US Dollar Outlook: AUD/USD

AUD/USD struggles to retain the advance from the start of the week following the kneejerk reaction to the US Consumer Price Index (CPI), but the exchange rate may attempt to further retrace the decline from the July high (0.6799) should it continue to carve a series of higher highs and lows.

US Dollar Forecast: AUD/USD Bullish Price Series Persists

AUD/USD pulls back from a fresh weekly high (0.6643) even as the headline US CPI narrows more-than-expected in July as the core rate slips to 3.2% from 3.3% per annum the month prior.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The limited progress in bringing down inflation may keep the Federal Reserve on the sidelines as the central bank pledges to ‘to make our decisions meeting by meeting,’ and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust its forward guidance at its next interest rate decision on September 18 as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP).

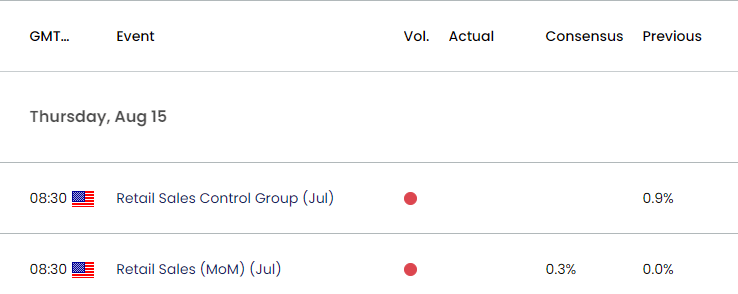

US Economic Calendar

Until then, developments coming out of the US may continue to sway foreign exchange markets as the Fed retains a data-dependent approach in managing monetary policy, and the Retail Sales report may encourage the FOMC to further combat inflation as the update in anticipated to show a 0.3% rise in July.

A rebound in consumer spending may generate a bullish reaction in the US Dollar as it instills an improved outlook for growth, but a weaker-than-expected Retail Sales report may drag on the Greenback as it fuels speculation for an imminent Fed rate-cut.

With that said, AUD/USD may attempt to further retrace the decline from the July high (0.6799) as it pushes above the monthly opening range, but the exchange rate may continue to give back the advance from the start of the week if it snaps the recent series of higher highs and lows.

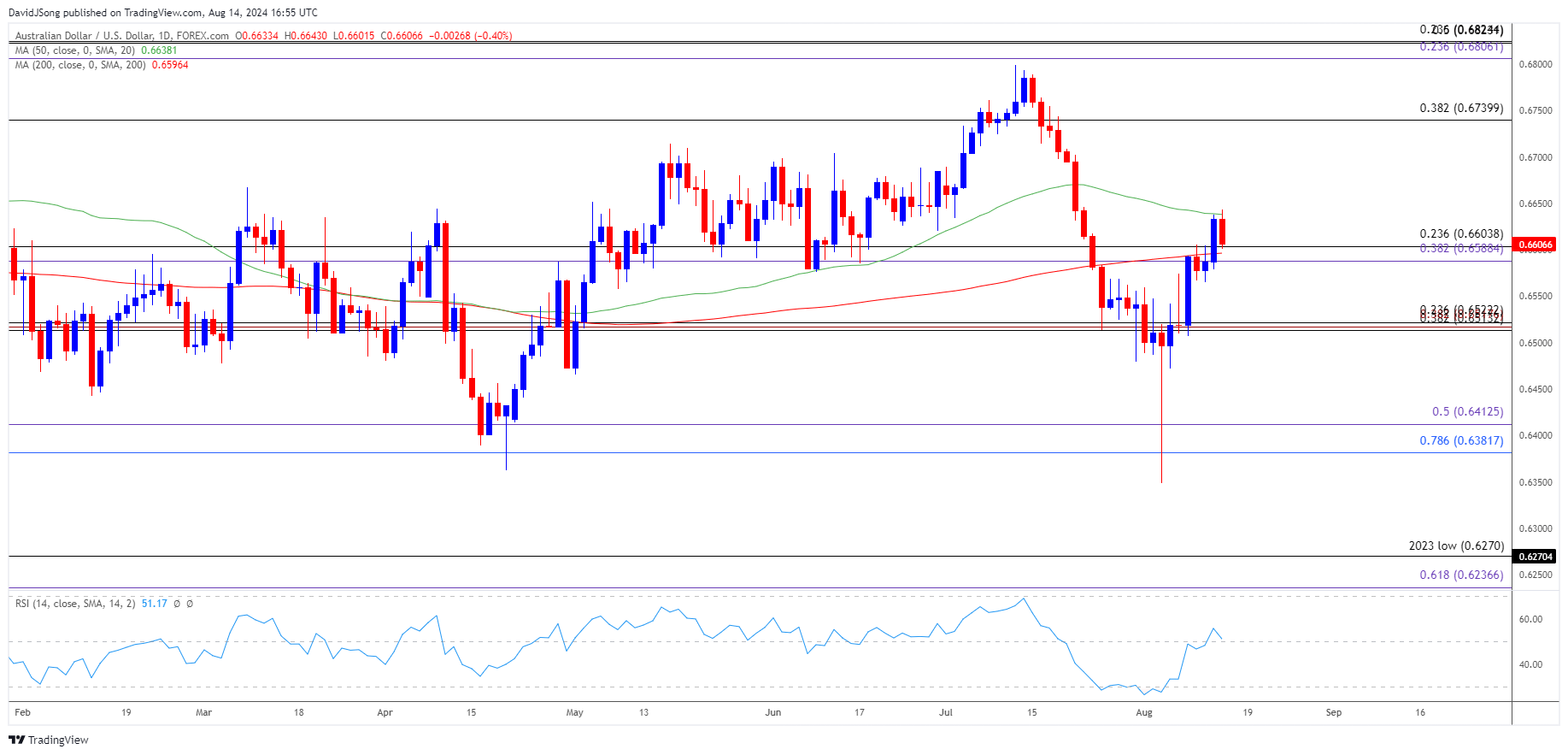

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD struggles to hold above the 50-Day SMA 06628) as it pulls back from a fresh weekly high (0.6643), and failure to hold above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region may push the exchange rate back towards the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area.

- A breach below the 0.6380 (78.6% Fibonacci retracement) To 0.6410 (50% Fibonacci extension) zone opens up the monthly low (0.6349) but AUD/USD may attempt to further retrace the decline from the July high (0.6799) should it continue to carve a series of higher highs and lows.

- Need a break/close above 0.6740 (38.2% Fibonacci retracement) to bring the July high (0.6799) on the radar, with the next area of interest coming in around 0.6810 (23.5% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

NZD/USD Rate Outlook Hinges on RBNZ Interest Rate Decision

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

US Dollar Forecast: USD/JPY Continues to Defend January Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong