US Dollar Outlook: AUD/USD

AUD/USD approaches the monthly low (0.6477) even as the Reserve Bank of Australia (RBA) insists that ‘it will be some time yet before inflation is sustainably in the target range,’ and the exchange rate may track the negative slope in the 50-Day SMA (0.6562) as it no longer traders above the moving average.

US Dollar Forecast: AUD/USD Approaches Monthly Low After RBA Meeting

Keep in mind, AUD/USD pushed above the moving average earlier this month to clear the February high (0.6610), but the exchange rate appears to have reversed well ahead of the January high (0.6839) amid the lack of momentum to hold above the indicator.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

As a result, AUD/USD may continue to give back the advance from the yearly low (0.6443) as the RBA no longer mentions higher interest rates, and it seems as though Governor Michele Bullock and Co. are preparing to shift gears later this year as the ‘Board is not ruling anything in or out.’

US Economic Calendar

Looking ahead, it remains to be seen if the Federal Reserve will adjust its forward guidance for monetary policy as the central bank is widely expected to retain the status quo, and the fresh forecasts from Fed officials may produce headwinds for the Greenback as Chairman Jerome Powell tells Congress that ‘it will likely be appropriate to begin dialing back policy restraint at some point this year.

In turn, the update to the Summary of Economic Projections (SEP) may curb the recent decline in AUD/USD should Fed officials continue to forecast lower interest rates in 2024, but the Federal Open Market Committee (FOMC) may tame speculation for an imminent rate cut amid the stickiness in the US Consumer Price Index (CPI).

As a result, an upward adjustment in the Fed’s interest rate dot-plot may keep AUD/USD under pressure, and the exchange rate may continue to approach the monthly low (0.6477) if the FOMC shows a greater willingness to further combat inflation.

With that said, the Fed rate decision may sway the near-term outlook for AUD/USD amid the bearish reaction to the RBA meeting, and the exchange rate may track the negative slope in the 50-Day SMA (0.6563) as it trades back below the moving average.

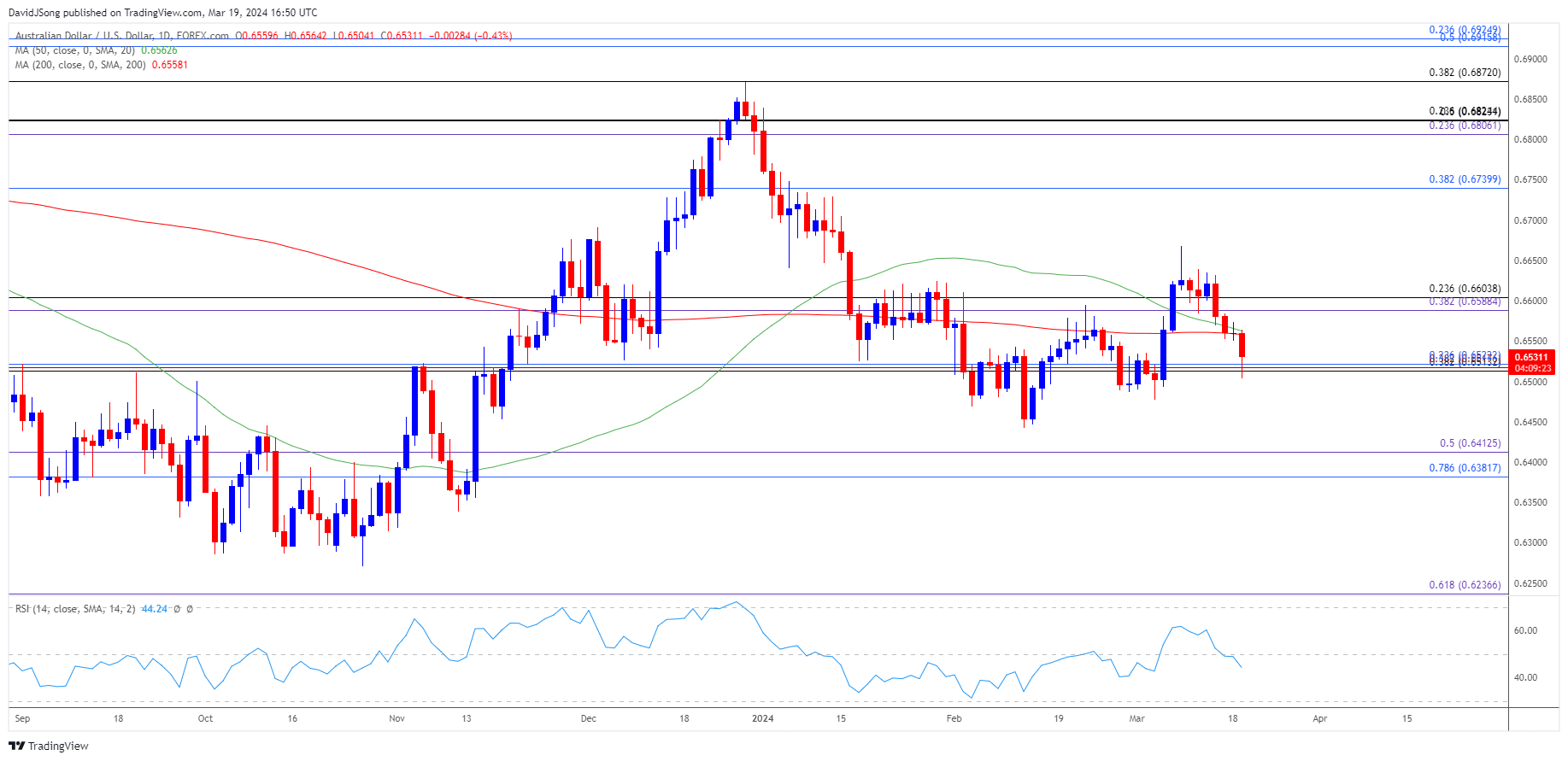

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD seems to have reversed course well ahead of the January high (0.6839) as it trades back below the 50-Day SMA (0.6563), with a close below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area raising the scope for a test of the monthly low (0.6477).

- AUD/USD may track the negative slope in the moving average if it fails to defend the March range, with a breach below the yearly low (0.6443) opening up the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region.

- However, failure to test the monthly low (0.6477) may push AUD/USD back above the moving average, with a break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area bringing the monthly high (0.6668) on the radar.

Additional Market Outlooks

US Dollar Forecast USD/JPY Attempts to Climb Back Above 50-Day SMA

US Dollar Forecast: GBP/USD Slips Below Former Resistance Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong