US Dollar Outlook: AUD/USD

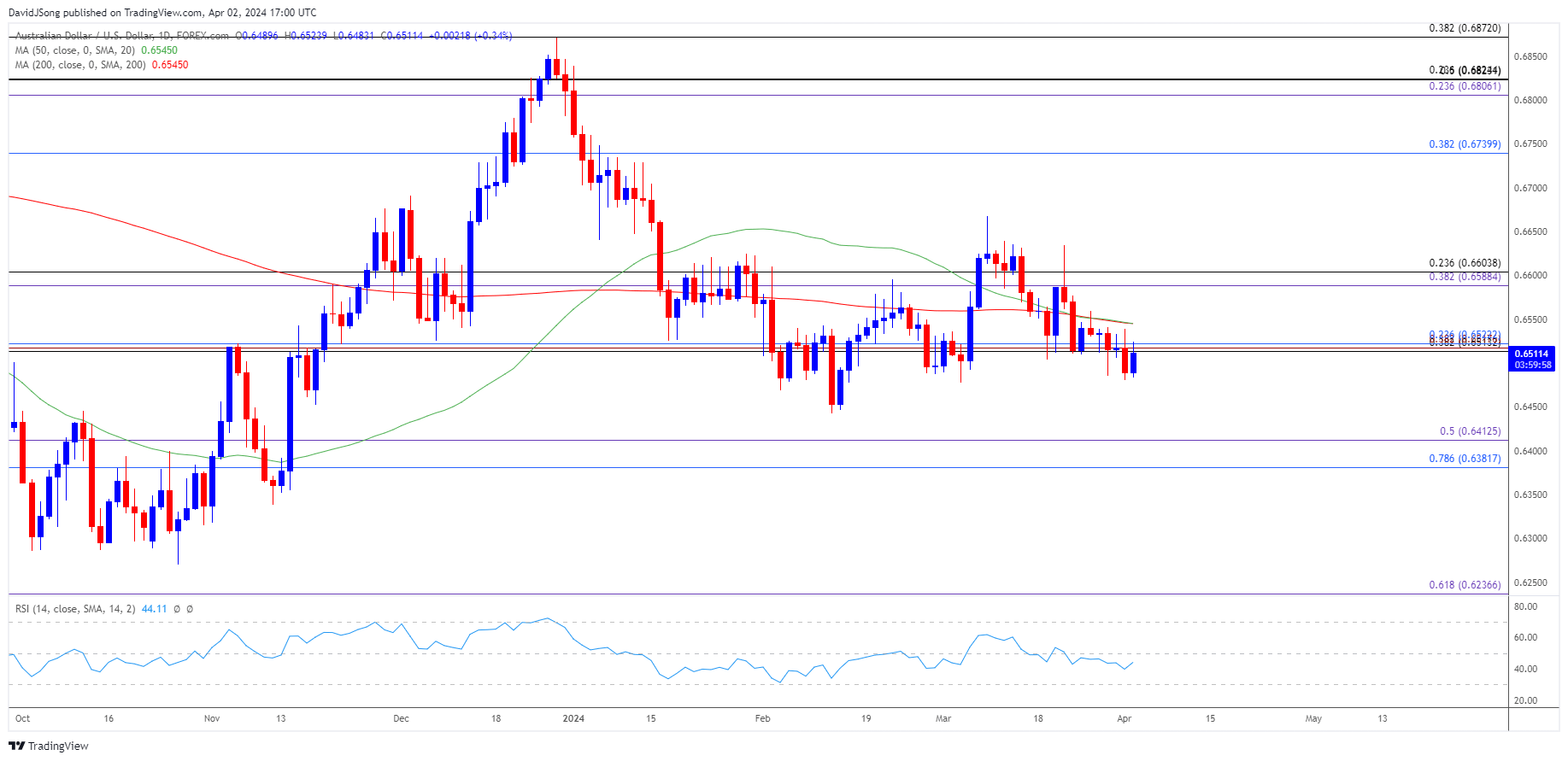

AUD/USD attempts to defend the March low (0.6477) as it retraces the decline from the start of the week, but the exchange rate may track the negative slope in the 50-Day SMA (0.6545) if it continues to hold below the moving average.

US Dollar Forecast: AUD/USD Attempts to Defend March Low

AUD/USD appears to be unfazed by the Reserve Bank of Australia (RBA) Minutes even though the central bank shows little intentions of pursing a more restrictive policy, and the opening range for April remains in focus as the exchange rate bounces back ahead of the weekly low (0.6481).

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Looking ahead, the RBA may continue to adjust its forward guidance for monetary policy as ‘members noted the importance of preserving as many of the gains in the labour market as possible,’ and it remains to be seen if the Federal Reserve will follow as similar path as Chairman Jerome Powell and Co. prepare US households and businesses for a less restrictive policy.

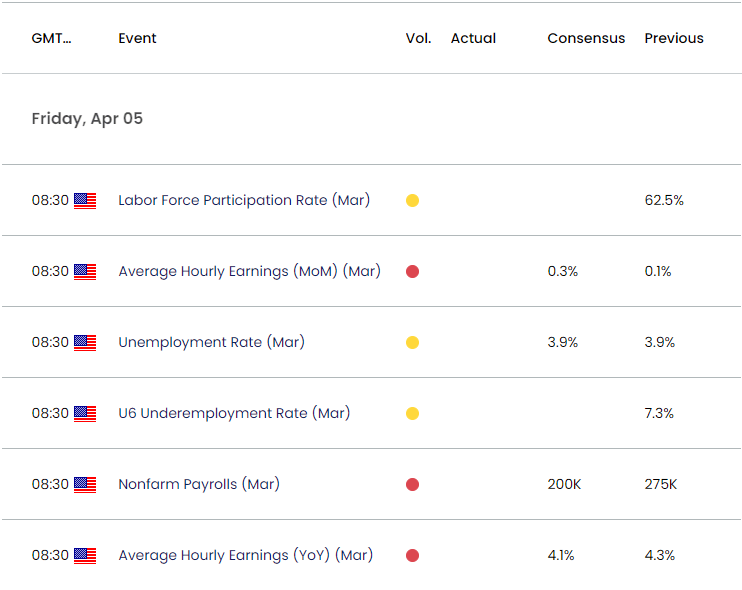

US Economic Calendar

However, the Federal Open Market Committee (FOMC) may come under pressure to further combat inflation as the Non-Farm Payrolls (NFP) report is anticipated to show the US adding 200K jobs in March while the Unemployment Rate is expected to hold steady at 5.9% during the same period.

Data prints reflecting a strong labor market may generate a bullish reaction in the Greenback as it raises the Fed’s scope to keep US interest rates higher for longer, but a weaker-than-expected NFP print may keep AUD/USD within last month’s range as it puts pressure on the FOMC to deliver a rate cut sooner rather than later.

With that said, AUD/USD may extend the rebound from the weekly low (0.6481) as it seems to be defending the March low (0.6477), but the exchange rate may respond to the negative slope in the 50-Day SMA (0.6546) if it continues to hold below the moving average.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD may trade within the March range as it retraces the decline from the start of the week, with a breach above the 50-Day SMA (0.6545) raising the scope for a move towards the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region.

- Next area of interest comes in around the March high (0.6668), but AUD/USD may track the negative slope in the moving average if it continues to hold below the indicator.

- Failure to defend the March low (0.6477) may lead to a test of the February low (0.6443), with the next region of interest coming in around the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Clears March Low Ahead of US NFP Report

US Dollar Forecast: USD/JPY Opening Range for April in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong