US Dollar Outlook: AUD/USD

AUD/USD cleared the March high (0.6668) as it broke above the opening range for May, but the exchange rate may continue to pullback from a fresh monthly high (0.6714) if it fails to extend the recent series of higher highs and lows.

US Dollar Forecast: AUD/USD Rally Pushes RSI Towards Overbought Zone

AUD/USD extends the rally following the downtick in the US Consumer Price Index (CPI) to push the Relative Strength Index (RSI) to its highest level since December, and the oscillator may push above 70 for the first time this year should the exchange rate further retrace the decline from the January high (0.6839).

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Looking ahead, developments coming out of the US may continue to sway AUD/USD amid the limited reaction to Australia’s Employment report, and it remains to be seen if the Federal Reserve will respond to the recent data prints as Cleveland Fed President Loretta Mester, who votes on the Federal Open Market Committee (FOMC) this year, warns that the central bank needs more data that shows ‘inflation is on that sustainable path back to 2%.’

Mester, who’s tenure is set to end on June 30, went onto say that the central bank needs to see ‘all the inflation rates move back down’ in order for the FOMC to achieve price stability, and the FOMC may keep US interest rates higher for longer as the committee continues to combat inflation.

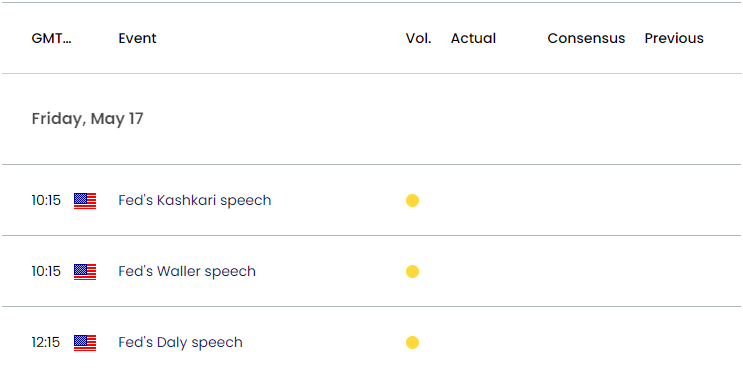

US Economic Calendar

In turn, Fed officials may tame speculation for an imminent change in regime as the FOMC promotes a data-dependent approach in managing monetary policy, and the upcoming speeches may curb the recent rally in AUD/USD should the authorities show a greater willingness to retain a restrictive policy.

However, Fed officials may further adjust the forward guidance for monetary policy as the central bank plans to ‘slow the pace of decline in our securities holdings,’ and hints of a less restrictive policy may keep AUD/USD afloat as it fuels speculation for a Fed rate cut in 2024.

With that said, AUD/USD may further retrace the decline from the January high (0.6839) as it pushes above the opening range for May, but the exchange rate may struggle to retain the advance from earlier this week if it fails to extend the recent series of higher highs and lows.

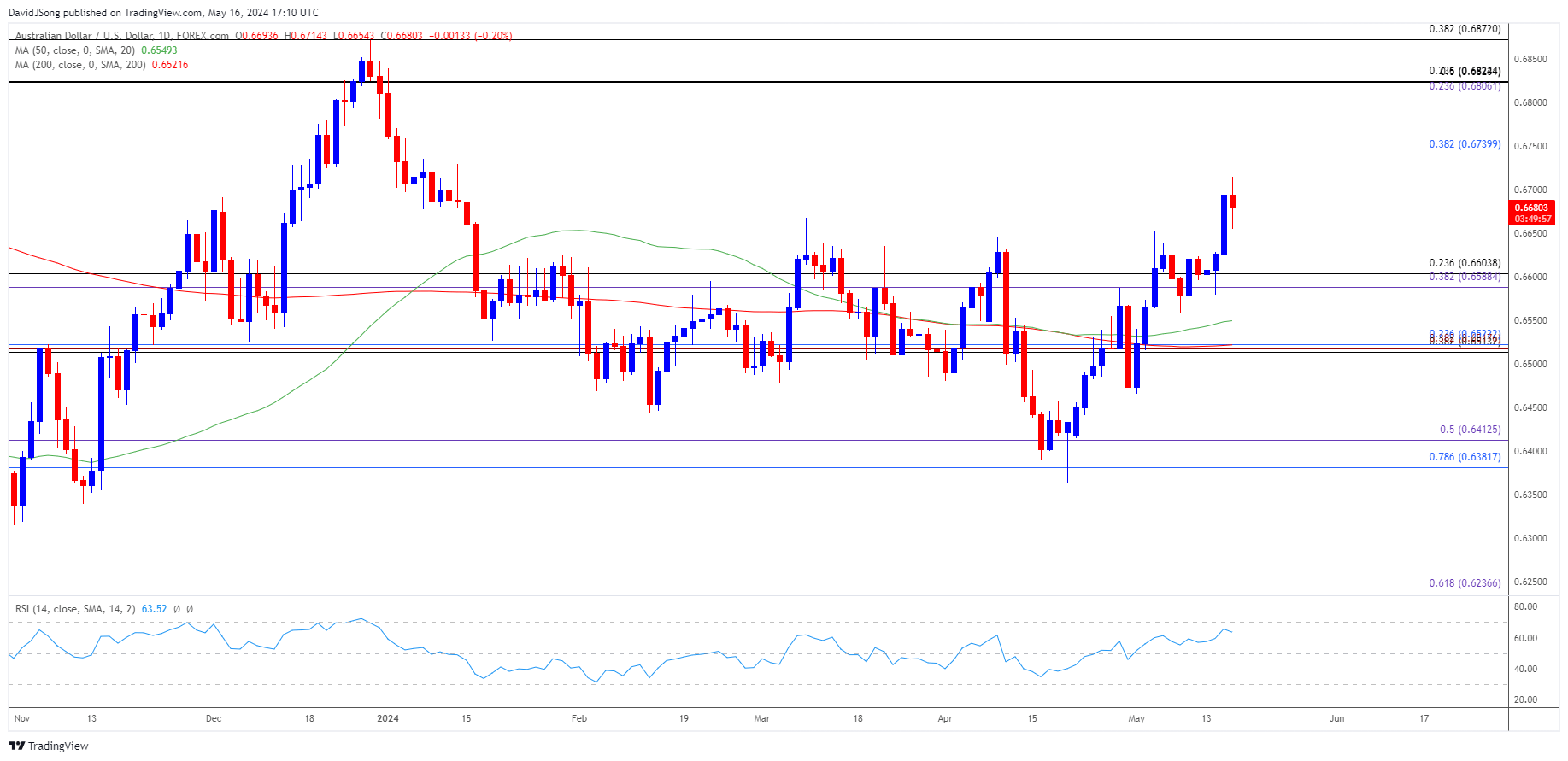

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD extends the recent series of higher highs and lows to clear the opening range for May, with the recent advance in the exchange rate pushing the Relative Strength Index (RSI) to its highest level since December.

- A break/close above 0.6740 (38.2% Fibonacci retracement) may push AUD/USD towards the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) region, with the next area of interest coming in around the January high (0.6839).

- However, lack of momentum to extend the recent series of higher highs and lows may keep the RSI below 70, with breach below the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region raising the scope for a move towards the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Extends Rebound from 50-Day SMA

US Dollar Forecast: GBP/USD Eyes 50-Day SMA Ahead of US CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong