US Dollar Outlook: AUD/USD

AUD/USD appears to be stuck in a narrow range amid the limited reaction to the Reserve Bank of Australia (RBA) Minutes, but the exchange rate may track the positive slope in the 50-Day SMA (0.6623) as it holds above the moving average.

US Dollar Forecast: AUD/USD 50-Day SMA Maintains Positive Slope

AUD/USD may consolidate ahead of the US Non-Farm Payrolls (NFP) report even as the RBA Minutes show little hints of a looming rate-cut, and it seems as though Governor Michele Bullock and Co. are in no rush to switch gears as ‘information received since the previous meeting had reinforced the need to be vigilant to upside risks to inflation.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Nevertheless, the range bound price action in AUD/USD may persist as US traders go offline in observance of the 4th of July holiday, but the US NFP report may sway the near-term outlook for the exchange rate as the update is anticipated to show another rise in employment.

US Economic Calendar

The US economy is projected to add 195K jobs in June while the Unemployment Rate is expected to hold steady at 4.0% during the same period, and a positive development may produce a bullish reaction in the US Dollar as it raises the Federal Reserve’s scope to further combat inflation.

However, a weaker-than-expected NFP print may encourage the Federal Open Market Committee (FOMC) to pursue a less restrictive policy, and signs of slowing job growth may drag on the Greenback as it fuels speculation for a Fed rate-cut in 2024.

With that said, AUD/USD may track the positive slope in the 50-Day SMA (0.6623) as it holds above the moving average, but the range bound price action may persist as the exchange rate continues to pull back from the weekly high (0.6689).

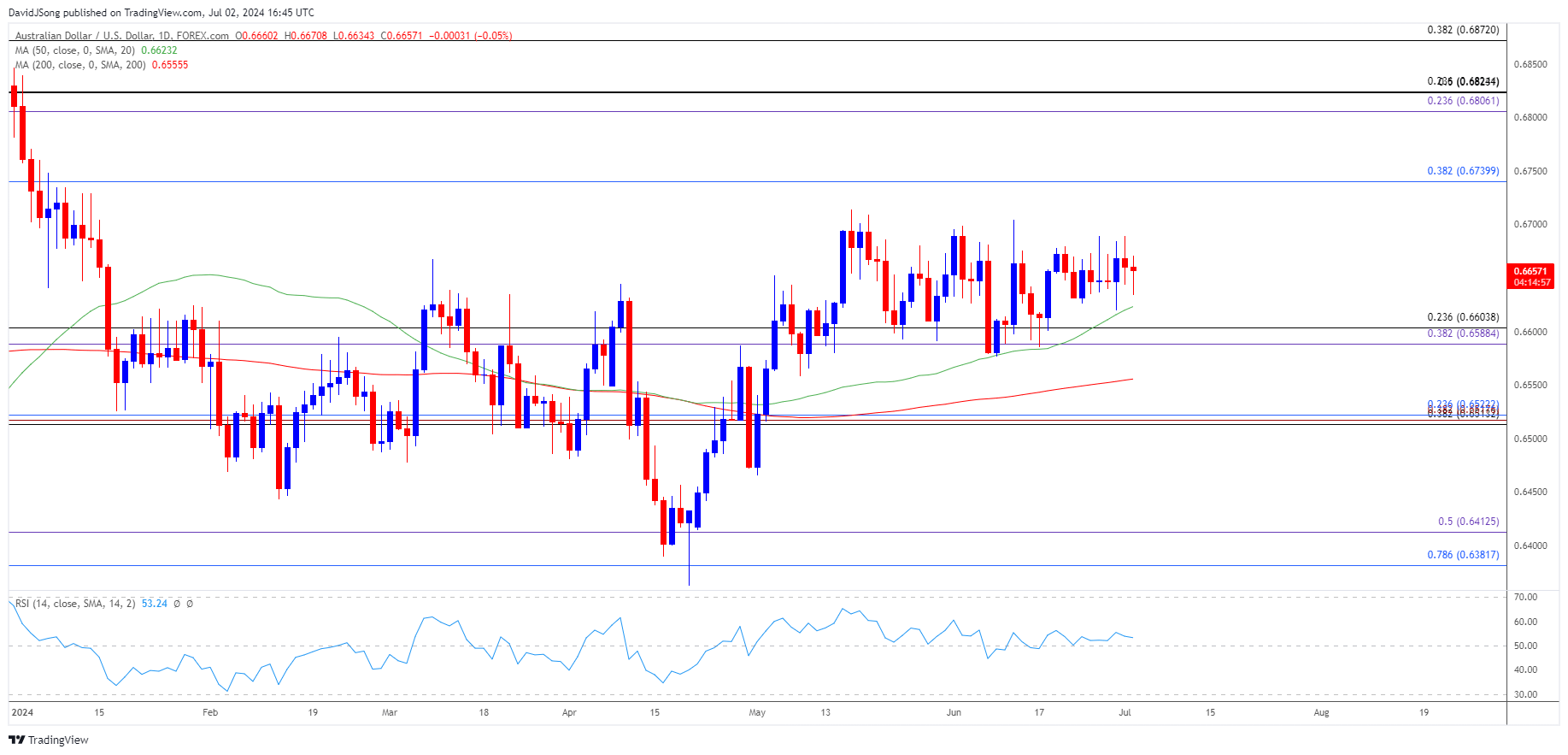

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD trades in a narrow range following the failed attempt to test the May high (0.6714), but failure to hold above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region may lead to a test of the June low (0.6576).

- Next area of interest comes in around 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) but AUD/USD may track the positive slope in the 50-Day SMA (0.6623) as it holds above the moving average.

- A move above the weekly high (0.6689) may spur another run at the May high (0.6714), with the next area of interest coming in around 0.6740 (38.2% Fibonacci retracement).

Additional Market Outlooks

Euro Forecast: EUR/USD Vulnerable to Slowing Euro Area Inflation

USD/JPY Forecast: RSI Holds in Overbought Territory

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong