Australian Dollar Outlook: AUD/USD

AUD/USD continues to trade below the 50-Day SMA (0.6598) as it holds within the February range, but the exchange rate may struggle to retain the advance from the yearly low (0.6443) if it tracks the negative slope in the moving average.

US Dollar Forecast: AUD/USD Faces Negative Slope in 50-Day SMA

AUD/USD extends the decline from the start of the week even as China, Australia’s largest trading partner, targets a growth rate of around 5% for 2024, and the exchange rate may continue to depreciate as it initiates a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Australia Economic Calendar

Nevertheless, the update to Australia’s Gross Domestic Product (GDP) report may sway AUD/USD as the economy is projected to grow 0.3% in the fourth quarter of 2023 after expanding 0.2% during the previous period, and a pickup in the growth rate may curb the recent decline in AUD/USD as it raises the Reserve Bank of Australia’s (RBA) scope to further combat inflation.

As a result, the RBA may keep the door open to pursue a more restrictive policy as ‘it was not yet possible to rule in or out further increases in interest rates,’ but a weaker-than-expected GDP print may produce headwinds for the Australian Dollar as puts pressure on Governor Michele Bullock and Co. to alter the course for monetary policy.

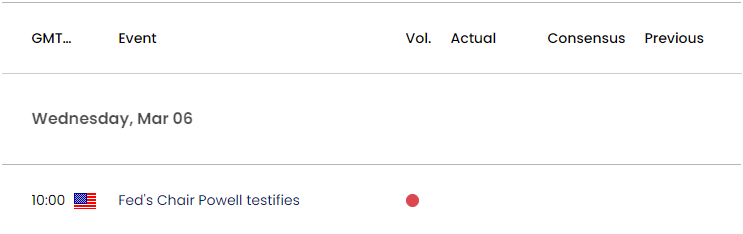

US Economic Calendar

At the same time, the semi-annual testimony from Federal Reserve Chairman Jerome Powell may also influence AUD/USD as the central bank appears to be at the end of its hiking-cycle, and it remains to be seen if Powell will continue to rule out a March rate cut in front of US lawmakers as Fed officials forecast lower interest rates for 2024.

With that said, AUD/USD may continue to trade within the February range as it holds below the 50-Day SMA (0.6598), but the exchange rate may struggle to retain the advance from the yearly low (0.6443) if it tracks the negative slope in the moving average.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD holds within the February range after struggling to trade back above the 50-Day SMA (0.6578), with a move above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region bringing the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area on the radar.

- A breach above the February high (0.6610) opens up 0.6740 (38.2% Fibonacci retracement), but AUD/USD may track the negative slope in the moving average if it struggles to defend the February low (0.6443).

- A break/close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region opens up the November low (0.6318), with the next area of interest coming in around the 2023 low (0.6270).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Trades in Ascending Channel Ahead of BoC

US Dollar Forecast: GBP/USD Rate Fails to Test February High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong