- Dollar analysis: It is all about inflation data moving forward

- Next week’s macro highlights include inflation data from Australia, Japan and US (core PCE)

- Dollar Index technical analysis points higher – for now

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week’s report, we will discuss the US dollar and look ahead to the next week.

Following a week full of central bank decisions, the dollar has gained strong traction, supported by better-than-expected US data and unexpected dovish moves from certain central banks, notably the Swiss National Bank (which delivered a surprise rate cut) and to a lesser degree Bank of England and Reserve Bank of Australia (which were less hawkish than expected). However, doubts persist regarding the durability of the dollar's rally, given the fact the Fed has expressed optimism about disinflation and possible rate cuts starting in June. With the economic calendar a bit quieter until the release of March inflation data in April, the dollar may start easing back down again.

Dollar analysis: It is all about inflation data moving forward

As mentioned, external factors have played a big role in the dollar’s recovery as other central banks aim to align with the Fed’s timeline of rate cuts. Had it not been for a dovish SNB, BOE and RBA, this week’s spike in the dollar may not have appeared so exaggerated, particularly in light of the Fed’s indication that economic resilience won't dissuade them from contemplating rate cuts if inflation continues its descent.

Therefore, the positive data surprises we saw this week such as the latest manufacturing PMI data, existing home sales and unemployment claims will not play a significant role in deterring the Fed from cutting rates in June for as long as inflation weakens. Neither should today’s upcoming data, although we do have a few speeches by the Federal Reserve officials to look forward to, including the Chairman himself, Jerome Powell. Vice Chair Philip Jefferson and Fed officials Michelle Bowman, Michael Barr and Raphael Bostic are also due to speak.

Looking ahead, the economic calendar is rather quiet next week which is not a major surprise because we have had all the important macro releases in recent weeks, including major central bank meetings that caused a bit of fireworks in the FX space. We do however have the Fed’s favourite inflation measure on Friday of a holiday shortened next week (see the data highlights below, for more). The week after next will be the NFP week followed by CPI data in the following week.

So, the March US data that will be released in the first half of April, should have a significant importance for the dollar’s trend. If they show weakness, especially the upcoming inflation data, then that could pave the way for a more sustainable dollar decline this time. Ahead of those data releases, I suspect the dollar will lose some momentum and we will be heading into choppy than trending conditions in the FX space as the relatively dovish message conveyed by the Fed is likely to continue to have an impact.

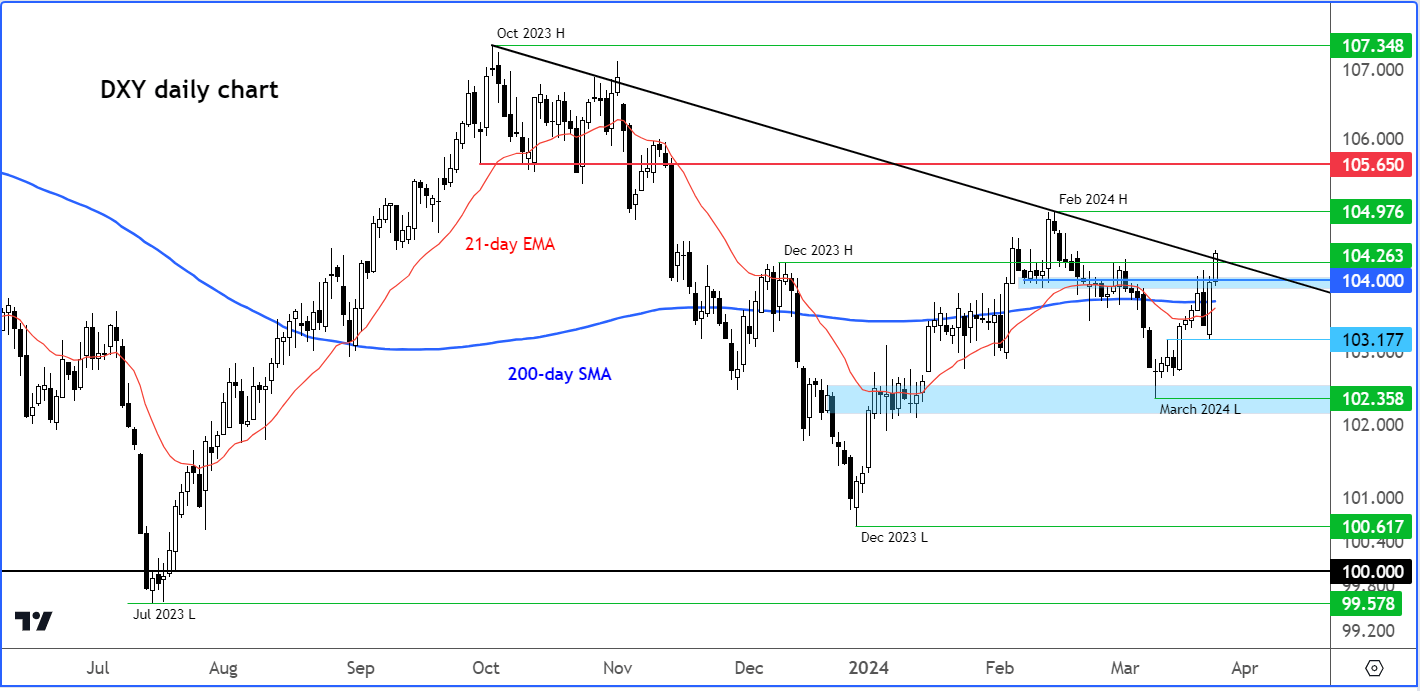

Before looking ahead to next week’s data releases, let’s have a quick look at the technical chart of the Dollar Index…

Dollar Index technical analysis

Source: tradingView.com

At the time of writing, the Dollar Index (DXY) was trading at its highest point of the month, having recovered from a sharp drop it suffered in the first week of the month. It was now up for the third consecutive month, albeit in a choppy trend at best.

The DXY will need to hold above support in the 104.00 area to keep the bullish momentum alive. Failure to do so would put the bulls in a spot of bother in the days ahead. The line in the sand is now this week’s low at 103.17. A potential break below that level could lead to a sharp decline as disappointed bulls rush for the exits.

The bulls will be looking for the DXY to break above its bearish trend line and head towards the February’s high of just under 105.00 handle, next. Thereafter, former support in the 105.65 region could be the next target.

All told, the trend is looking more bullish than bearish for the DXY, but with the Fed now keen to start the cutting cycle in June, the biggest move for the dollar, whenever it takes place, is likely to be to the downside. As such, I am on the lookout for a bearish pattern to emerge in the coming days and weeks.

Dollar analysis: Looking ahead to next week

Australia CPI

Wednesday, March 27

00:30 GMT

The RBA has ditched their slightly hawkish stance, surprising everyone. Now they're in a holding pattern until any hiccups in the Australian or global economy or a spike in commodity prices jolts the central bank back to hawkishness. Last week's robust Aussie jobs report, with a big 116.5k rise in employment and unemployment dipping to 3.7%, defied expectations of an imminent rate cut. If CPI figures come in strong, it could drive the Aussie dollar higher as investors delay betting on rate cuts.

Tokyo Core CPI

Thursday, March 29

23:30 GMT

Last week, the Bank of Japan made a significant move by ending its eight-year stint with negative interest rates, raising rates from -0.1% to 0% and abandoning its Yield Curve Control (YCC) policy. The yen weakened in response, as this action was not only anticipated but also fell short of market expectations for greater tightening measures from the BoJ. The central bank and yen traders are now watching inflation data closely to work out whether and when the next hike could come. Tokyo is by far Japan's most populous city and unveils CPI data a month before the national figures. This preliminary data is widely regarded as the key indicator of consumer inflation for the nation as a whole.

Core PCE Price Index

Friday, March 29

12:30 GMT

The Fed held interest rates unchanged for the fifth successive meeting last week, reaffirming its position of awaiting stronger confidence in inflation before contemplating rate cuts. The principal takeaway was that despite recent elevated inflation figures, the Fed's dot plots, and Powell’s remarks hinted at three rate cuts for this year. Should US inflation data begin to decline again, confirming the Fed's doubts regarding early-year inflation spikes, we may witness bearish for the dollar in the months ahead.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R