US Dollar Outlook: AUD/USD

AUD/USD is on the cusp of testing the monthly high (0.6610) as it stages a five-day rally, but the exchange rate may struggle to break out of the February range as the 50-Day SMA (0.6632) starts to reflect a negative slope.

US Dollar Forecast: AUD/USD on Cusp of Testing Monthly High

Keep in mind, AUD/USD registered a fresh monthly low (0.6443) as the update to the US Consumer Price Index (CPI) revealed sticky inflation, and the shift in the moving average may indicate a change in the near-term trend as the Federal Reserve appears to be in no rush to implement lower interest rates.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

US Economic Calendar

In turn, the Federal Open Market Committee (FOMC) Minutes may sway foreign exchange markets as Chairman Jerome Powell rules out a rate cut in March, and a hawkish statement may curb the recent rally in AUD/USD should the central bank show a greater willingness to retain a restrictive policy over the coming months.

At the same time, signs of a dissent within the FOMC may drag on the US Dollar as the Summary of Economic Projections (SEP) reflect lower interest rates for 2024, and AUD/USD may attempt to test the monthly high (0.6610) if a growing number of Fed officials look to switch gears sooner rather than later.

With that said, AUD/USD may attempt to retrace the decline from the January high (0.6839) should it break out of the February range, but the exchange rate may track the negative slope in the 50-Day SMA (0.6632) if it fails to clear the monthly high (0.6610).

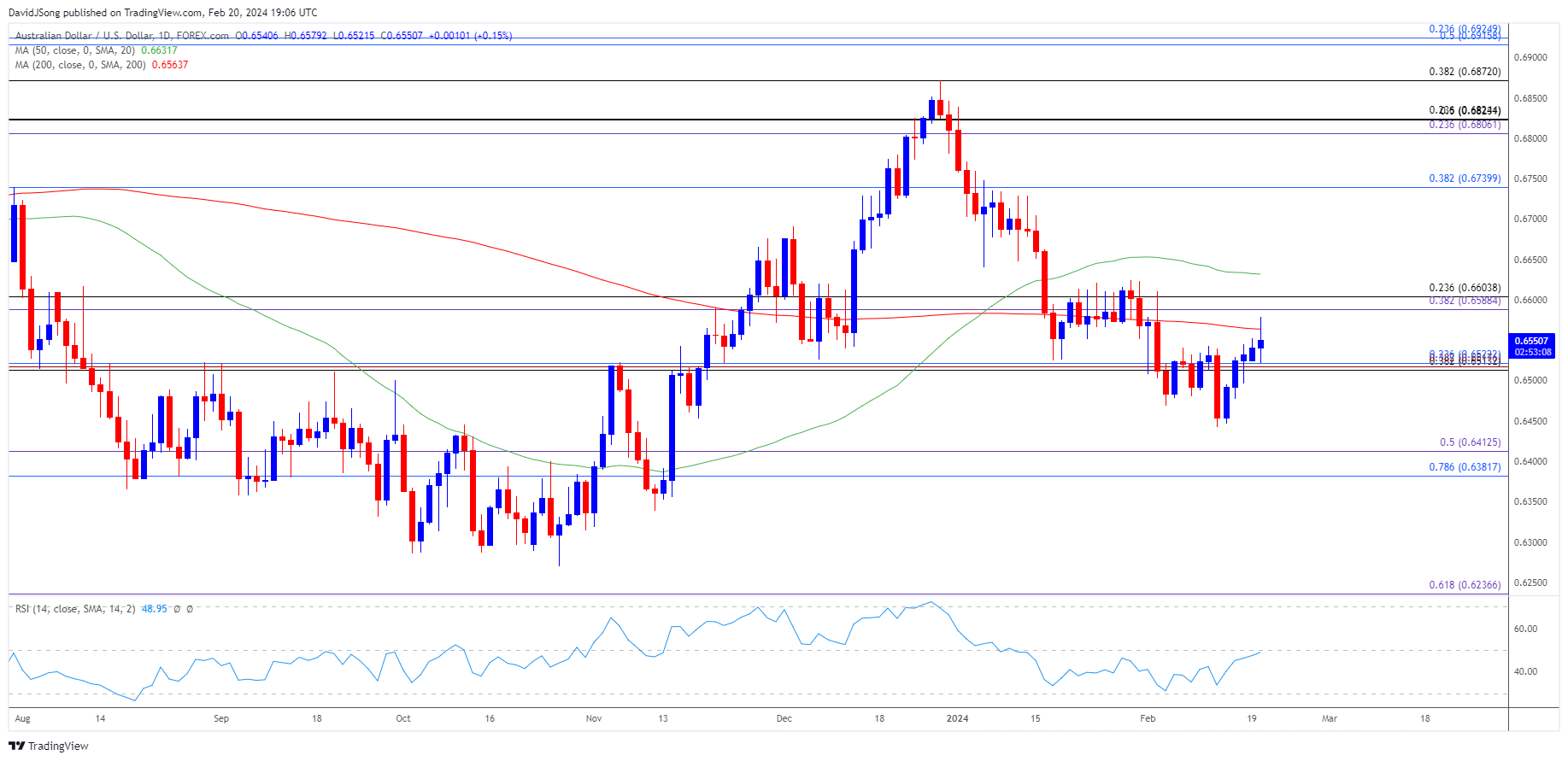

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD registered a fresh monthly low (0.6443) even as the Relative Strength Index (RSI) held above 30, but the oscillator may continue to show the bearish momentum abating as it moves away from oversold territory.

- In turn, AUD/USD may test the monthly high (0.6610), with a move above the 50-Day SMA (0.6632) raising the scope for a move towards 0.6740 (38.2% Fibonacci retracement).

- Next area of interest comes in around 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement), but failure to break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region may keep AUD/USD within the February range.

- Nevertheless, the shift in the moving average may indicate a change in the near-term trend as it starts to reflect a negative slope, and failure to defend the monthly low (0.6443) may push AUD/USD towards the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area.

Additional Market Outlooks

GBP/USD Vulnerable amid Failure to Close Above 50-Day SMA

USD/CAD Rate Susceptible to Flattening Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong