U.S. Dollar Talking Points:

- The U.S. Dollar has set another fresh two-year-high to start this week.

- The big item on the calendar for the USD this week is the U.S. CPI print set for release on Wednesday, and the expectation is for another increase in headline CPI YoY.

- I’ll be looking at the U.S. Dollar from multiple vantage points in tomorrow’s webinar, and you’re welcome to join: Click here for registration information.

USD bulls still have yet to relent and this week’s open ushered in yet another fresh two-year-high in the USD. The DXY basket pushed its first test of the 110.00 handle since the fall in the currency in November of 2022. Back then, there was a potent combination of slowing U.S. rate hikes, softening inflation and the mirror image in counterparts as the European Central Bank was ramping up rate hikes.

In this episode, however, U.S. inflation has continued to impress, and it’s expected to increase again on Wednesday with headline CPI YoY expected at 2.8%.

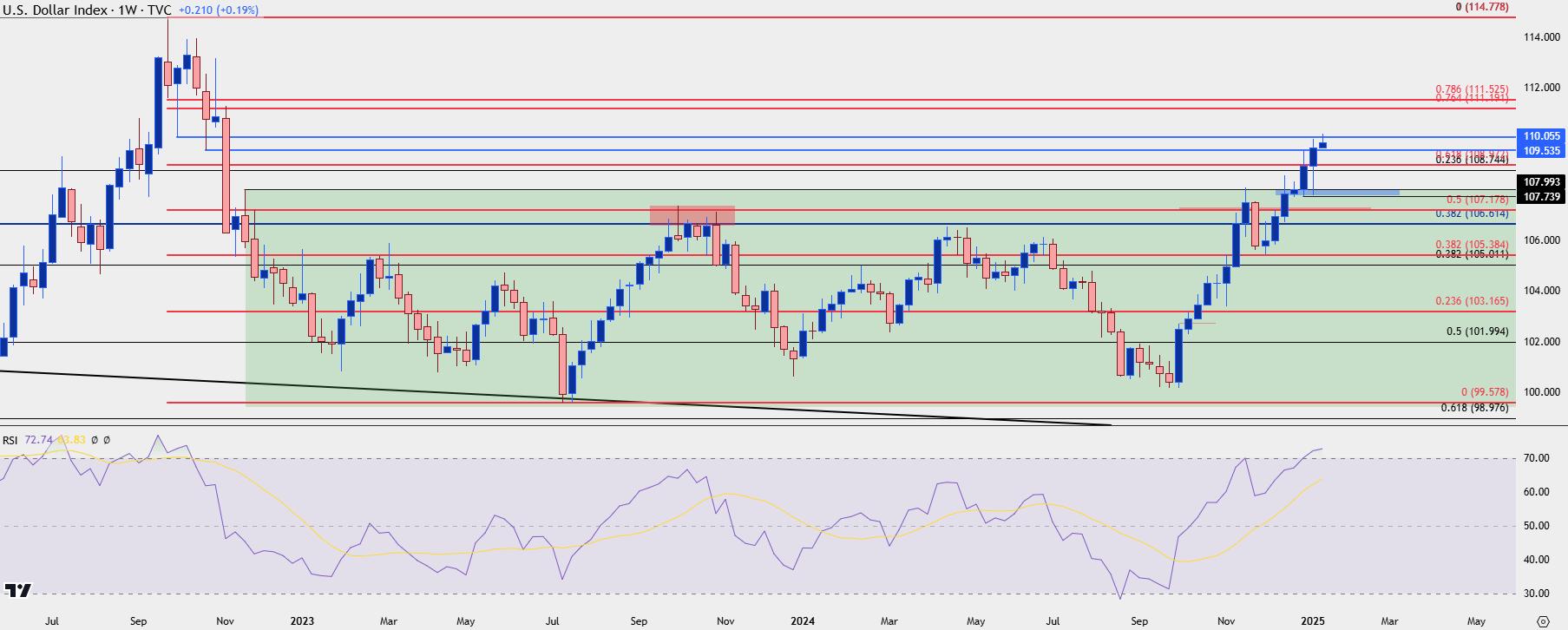

On the weekly chart below, we can see an overbought backdrop as the RSI indicator is now at its highest since October of 2022. That doesn’t necessarily spell doom-and-gloom, though, as you you’ll notice that the prior instance showed as multiple episodes of overbought over a few-month-period before prices ultimately snapped back.

It does, however, make for a more difficult argument if chasing at or near freshly-established highs.

U.S. Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

U.S. Dollar Strategy

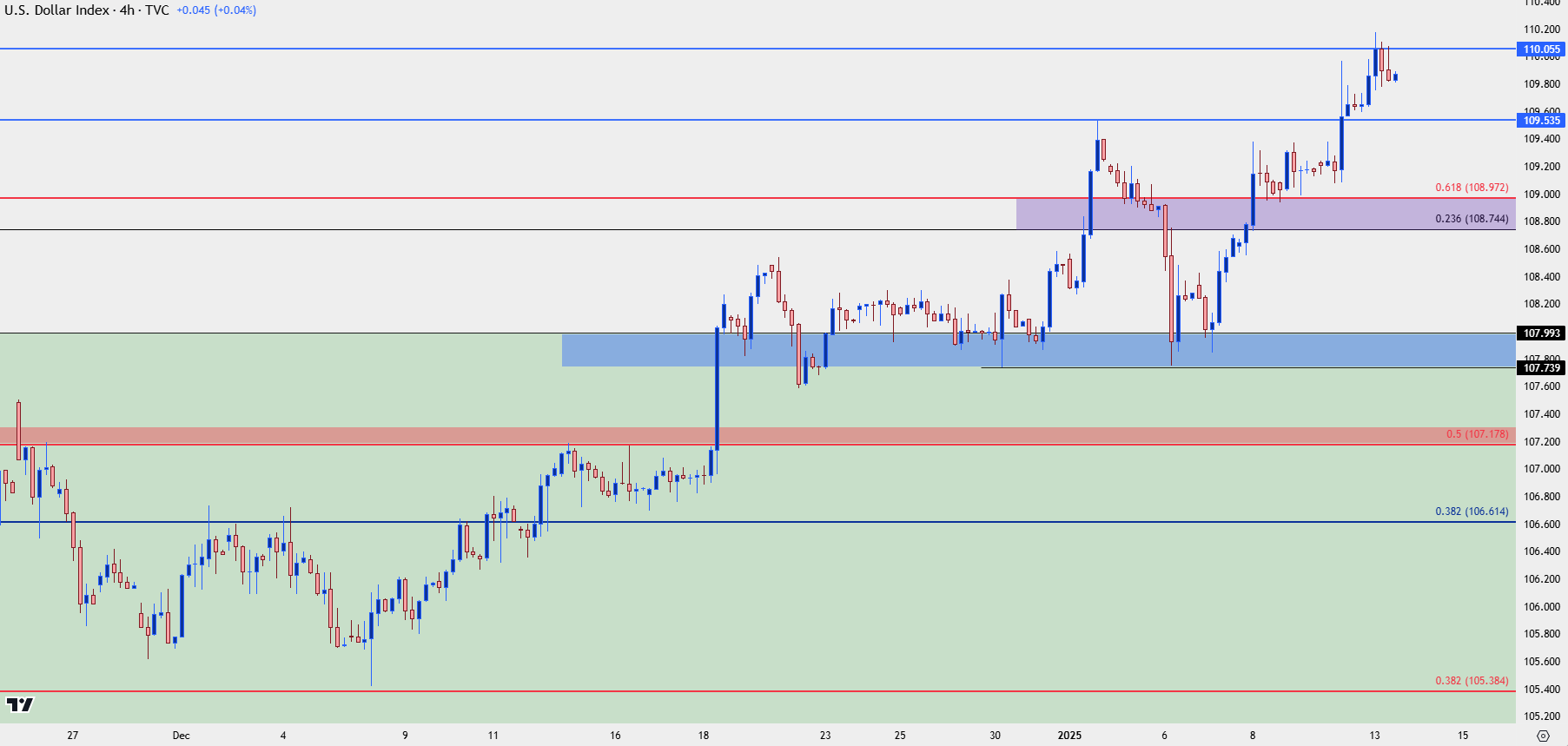

When I looked at the USD in last week’s webinar, I highlighted the fact that the trend was still bullish, even though the currency had just posed a pullback.

That pullback found support right around a prior spot of resistance of 108.00 in DXY, and then the final four days of last week printed green with a massive move on Friday on the back of the NFP print. And that highlights what I’m expecting to be the driver for this week with U.S. inflation.

At this point CPI is expected to come out at 2.8% against last month’s 2.7% print and the 2.6% reading from the month before (via headline CPI, YoY). And even though the USD is overbought on the weekly and, as of this writing, the daily chart, there could be scope for continuation on the basis of that data point. But, as noted above, chasing the move-higher could be a challenge.

Instead, there’s three different areas of support that I’m tracking for bullish continuation potential. The first is a spot of support-turned-resistance at 109.54. This price helped to set a high in early-2025 trade which brought the pullback that ran into last week’s open. So far, however, there hasn’t been much there for support since the breakout. Below that is a zone between two Fibonacci levels, plotted from 108.74-108.97. And below that is the support from last week, looked at in the webinar, plotted from 107.47-108.00. If bulls can’t hold that zone then I think the door opens wider for reversal potential of the near-term trend.

U.S. Dollar Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist