USD/CAD falls ahead of the BoC rate decision

The BoC is expected to raise interest rates by 75 basis points, marking the fifth straight outsized hike from the central bank. This would take the benchmark rate to 4%, a level that was last seen in 2008.

BoC Governor Tiff Macklem has been clear on the central bank’s intention to keep hiking rates to tame inflation. However, with signs that the economy is heading towards a marked slowdown and with high household indebtedness, this could be the final outsized hike that we see from the BoC in this hiking cycle.

There is growing speculation that the Federal Reserve could also look to slow the pace of interest rate hikes after November.

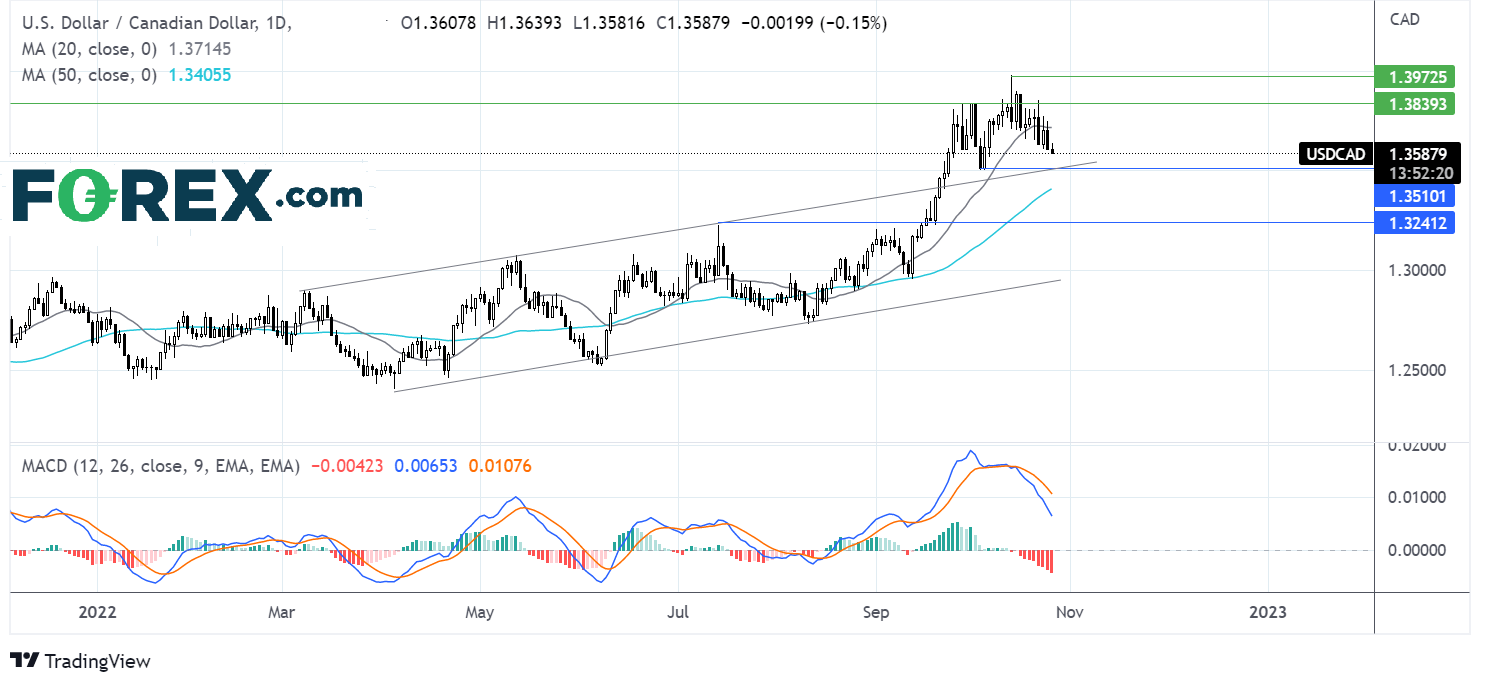

Where next for USD/CAD?

After running into resistance at 1.3975, USD/CAD has been steadily declining, falling through its 20 sma, and below 1.36 round number. This combined with the bearish crossover on the MACD, suggests that there is more downside to come.

Support can be seen at 1.35 the rising trendline support and the October low. A break below here brings the pair back into the multi-month rising channel and exposes the 50 sma a 1.3405. A break below here could open the door to 1.3230 the July high.

On the flip side, buye5rs could first aim to rise above the 20 sma at 13715, to bring 1.138 round number and the 2022 high of 1.3970 into focus.

Gold rises on Fed dovish pivot hopes

Gold is rising for a second straight session amid rising hopes that the Fed could soon slow the pace of rate hikes.

A string of weaker-than-expected US data this week is fueling bets that the US central bank will hike by 50 basis points after November. Yesterday US housing index data was softer than forecast, and consumer confidence fell to a 3-month low. The data comes following disappointing PMI data at the start of the week.

The US dollar index has fallen 1.25% so far this week, giving USD denominated gold a help higher.

Today attention will be on new home sales figures. Further signs of the housing market cooling could lift Gold further.

US earnings season continues with big names such as Boeing, Meta, and Kraft Heinz. Signs of weakness could help gold higher.

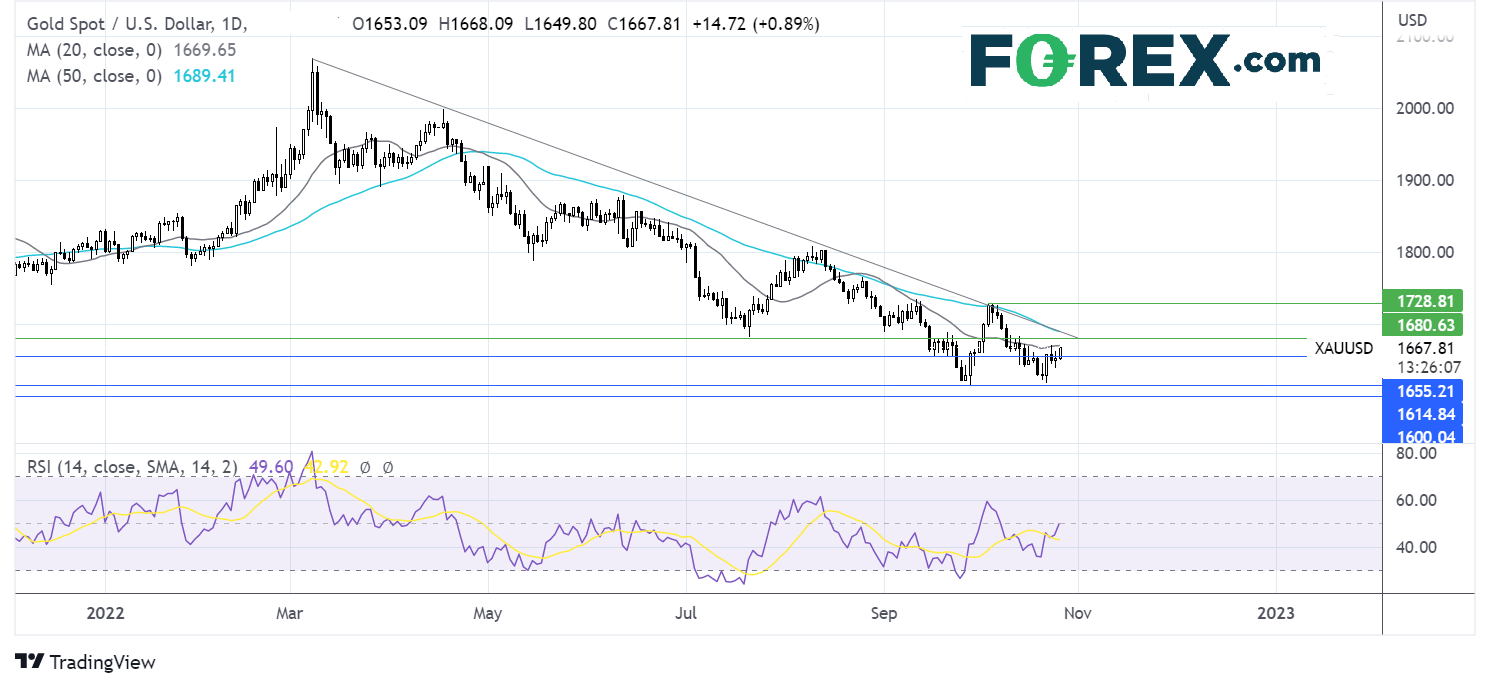

Where next for Gold?

Gold have rebounded off the 1617 low from last week and is attempting to break above the 20 sma at 1675. This would be significant as the price has traded below the 20 sma across the past two weeks. The RSI has also risen to neutral.

A push over the 20 sma is needed to test 1680 the July low and expose the 50 sma and multi-month falling trendline resistance at 1690. The price has trended below the falling trendline since March. Above here 1730 comes into play.

Meanwhile, sellers will take hope from the longer-term bearish trend. A break below 1617 is needed to extend the selloff towards 1600.