US Dollar Outlook: AUD/USD

AUD/USD registers a fresh monthly high (0.6677) as Australia’s Consumer Price Index (CPI) shows a smaller-than-expected slowdown in underlying inflation, and the exchange rate may further retrace the decline from the August high (0.6724) as it continues to carve a series of higher highs and lows.

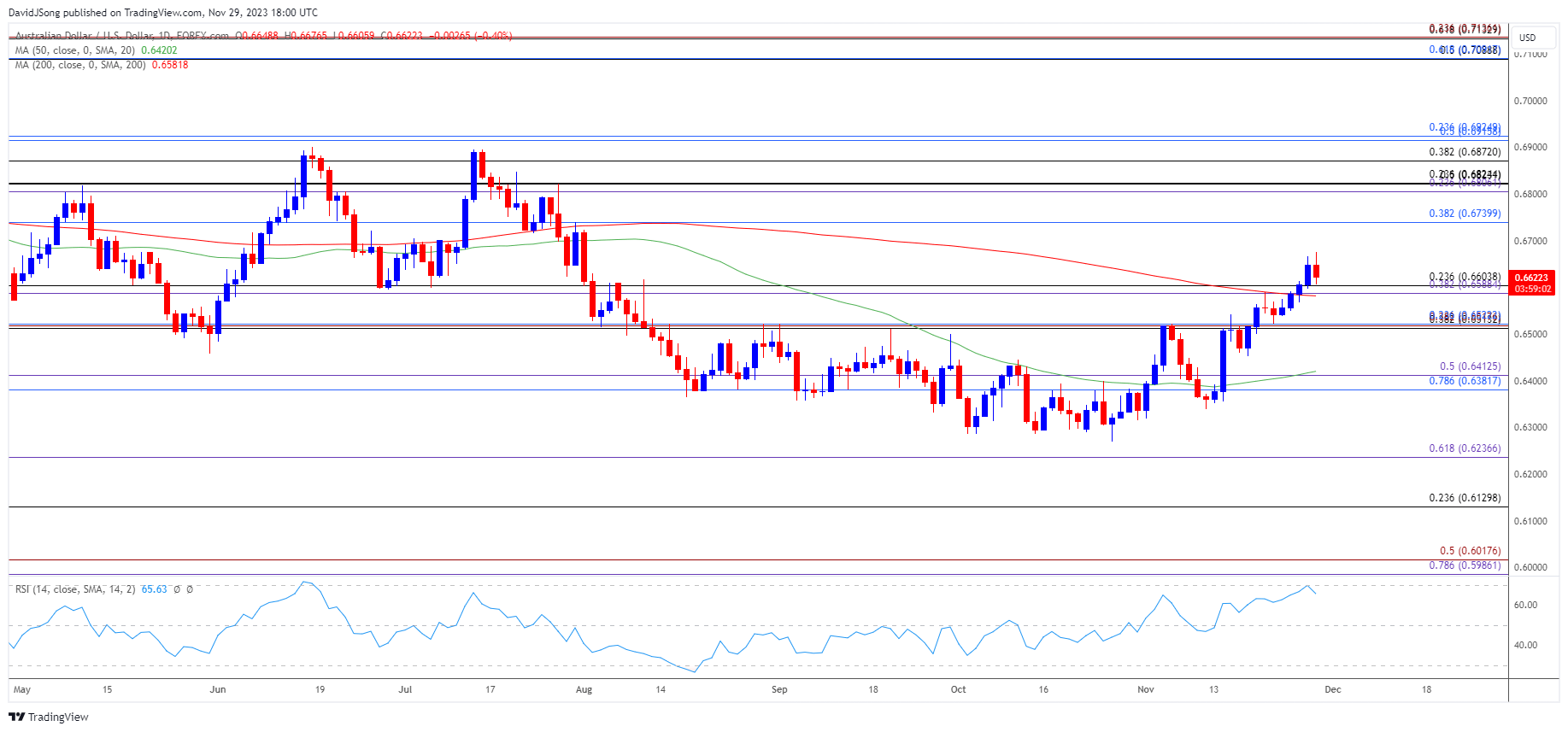

US Dollar Forecast: AUD/USD Fails to Push RSI Into Overbought Zone

Keep in mind, AUD/USD trades above the 200-Day SMA (0.6582) for the first time since July as it extends the advance from the start of the month, and fresh data prints coming out of the US may keep the exchange rate afloat amid signs of slowing price growth.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

US Economic Calendar

The update to the US Personal Consumption Expenditure (PCE) Price Index may sway AUD/USD as the core reading, the Federal Reserve’s preferred gauge for inflation, is expected to narrow to 3.5% in October from 3.7% per annum the month prior.

The development may keep the Federal Open Market Committee (FOMC) on the sidelines at its next interest rate decision on December 13 as inflation falls toward the central bank’s 2% target, but a higher-than-expected core PCE print may drag on AUD/USD as it puts pressure the Fed to pursue a more restrictive policy.

Until then, speculation surrounding US monetary policy may influence AUD/USD as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP), while recent price action raises the scope for a further advance in the exchange rate as it extends the series of higher highs and lows from last week.

With that said, AUD/USD may continue to retrace the decline from the August high (0.6724) as it trades above the 200-Day SMA (0.6582) for the first time since July, but the Relative Strength Index (RSI) may show the bullish momentum abating amid the failed attempt to push into overbought territory.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD extends the series of higher highs and lows from last week to register a fresh monthly high (0.6677), with the break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region bringing the August high (0.6724) on the radar.

- Need a break/close above 0.6740 (38.2% Fibonacci retracement) to open up the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) area, but the Relative Strength Index (RSI) may show the bullish momentum abating as it seems to be reversing ahead of overbought territory.

- Failure to test the August high (0.6724) may curb the bullish price action in AUD/USD, with a breach below the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region raising the scope for a move towards the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Breaks Above Channel Resistance

US Dollar Forecast: USD/JPY Struggles to Trade Back Above 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong