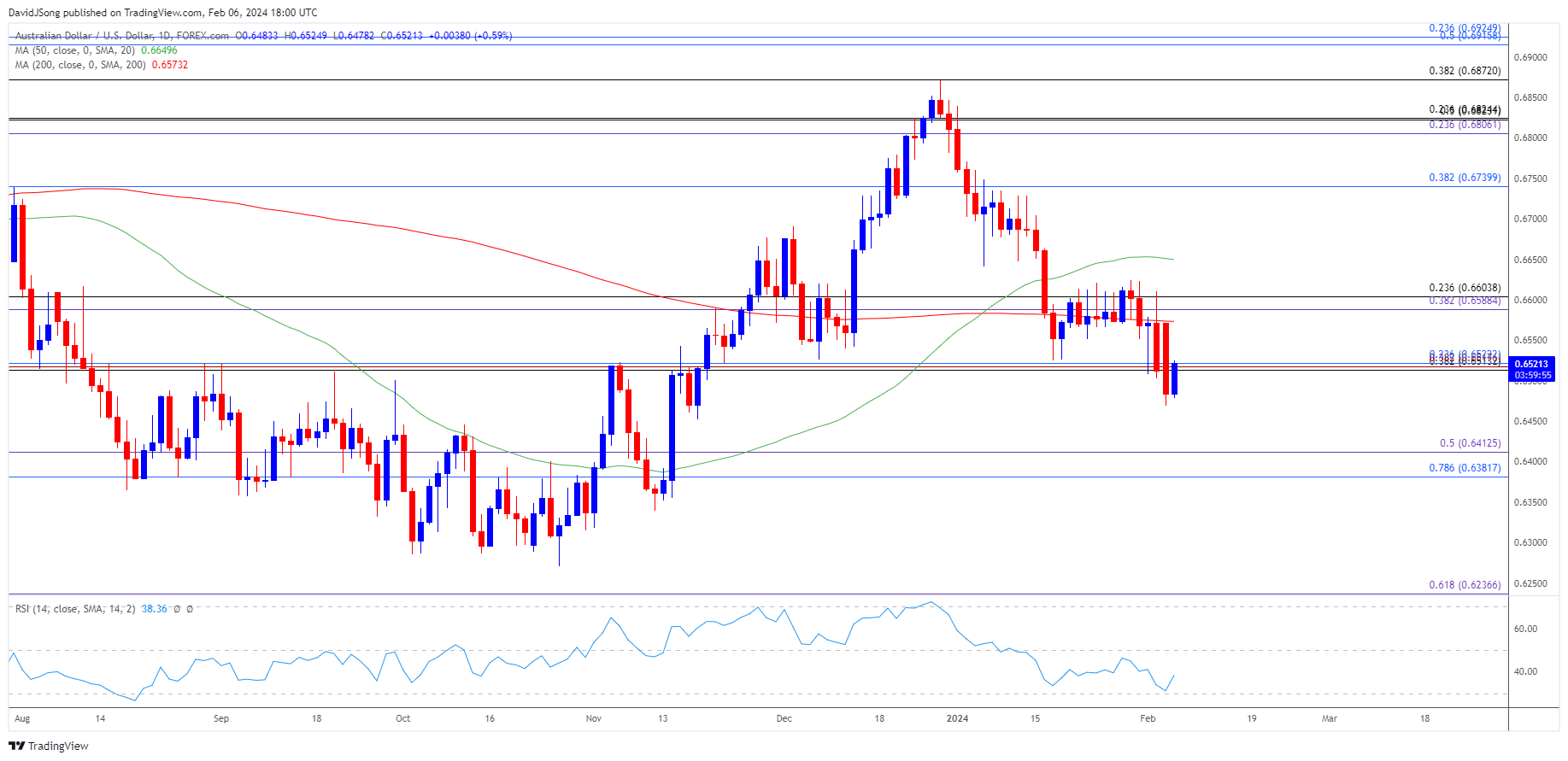

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD retraces the decline from the start of the week to keep the Relative Strength Index (RSI) out of oversold territory, with a close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone raising the scope for a move towards the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region.

- Next area of interest comes in around the monthly high (0.6610), but the recent rebound in AUD/USD may end up being short lived as the 50-Day SMA (0.6650) no longer reflects a positive slope.

- Failure to close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone may push AUD/USD towards the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area, with the next region of interest coming in around the November low (0.6318).

Additional Market Outlooks

EUR/USD Post-NFP Selloff Brings Test of December Low

US Dollar Forecast: USD/CAD Trades Back Above 50-Day SMA on Upbeat NFP

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong