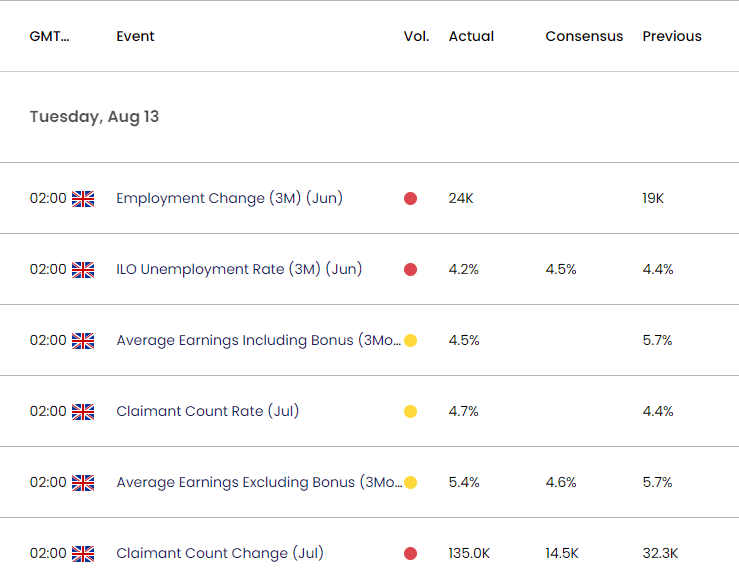

UK Employment Change

The UK Employment report showed a 24K expansion during the three-months though June following a 19K rise during the previous period.

UK Economic Calendar – August 13, 2024

A deeper look at the report showed the Unemployment Rate unexpectedly narrowing to 4.2% from 4.4% in May, while Average Earnings excluding Bonuses narrowed to 5.4% from 5.7% during the same period.

At the same time, claims for unemployment benefits jumped to 135.0K in July from 32.3K the month prior, with the Claimant Count Rate widening to 4.7% from 4.4% in June.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

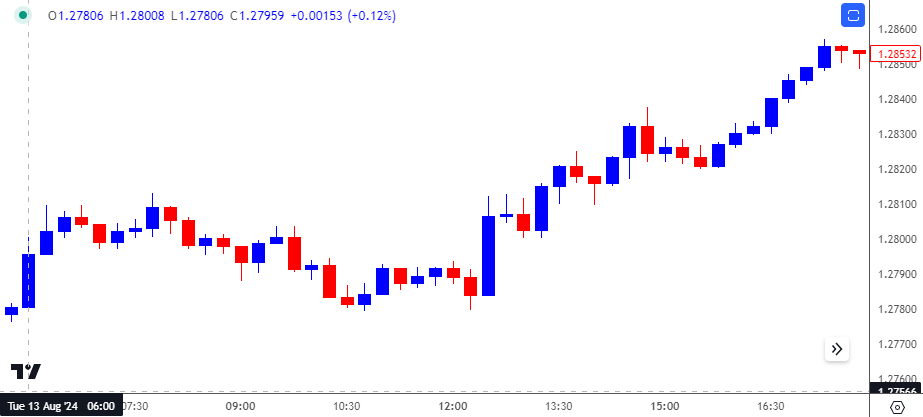

GBP/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

Despite the mixed data prints, GBP/USD traded higher following the release, with the exchange rate ending the day at 1.2877. The strength in GBP/USD persisted throughout the remainder of the week as it closed at 1.2945.

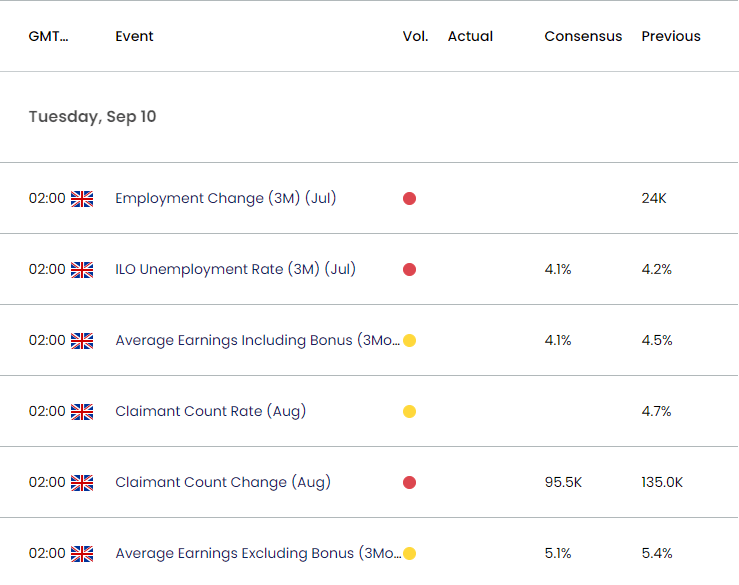

Looking ahead, fresh figures coming out of the UK may generate a mixed reaction as the UK Unemployment Rate is expected to fall to 4.1% from 4.2% during the three-months through July, while Average Earnings excluding Bonus is seen narrowing to 5.1% from 5.4% during the same period.

With that said, signs of a weakening labor market may produce headwinds for the British Pound as it puts pressure on the Bank of England (BoE) to further unwind its restrictive policy, but a positive development may prop up GBP/USD as it limits the central bank to deliver back-to-back rate cuts.

Additional Market Outlooks

EUR/USD Pulls Back Ahead of August High with US CPI in Focus

US Dollar Forecast: USD/JPY Eyes August Low as NFP Report Disappoints

GBP/USD Rebound Pushes RSI Back Towards Overbought Zone

Gold Price Outlook Supported by Positive Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong