US Dollar, EUR/USD, GBP/USD Talking Points:

- The US Dollar continued its descent through the first half of last week, continuing a bearish run that started just ahead of the Q3 open.

- As discussed in the Monday video and the Tuesday webinar, EUR/USD was coming into some key resistance with a Fibonacci level of note plotted at 1.0943. GBP/USD, on the other hand, was showing even more strength, rallying up to the 1.3000 level that hasn’t been traded since last July in the pair, while RSI had moved into overbought territory on the daily chart.

- The late week reaction of USD-strength helped both EUR/USD and GBP/USD to moderate off of resistance, but the question remains as to whether that’s a pullback or the start of fresh trends.

- I’ll be discussing these themes in-depth in the weekly webinar. It’s free for all to register: Click here to register.

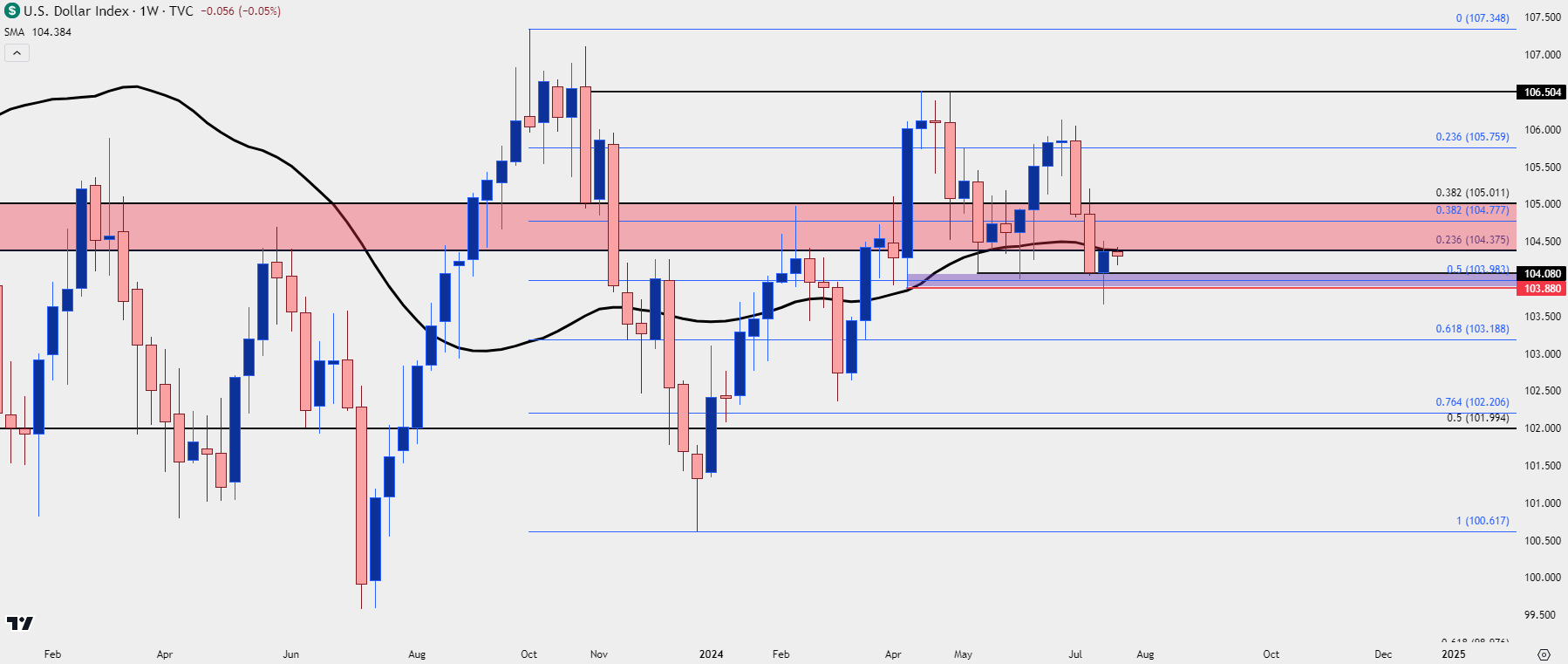

The US Dollar put in a strong move in late-week trade to hold the 104.00 level on the weekly chart. That remains a key zone for the currency, as this is the same spot that held the lows in Q2 and the fact that the bounce took place after the European Central Bank rate decision, when EUR/USD tested a key Fibonacci level, makes the move all the more interesting.

In DXY, the weekly bar finished in the green for the first time in Q3. As you can see from the Fibonacci level at 104.38 on the below chart, bulls aren’t quite out of the woods yet, as there could be a claim to lower-high resistance.

The 200-day moving average is also of note as this similarly helped to hold the highs after last week’s bounce and remains a spot of contention for bulls should they attempt to force continuation.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

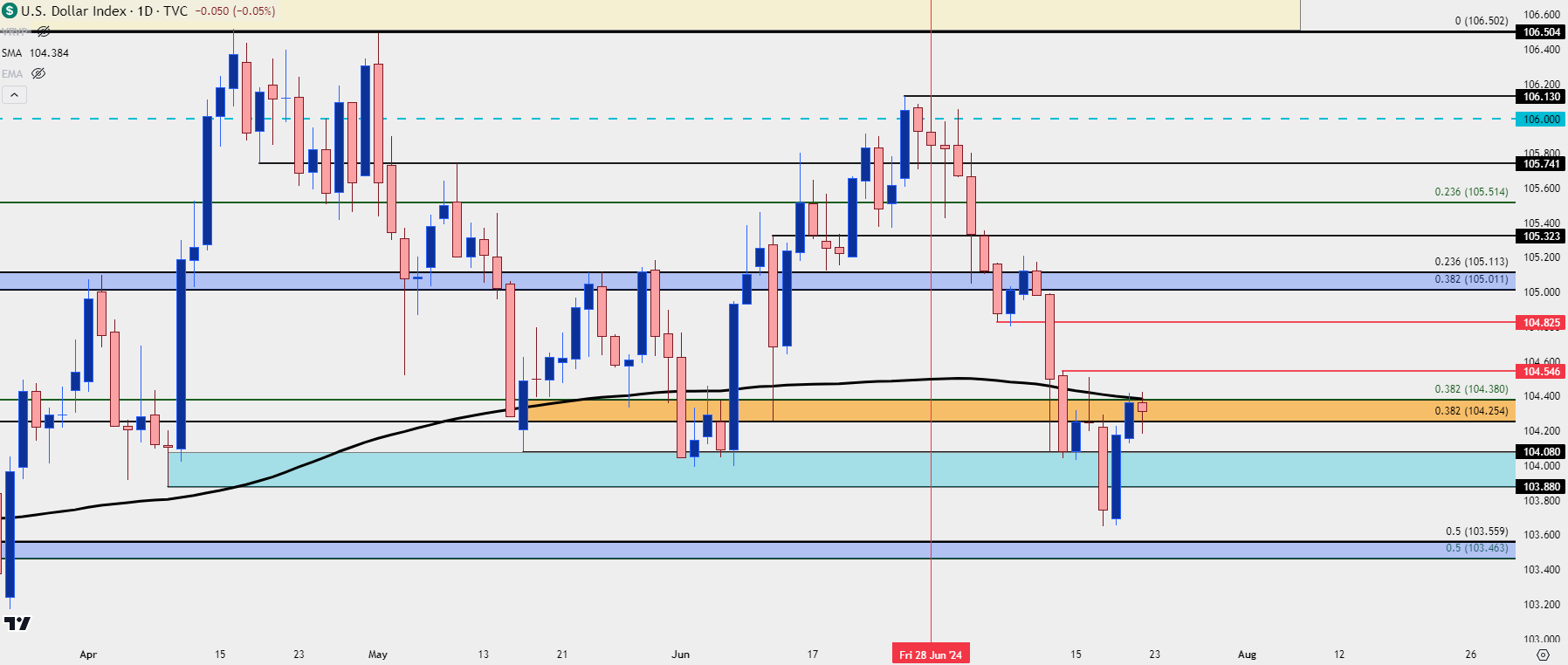

From the daily USD chart we can get a bit more context with the recent backdrop. Prices had fallen aggressively since late June where, interestingly, the high was a hold just after the Presidential Debate. Since then the USD was besieged by bears on the way to fresh three-month-lows.

Given the incredibly important role of USD in major FX pairs, this also had the impact of lifting EUR/USD and GBP/USD to fresh highs.

But, from the below chart we can see the two-day rally on Thursday and Friday re-claiming the 104.00 handle as prices pushed right back to the 200-day moving average.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

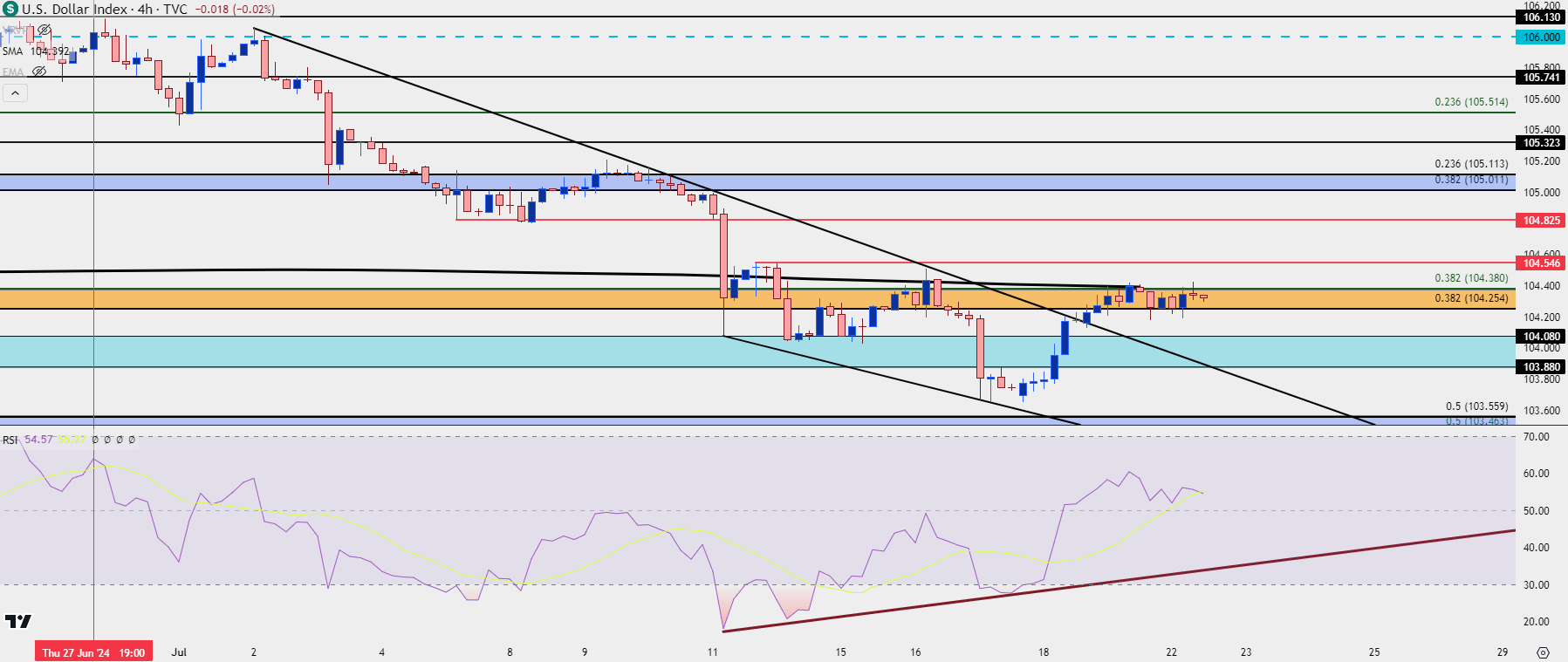

US Dollar Shorter-Term

The four-hour chart has a bit of additional context that’s notable: The fall happened so quickly that a falling wedge formation had formed, which is often approached with aim of bullish reversal. And given the stretch from Thursday the 11th until the 18th, which runs from the last US CPI release into the European Central Bank rate decision, there was a case of RSI divergence.

Those two factors have helped to push the recent bullish move and from the four-hour chart below, we can see a progression of higher-highs as price has climbed into the 104.25-104.38 resistance zone, with the 200-dma coming back into the picture.

The big question now is whether bulls can hold a higher-low to continue the trend, and given the zone just below from 103.88-104.08, there’s a very clear area where this could take place around.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

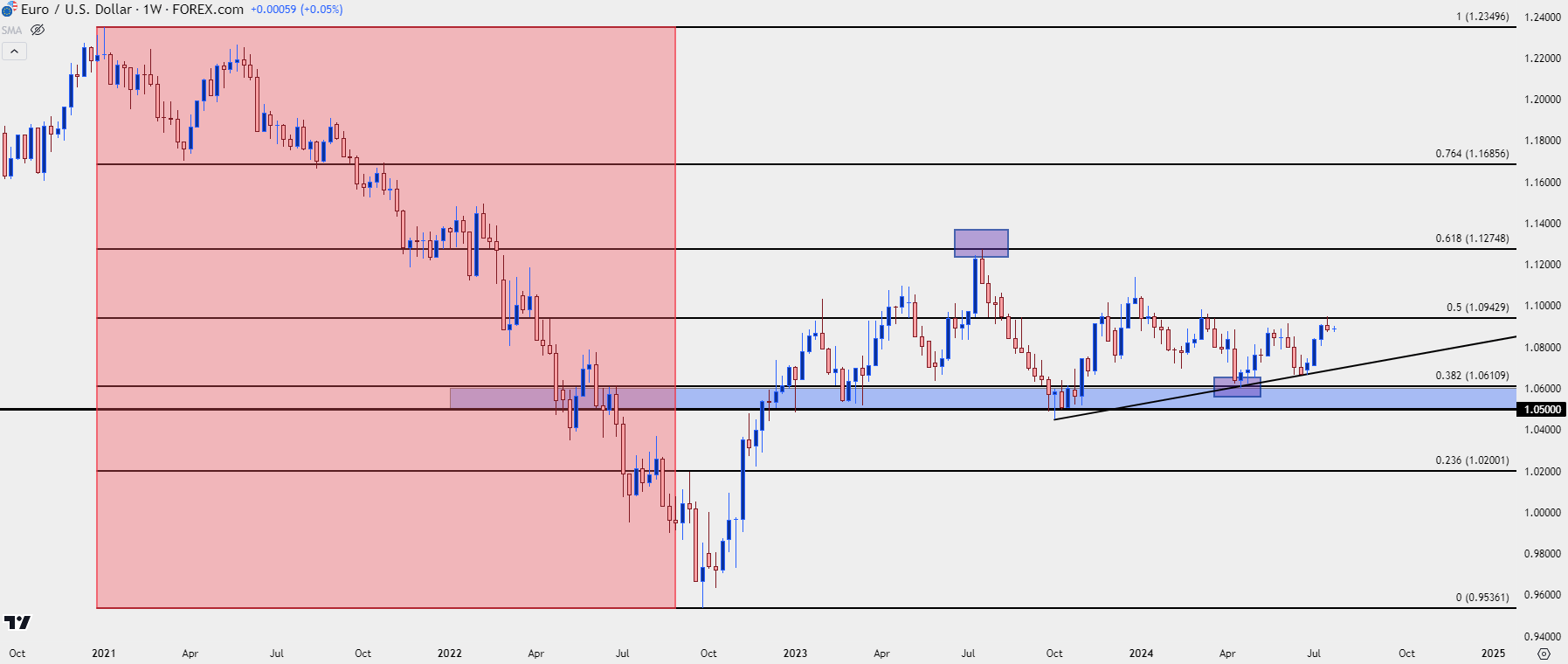

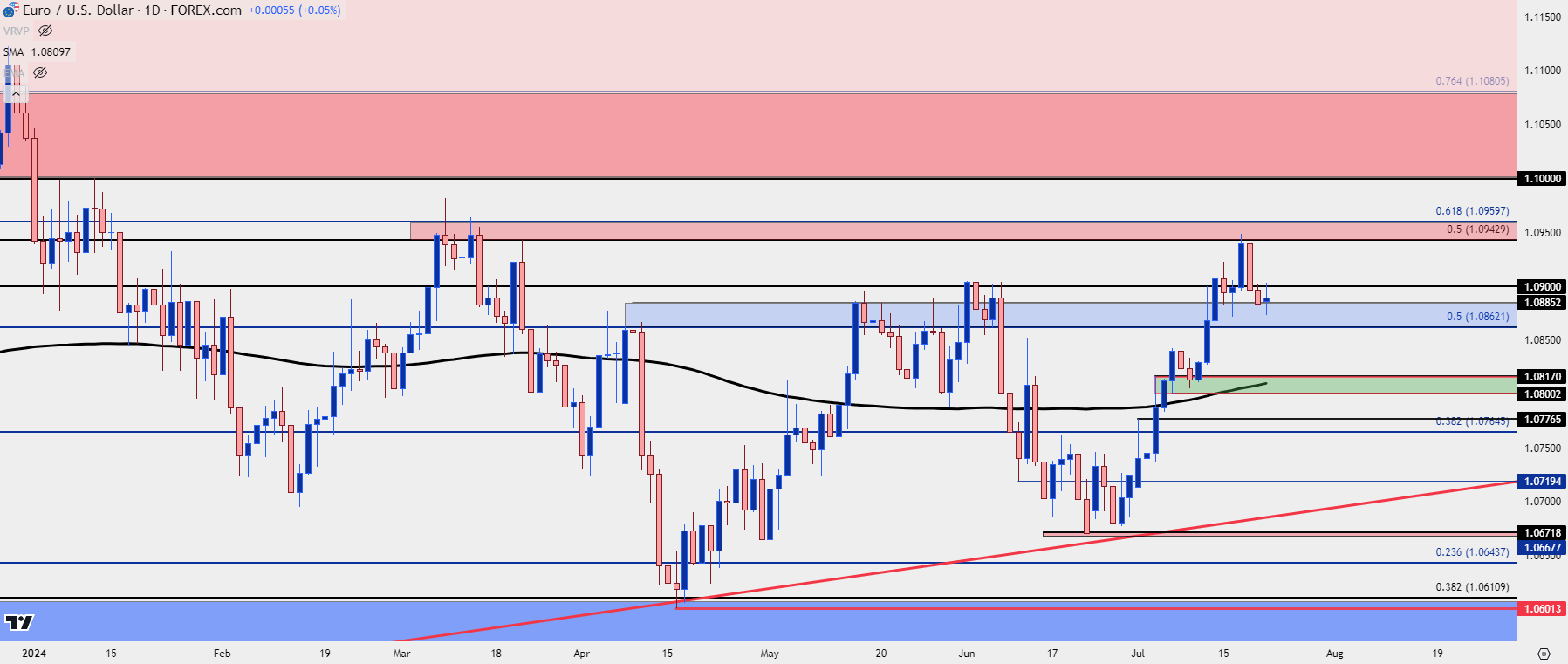

EUR/USD Fibonacci Resistance

Bulls have been going to work for almost a full month in EUR/USD and interestingly, this has taken place after the ECB already started their rate cutting cycle. There was a two-day sell-off around that rate cut, with a low coming in at 1.0670, but sellers were unable to do anything below that level as prices grinded for two weeks until the USD started its descent.

But notably, the price that came into play last week to hold the highs comes from a key Fibonacci retracement, drawn from the 2021 high down to the 2022 low. That same Fibonacci retracement has helped to mark the 2023 high at 1.1275 (the 61.8% retracement), as well as the current 2024 low at 1.0611 (the 38.2% retracement).

The 50% mark plots at 1.0943 and it was last in-play in March, helping to hold resistance just before a bullish run in the USD appeared.

EUR/USD Weekly Price Chart:

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Pullback

That resistance came into play last week and bulls were unable to do much beyond that level. But – the pullback from that has so far held support at prior resistance, in the 1.0862-1.0885 zone. This has a similar look as last week when the same zone was being tested as support on Tuesday; and also similar to the week before when EUR/USD was trying to hold a higher-low around the 1.0800 handle.

So bullish continuation cannot yet be ruled out and this syncs with the above scenario in USD, where bears can still make claim to the trend if they’re able to hold resistance at the 200-day moving average.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

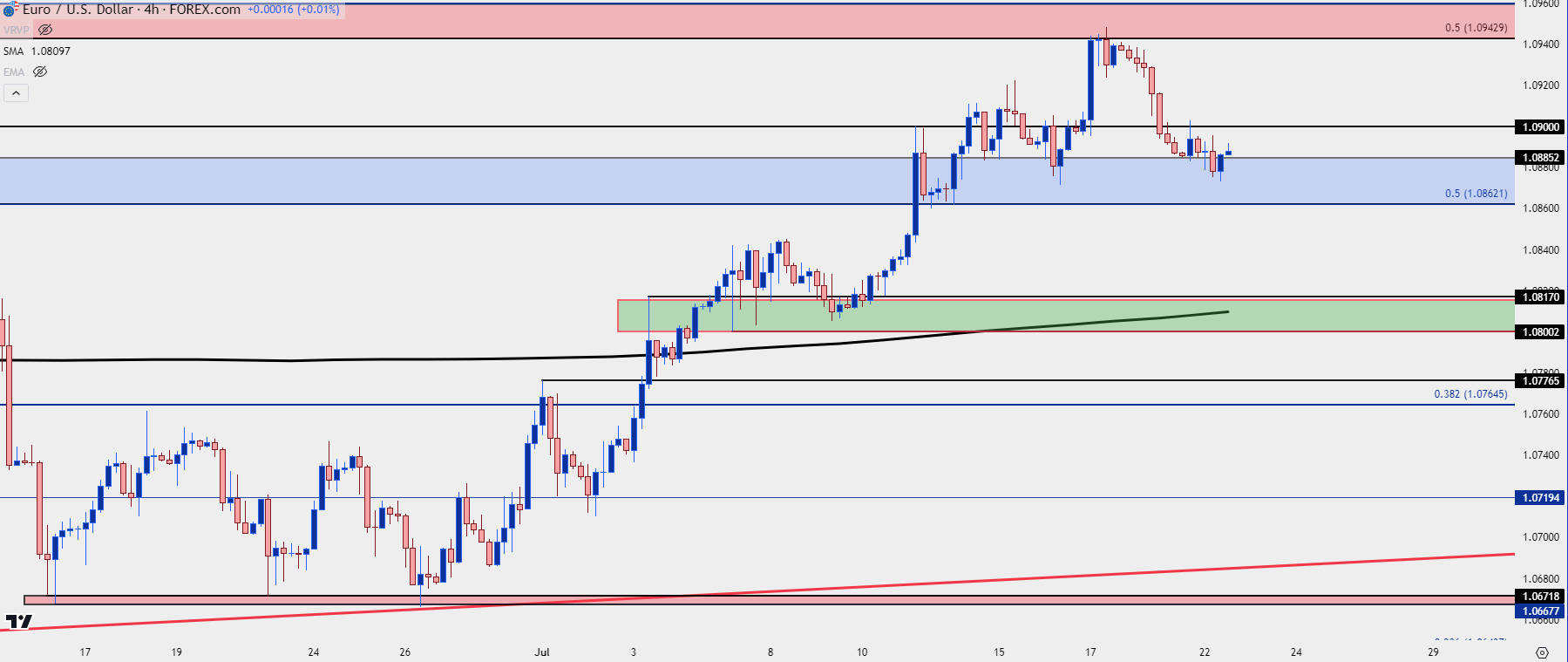

EUR/USD Four-Hour

From a shorter-term basis the big item of interest is whether EUR/USD has already set a local top. The reaction to resistance was strong and from the four-hour chart below, we can see where bulls haven’t exactly had a strong reaction to that support zone at this point. If sellers can push-below 1.0862, that sets up a scenario with which the 200-day moving average becomes another possible point of support.

That currently plots in the support zone from the prior week, spanning from 1.0800 up to 1.0817, and a re-test there would highlight a short-term lower-low that could further enforce range continuation from the longer-term chart.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

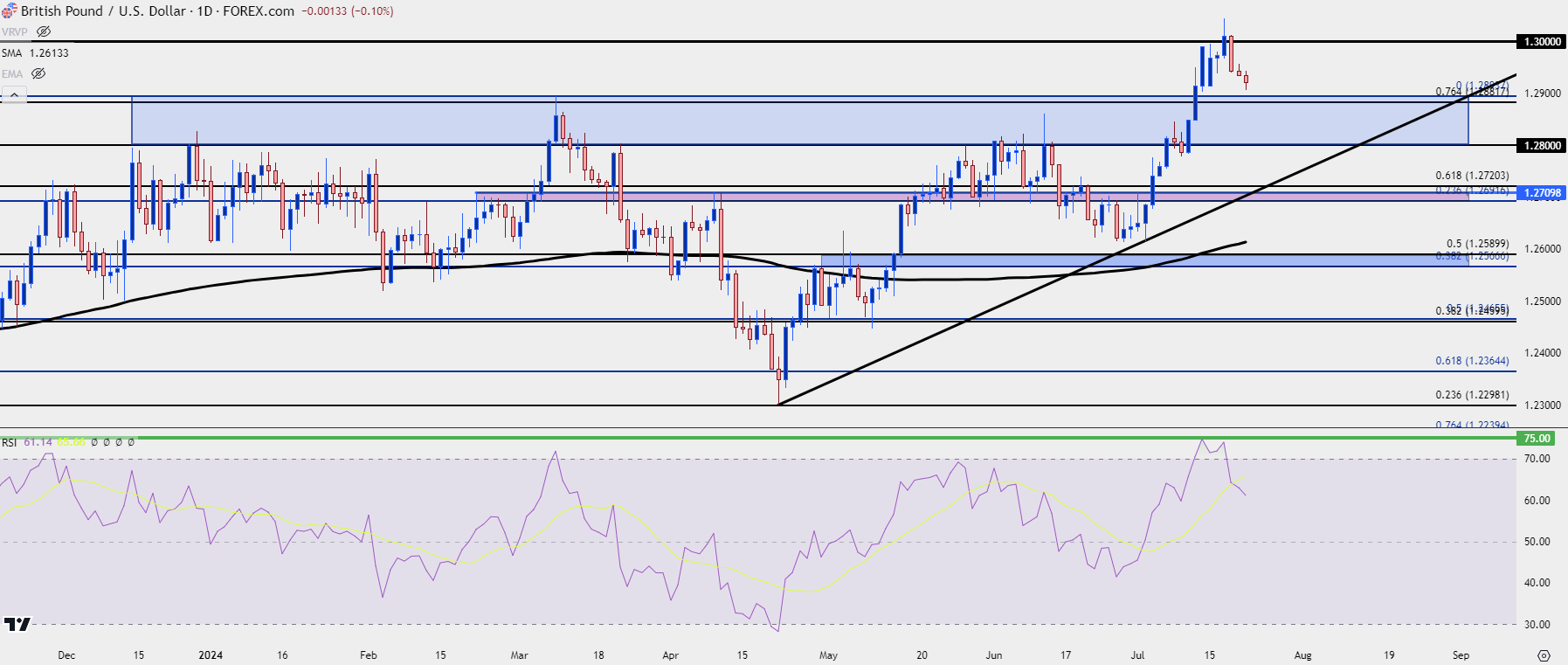

GBP/USD

While EUR/USD showed a reaction to a key price last week, so did GBP/USD, and the resistance in Cable is perhaps even more clear-cut than what was seen in the Euro.

GBP/USD re-tested the 1.3000 handle for the first time since last July. This also happened as GBP/USD went overbought on the daily chart via RSI. Since then a fast pullback has developed in the pair.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

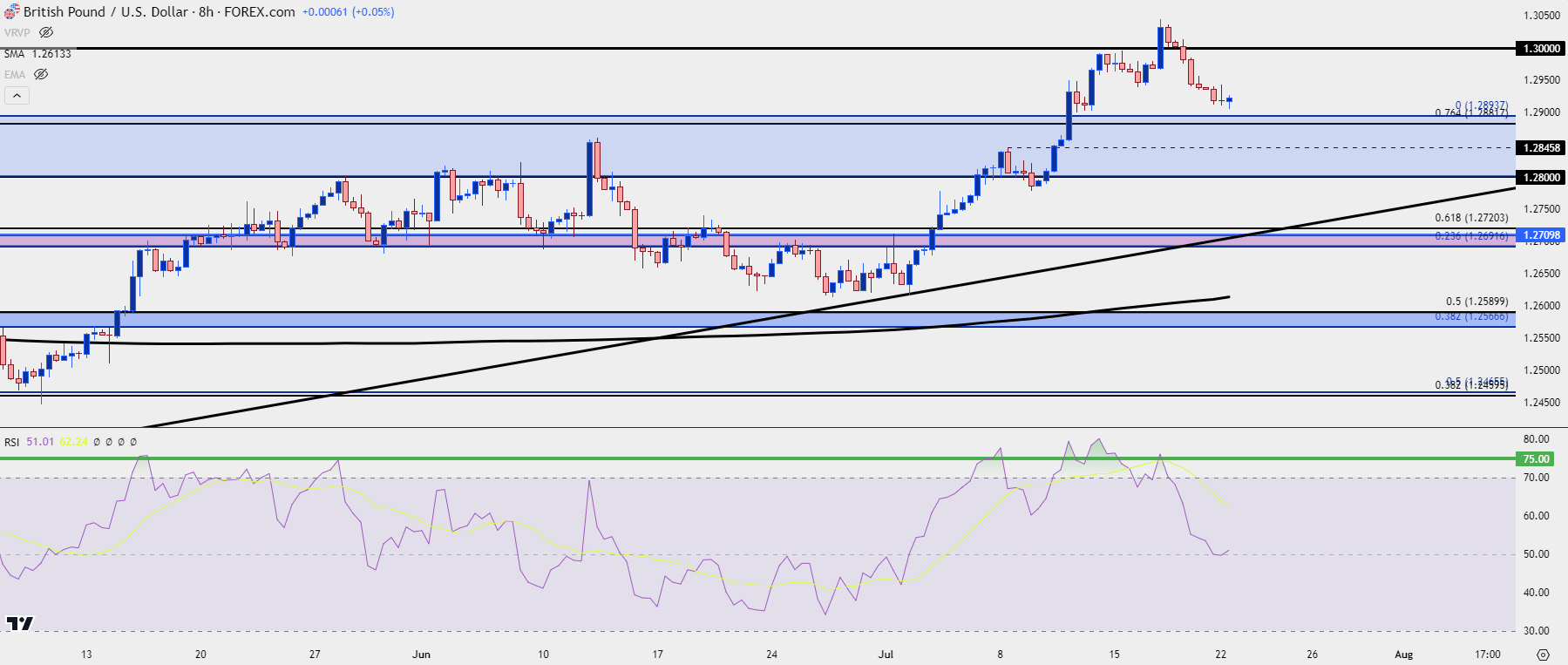

GBP/USD Shorter-Term

While the daily chart shares resemblance to EUR/USD, there’s also a key difference and that’s the fact that EUR/USD remains inside of prior resistance swings from early-2024 trade while GBP/USD has taken the shape as more of a breakout-style move.

So, for those looking for bearish USD scenarios on the premise of DXY holding resistance at the 104.38 Fibonacci level or the 200-day moving average, GBP/USD may hold more attraction than the above in EUR/USD.

GBP/USD is already near a possible support level at the prior high of 1.2894 and there’s another Fibonacci level of note just below that at 1.2881 and that’s followed by the 1.2845 level which was a prior swing-high.

GBP/USD Eight-Hour Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist