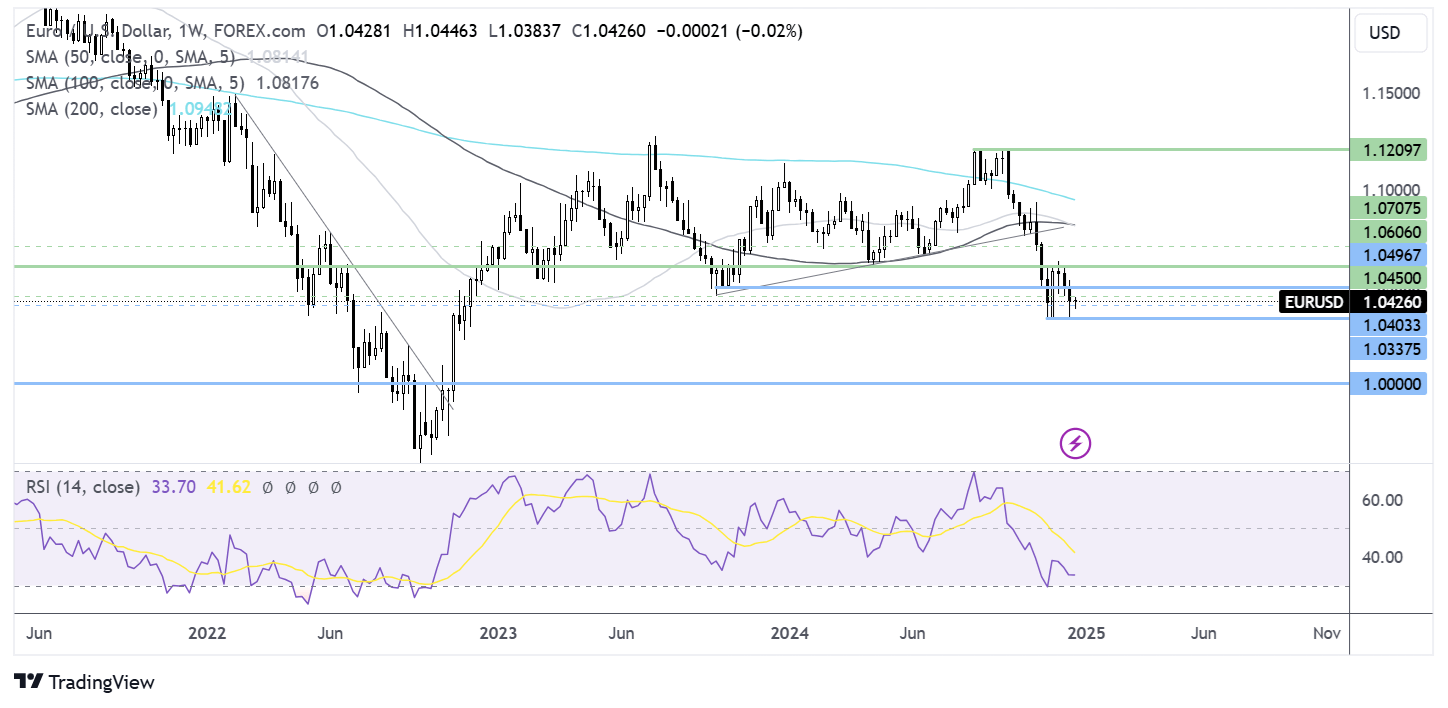

EUR/USD has fallen sharply from the 1.12 level it was trading it just a few months ago. But a lot can change in the markets over a quarter and EUR/USD struggles below 1.0450.

With Trump heading to the White House and a widening gap between the US and eurozone economies, the EUR/USD remains weak, with the prospect of testing parity in H1 2025.

Dovish ECB, weak growth & political instability

The ECB was among the first major central banks to cut rates in June and has reduced rates by 25 basis points at four meetings this year. While inflation appears under control, growth looks weak at best, with the potential for a recession rising. Weak consumption is expected to continue into 2025.

Along with economic woes, political uncertainty is likely to linger at the start of the year, with a snap election in Germany in February and ongoing instability in France after Michel Barnier’s government collapsed.

Trump 2.0

The USD is trading at a two-year high as we head towards the end of the year. Trump's victory in the US elections has been the key catalyst for the USD’s latest leg higher.

Trump’s policies are expected to be inflationary amid plans to cut taxes and impose tariffs on foreign goods and services. These policy measures come at a time when the US economy is showing resilience and solid employment levels.

While the Federal Reserve has cut rates at three meetings, the dot plot pointed to a slower pace of cuts in 2025 after the Fed upwardly revised its inflation outlook for the year. Only two rate cuts are expected this year, supporting the USD.

Fed - ECB divergence

The Fed forecasts two rate cuts next year and upwardly revised its growth forecast. Meanwhile, the ECB is expected to cut rates further this year amid weak growth. Should Trump implement trade tariffs in Europe, this could slow growth further, ramping up the need for further rate cuts.

The bottom line is that the Fed faces upward inflationary pressures, while the ECB risks needing to cut rates more aggressively. This could pressurize EUR/USD, further pulling the pair towards parity.

Where next for EUR/USD?

On the weekly chart, EUR/USD rebounded lower from 1.12, dropping to support at 1.0330. While the price recovered from this low, it failed to retake 1.0630 before falling again.

Sellers supported by rejection at 1.0630 and the RSI below 50 will look to extend this bearish run below 1.0330 toward 1.02 and parity.

Buyers will need to retake 1.0630 to create a higher high and put a more positive spin on the chart.