EUR/GBP falls despite dismal UK data

EUR/GBP dropped 0.8% yesterday after BoE Governor Andrew Bailey spooked the markets just hours after shoring them up.

Andrew Bailey warned pensions that they had 3 days to shore up their positions ahead of Friday’s hard deadline when support would be withdrawn. His comments

However, today’s reports suggest that the BoE is more willing to be flexible regarding its position, saying privately that it could prolong support.

UK GDP unexpectedly contracted -0.3% MoM in August after rising 0.2% in July. This drop in GDP means that the UK economy is likely to contract in Q3 making a recession in Q4 almost unavoidable.

Looking ahead, any further commentary from the BoE will be watched closely.

Eurozone industrial production is also due to show a small rebound of 1.2% YoY after falling -2.4% in July.

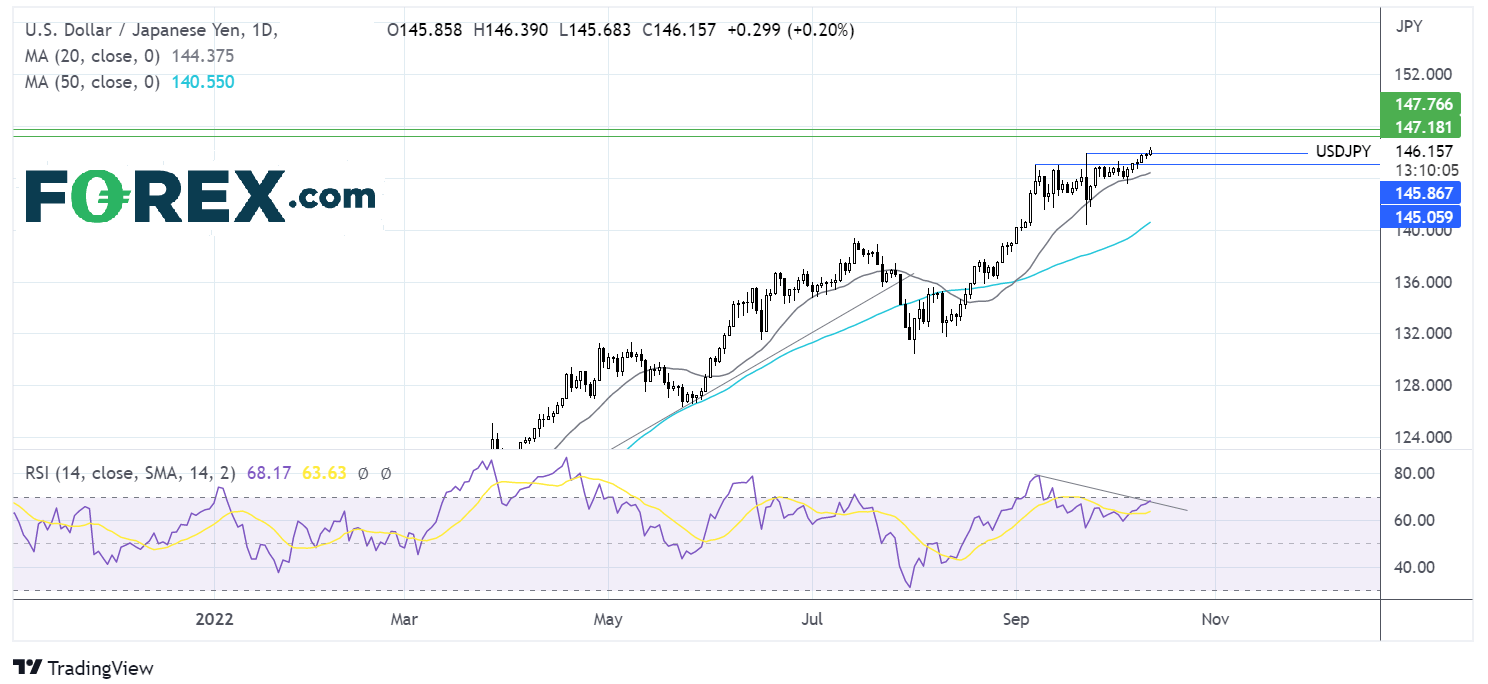

Where next for EUR/GBP?

EUR/GBP rebounded off the 20 sma yesterday and pushed back up towards 0.8870. The receding bearish bias on the MACD supports further upside.

Buyers will look for a move over 0.8870 push towards 0.90 round number and high September 27.

Should the sellers successfully defend the 0.8870 the price could look to retest support at 0.88 the 20 sma ahead of 0.8720 the October 10 low. A break below here creates a lower low.

USD/JPY rises with US PPI & FOMC minutes due

USD/JPY is rising for a sixth straight session, pushing above 146.00 to fresh 24-year highs and above, where the Japanese Ministry of Finance intervened on September 22nd to shore up the yen.

While the pair dropped following the intervention, it has since drifted higher amid ongoing Fed-BoE divergence.

The USD was boosted overnight by hawkish Fed comments. Fed President Mester said the Fed still had a lot of work to do to bring inflation down and that a more restrictive policy was needed.

Today attention turns to US PPI inflation which is expected to ease very slightly to 8.4% YoY, down from 8.6%.

The minutes from the September FOMC are also due to be released. The Fed hiked rates by 75 basis points at the meeting. The minutes are expected to support the Fed’s hawkish stance.

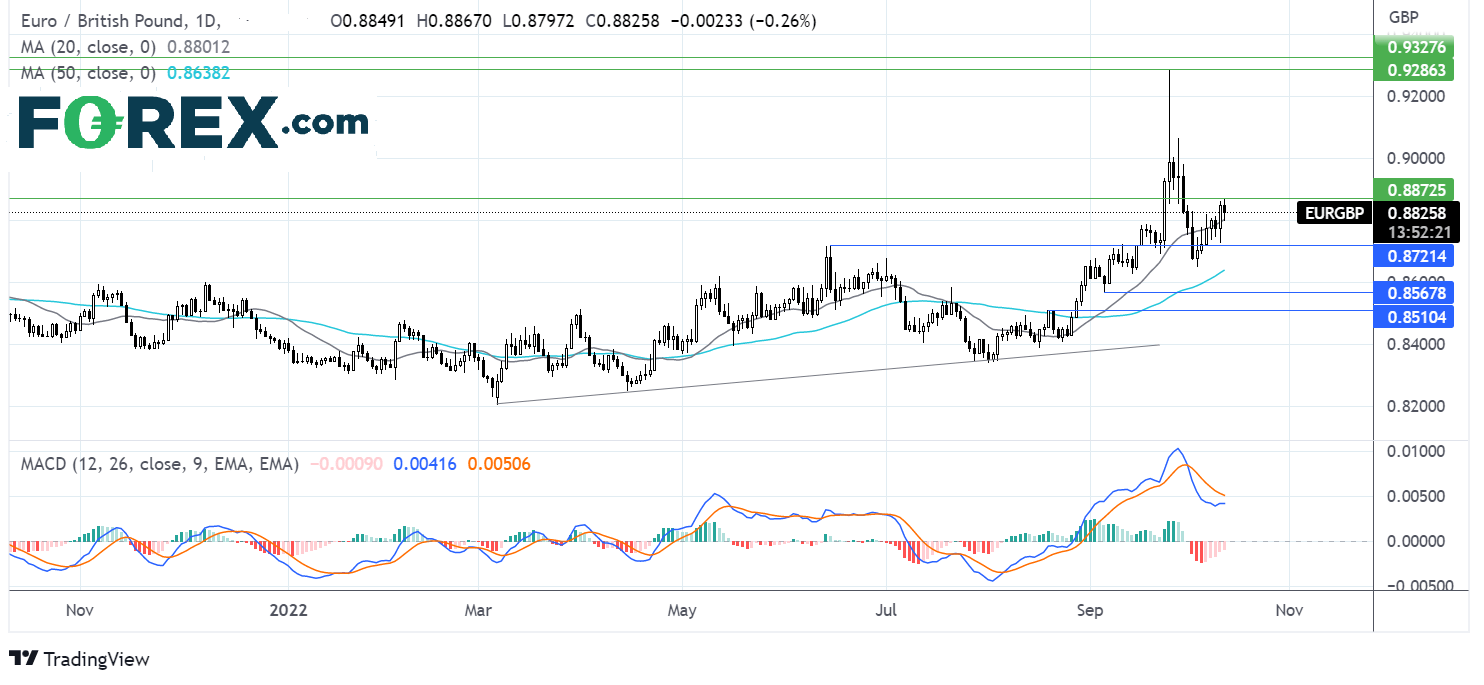

Where next for USD/JPY?

USD/JPY has risen to its highest level since August 1998 in the Asian session. It sees sustained strength over 145.00, which has helped it push over 146.00.

However, the RSI divergence suggests that the run higher could run out of steam, and buyers should be cautious. Waiting for some consolidation or a pullback could be prudent.

A fall below 146.00 is likely to find solid support at 145.00, which is broken, and could open the door to 144 round figure.

On the flipside, a move over 146.40 daily high, could open the door to 147.00 round number and 147.70 the 1998 swing high.