US Dollar Outlook: AUD/USD

AUD/USD extends the pullback from the monthly high (0.6761) to snap the series of higher highs and lows carried over from last week, but the exchange rate may stage further attempts to test the January high (0.6839) should it track the positive slope in the 50-Day SMA (0.6645).

US Dollar Forecast: AUD/USD Rally Stalls Ahead of US CPI

AUD/USD slips to a fresh weekly low (0.6724) as Federal Reserve Chairman Jerome Powell tells US lawmakers that ‘it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent,’ with the official going onto say that ‘reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

The prepared remarks suggest the Federal Open Market Committee (FOMC) will retain a data-dependent approach in managing monetary policy as ‘the Committee will continue its practice of carefully assessing incoming data and their implications for the evolving outlook,’ and the update to the US Consumer Price Index (CPI) may sway AUD/USD as the central bank continues to combat inflation.

US Economic Calendar

In turn, a slowdown in both the headline and core CPI may encourage the FOMC to adopt a less restrictive policy as ‘reducing policy restraint too late or too little could unduly weaken economic activity and employment,’ and evidence of easing price growth may produce headwinds for the US Dollar as it fuels speculation for an imminent Fed rate-cut.

However, a higher-than-expected CPI print may force the FOMC to keep US interest rates higher for longer, and signs of sticky inflation may generate a bullish reaction in the Greenback as it limits the Fed’s scope to alter monetary policy in 2024.

With that said, AUD/USD may struggle to retain the advance from the monthly low (0.6634) as it snaps the recent series of higher highs and lows, but the exchange rate may stage further attempts to test the January high (0.6839) if it tracks the positive slope in the 50-Day SMA (0.6645).

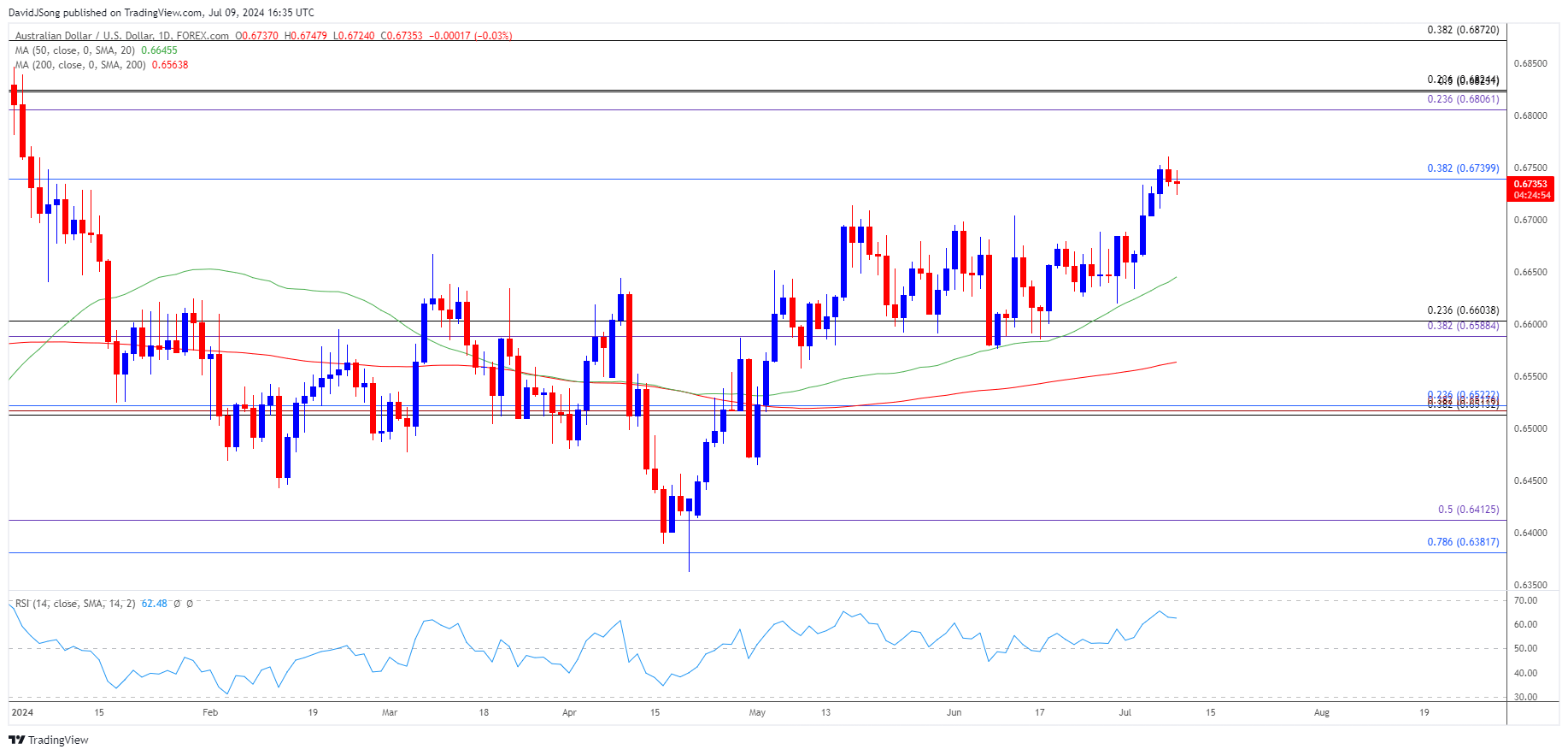

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- The recent rally in AUD/USD appears to have stalled ahead of the January high (0.6839) as it snaps the series of higher highs and lows, and failure to defend the monthly low (0.6634) may push the exchange rate back towards the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region.

- A breach below the June low (0.6576) opens up the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area but the recent weakness in AUD/USD may end up short-lived should it track the positive slope in the 50-Day SMA (0.6645).

- Need a break/close above the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) area to bring the January high (0.6839) on the radar, with the next region of interest coming in around the December high (0.6871).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Defends May Low Ahead of Fed Testimony

US Dollar Forecast: GBP/USD Recovers amid Failure to Test June Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong