US Dollar Outlook: AUD/USD

AUD/USD trades to a fresh monthly low (0.6548) as the Reserve Bank of Australia (RBA) keeps the official cash rate at 4.35%, and the exchange rate may struggle to retain the advance from the November low (0.6339) as the Relative Strength Index (RSI) reverses ahead of overbought territory.

US Dollar Forecast: AUD/USD Post-RBA Decline in Focus Ahead of US NFP

The recent rally in AUD/USD seems to have stalled ahead of the August high (0.6724) as it failed to push the RSI above 70, and the update to Australia’s Gross Domestic Product (GDP) report may do little to influence the RBA as ‘returning inflation to target within a reasonable timeframe remains the Board’s priority.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

US Economic Calendar

As a result, developments coming out of the US may sway AUD/USD as the Non-Farm Payrolls (NFP) report is now anticipated to show the economy adding 185K jobs in November, and indications of a resilient labor market may lead to a bullish reaction in the Greenback as it would raise the Federal Reserve’s scope to further combat inflation.

However, a weaker-than-expected NFP print may drag on the US Dollar as it fuels speculation of seeing US interest rate unchanged at the Fed’s last meeting for 2023, and AUD/USD may attempt to retrace the decline from the monthly high (0.6691) should it snap the recent series of lower highs and lows.

With that said, speculation surrounding Fed policy may sway AUD/USD as the RBA endorses a wait-and-see approach, but the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it flips ahead of overbought territory.

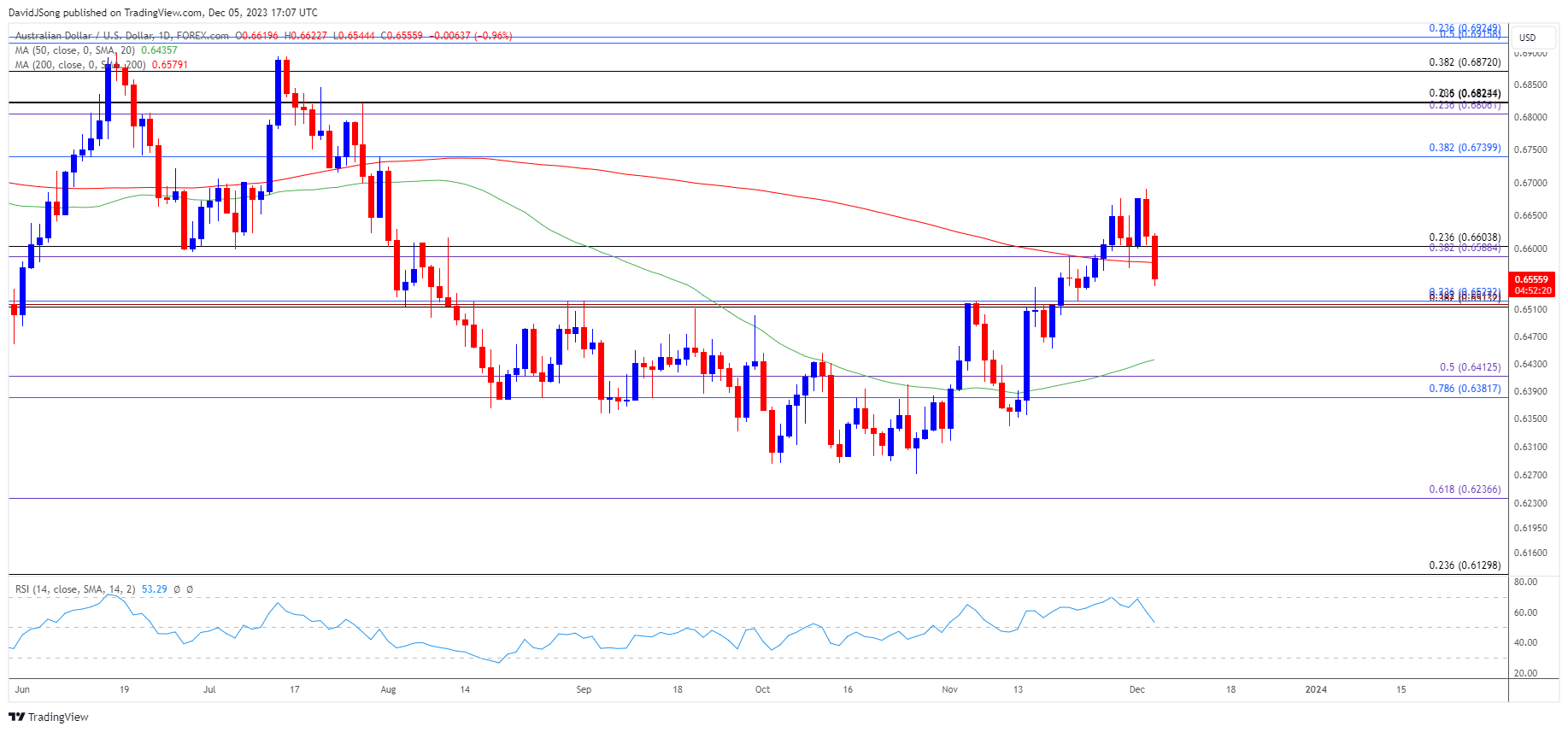

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD appears to have reversed course ahead of the August high (0.6724) as it initiates a series of lower highs and lows, with the Relative Strength Index (RSI) reflecting a similar dynamic as the oscillator continues to move away from overbought territory.

- A break/close below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area may push AUD/USD towards the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region, with the next zone of interest coming in around the November low (0.6318).

- Nevertheless, AUD/USD may consolidate if it struggles to break/close below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area, but need a move back above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region to bring the monthly high 0.6691) on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Vulnerable Ahead of NFP Report

USD/CAD Forecast: December Open Range in Focus with BoC on Tap

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong