US Consumer Price Index (CPI)

The US Consumer Price Index (CPI) unexpectedly slowed in July, with the headline reading narrowing to 2.9% from 3.0% the month prior.

US Economic Calendar – August 14, 2024

At the same time, the core CPI slipped to 3.2% from 3.3% during the same period to mark the lowest reading since April 2021.

The update from the Bureau of Labor Statistics (BLS) showed that ‘the shelter index increased 5.1 percent over the last year, accounting for over 70 percent of the total 12-month increase in the all items less food and energy index,’ with the report going onto say that ‘other indexes with notable increases over the last year include motor vehicle insurance (+18.6 percent), medical care (+3.2 percent), personal care (+3.4 percent), and recreation (+1.4 percent).’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

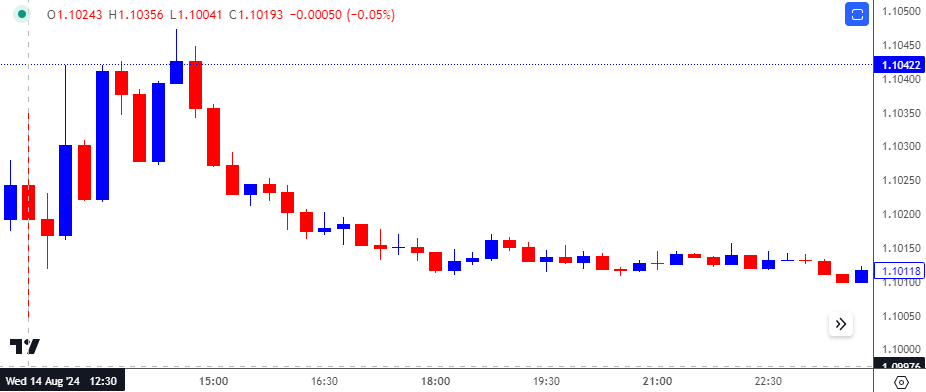

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

EUR/USD showed a whipsaw-like reaction to the slowdown in the US CPI but climbed to a fresh weekly high (1.1047) following the release. EUR/USD ended the week at 1.1029 but exchange rate continued to trade higher in the week ahead to close at 1.1192.

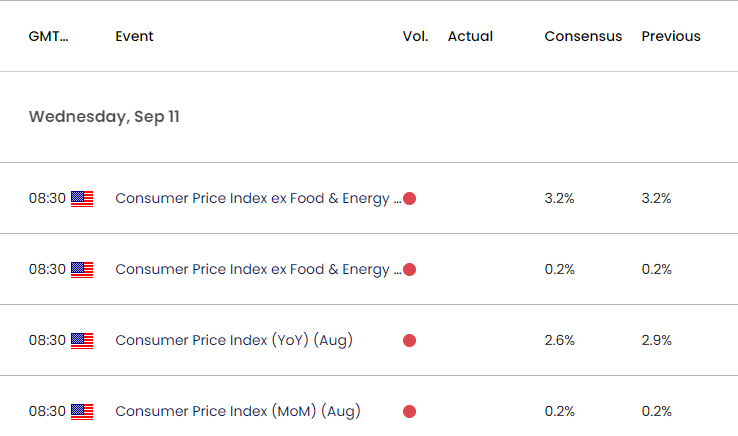

Looking ahead, the CPI may generate another mixed reaction as the headline reading is expected to print at 2.6% in August versus 2.9% the month prior while the core reading is anticipated to hold steady at 3.2% during the same period.

Nevertheless, further evidence of slowing inflation may drag on the Greenback as it encourages the Federal Reserve to unwind its restrictive policy, but signs of persistent price growth may spur a bullish reaction in the US Dollar as it limits the central bank’s scope to implement a series of rate-cuts.

Additional Market Outlooks

Australia Dollar Forecast: AUD/USD Reverses Ahead of January High

EUR/USD Pulls Back Ahead of August High with US CPI in Focus

GBP/USD Rebound Pushes RSI Back Towards Overbought Zone

Gold Price Outlook Supported by Positive Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong