US Consumer Price Index (CPI)

The US Consumer Price Index (CPI) narrowed more-than-expected in June, with the headline reading slipping to 3.0% from 3.3% in May.

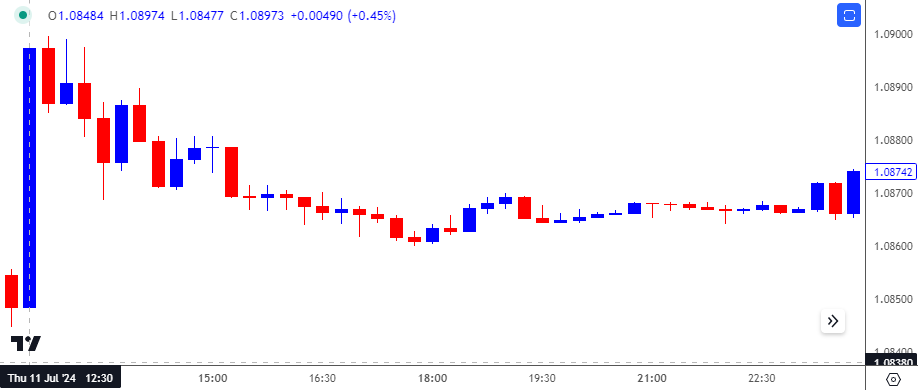

US Economic Calendar – July 11, 2024

At the same time, the core CPI unexpectedly fell to 3.3% from 3.4% during the same period, with the Bureau of Labor Statistics (BLS) noting that the print was ‘the smallest 12-month increase in that index since April 2021.’

Nevertheless, the BLS revealed that ‘the shelter index increased 5.2 percent over the last year, accounting for nearly seventy percent of the total 12-month increase in the all items less food and energy index,’ with a deeper look at the CPI report showing that ‘other indexes with notable increases over the last year include motor vehicle insurance (+19.5 percent), medical care (+3.3 percent), personal care (+3.2 percent), and recreation (+1.3 percent).’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The slowdown in the US CPI led to a bearish reaction in the US Dollar as it pushed EUR/USD to a fresh session high of 1.0900. However, EUR/USD pared the market reaction as the exchange rate closed the day at 1.0868.

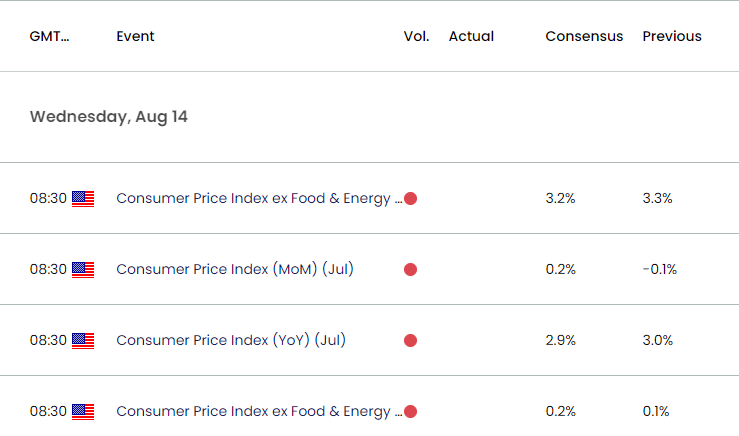

Looking ahead, price growth in the US is expected to slow further in July, with both the headline and core CPI seen narrowing from the previous month.

Evidence of easing inflation may encourage the Federal Reserve to pursue a less restrictive policy, and another downtick in both the headline and core CPI may drag on the US Dollar as it fuels speculation for a rate-cut at the next Fed meeting on September 18.

However, a higher-than-expected CPI report may push the Federal Open Market Committee (FOMC) to further combat inflation, and signs of persistent inflation may spark a bullish in the Greenback as it dampens bets for an imminent rate-cut.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

Canadian Dollar Forecast: USD/CAD Flirts with 50-Day SMA

US Dollar Forecast: USD/JPY Continues to Defend January Low

Gold Price to Eye Monthly High on Failure to Close Below 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong