US Dollar Outlook: AUD/USD

AUD/USD extends the rebound from the weekly low (0.6465) as the Federal Reserve appears to be on track to pursue a less restrictive policy, but the recent recovery in the exchange rate may unravel as the US Non-Farm Payrolls (NFP) report is anticipated to show another rise in employment.

US Dollar Forecast: AUD/USD Post-Fed Recovery Faces US NFP Report

AUD/USD may hold within last month’s range as the Federal Open Market Committee (FOMC) plans to ‘slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion’ starting in June, and it seems as though the central bank will gradually shift gears in 2024 as Chairman Jerome Powell acknowledges that ‘the inflation data received so far this year have been higher than expected.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

In turn, developments coming out of the US may continue to sway foreign exchange markets even though the FOMC reiterates that the committee does ‘not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent,’ and it remains to be seen if the Fed will adjust its forward guidance at its next meeting in June as the central bank is slated to update the Summary of Economic Projections (SEP).

US Economic Calendar

Until then, the update to the US NFP report may sway AUD/USD as the economy is projected to add 243K jobs in April, and a positive development may generate a bullish reaction in the Greenback as it raises the Fed’s scope to keep US interest rates higher for longer.

However, a weaker-than-expected NFP print may drag on the US Dollar as the Fed is ‘prepared to respond to an unexpected weakening in the labor market,’ and AUD/USD further retrace the decline from the April high (0.6645) should the development boost speculation for a looming change in regime.

With that said, AUD/USD may further extend the rebound from the weekly low (0.6465) as it snaps the recent series of lower highs and lows, and the opening range for May is in focus for the exchange rate as it trades within last month’s range.

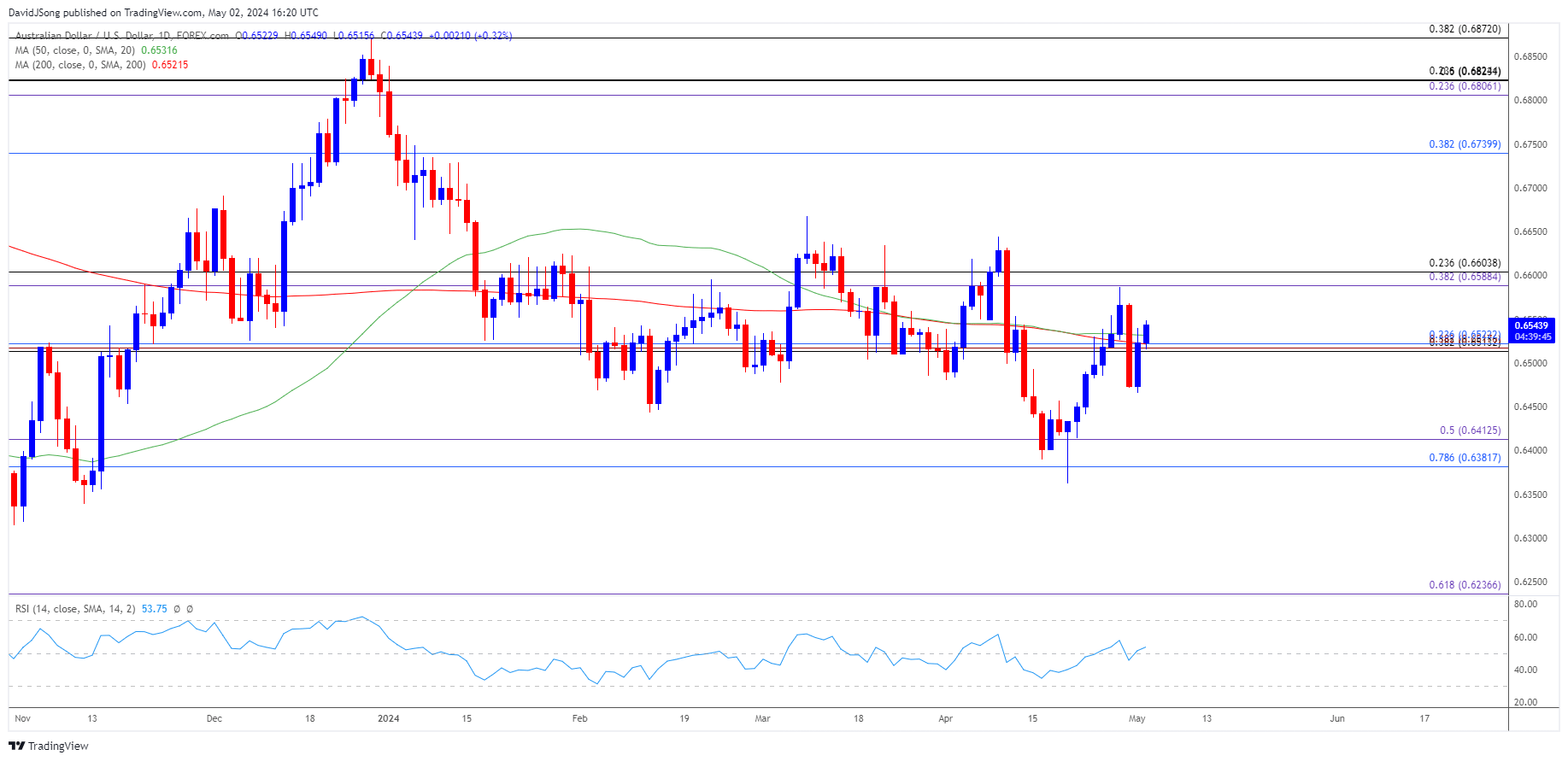

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- The opening range for May is in focus for AUD/USD as it extends the rebound from the weekly low (0.6465), and the exchange rate may stage a further advance over the coming days as it snaps the recent series of lower highs and lows.

- A break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region raises the scope for a test of the April high (0.6645), with the next area of interest coming in around the March high (0.6668).

- However, AUD/USD may face range bound conditions if it struggles to clear the weekly high (0.6587), with a breach below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone bringing the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area back on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Recovery Stalls Ahead of 50-Day SMA

US Dollar Forecast: EUR/USD Bear Flag Formation Remains Intact

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong