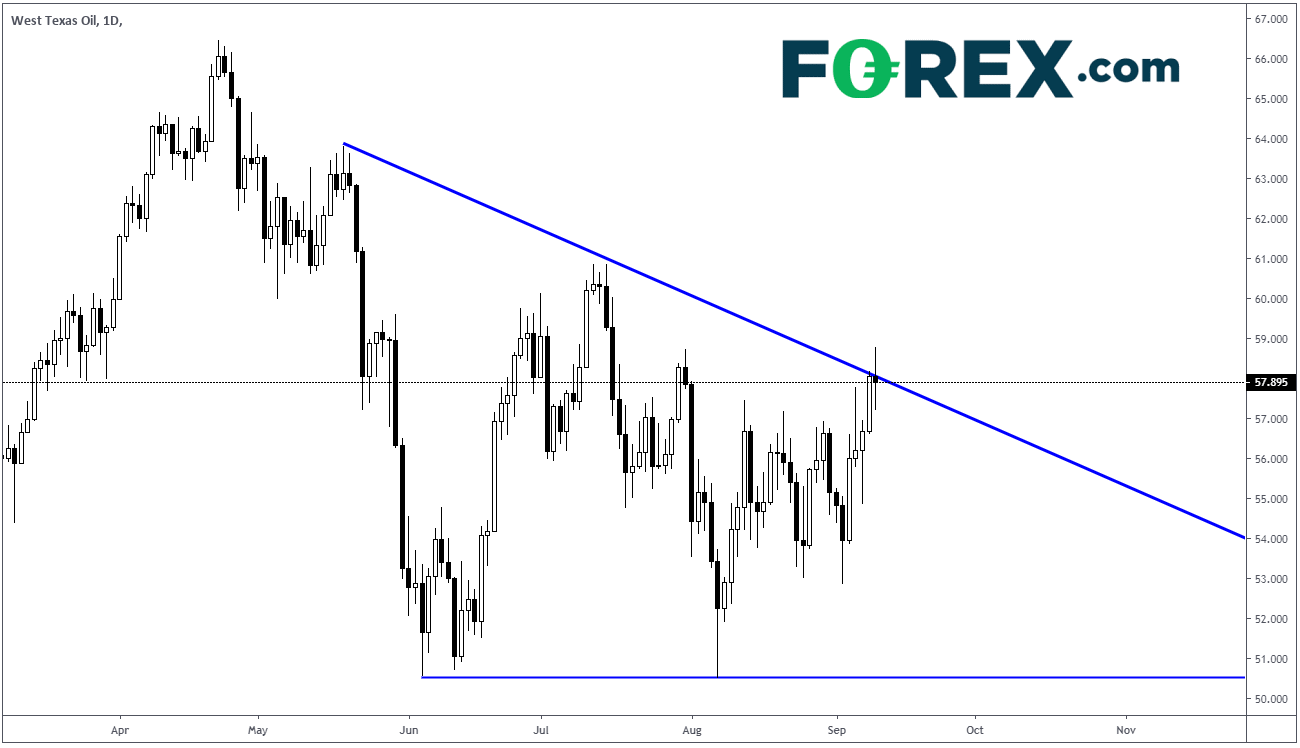

Crude broke out above the downward sloping trendline of a triangle today. However, it also closed down 0.28% on the day. After breaking out, Crude turned lower on the day and moved back into the triangle, in negative territory for the day. This candlestick is a doji candle and is considered to be a candle of indecision.

Source: Tradingview. FOREX.com

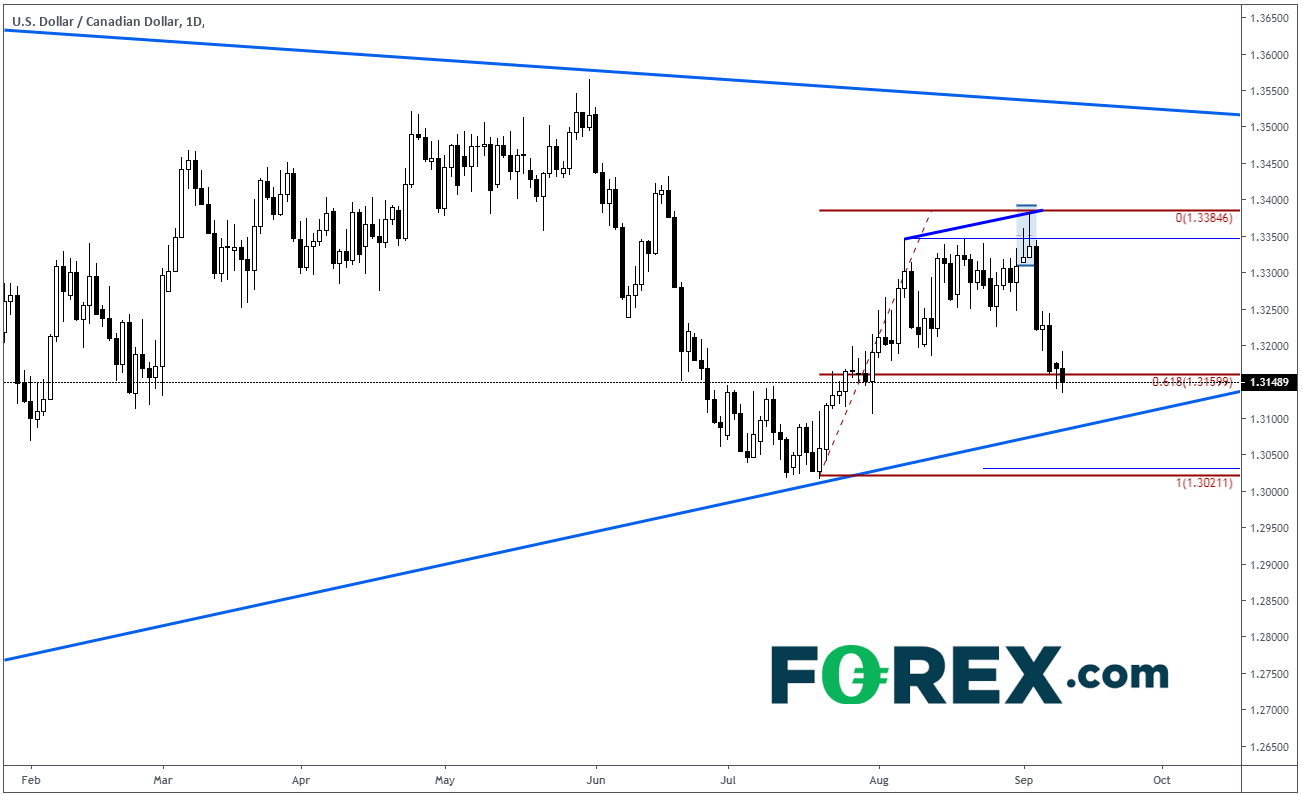

In contrast, USD/CAD continued its moved lower today (CAD higher) from the bearish engulfing candle put in last week. The pair is hovering around the 61.8% retracement level near 1.3148 from the July 19th lows to the September 3rd highs. Trendline support comes in roughly 50 pips lower near 1.3100.

Source: Tradingview, FOREX.com

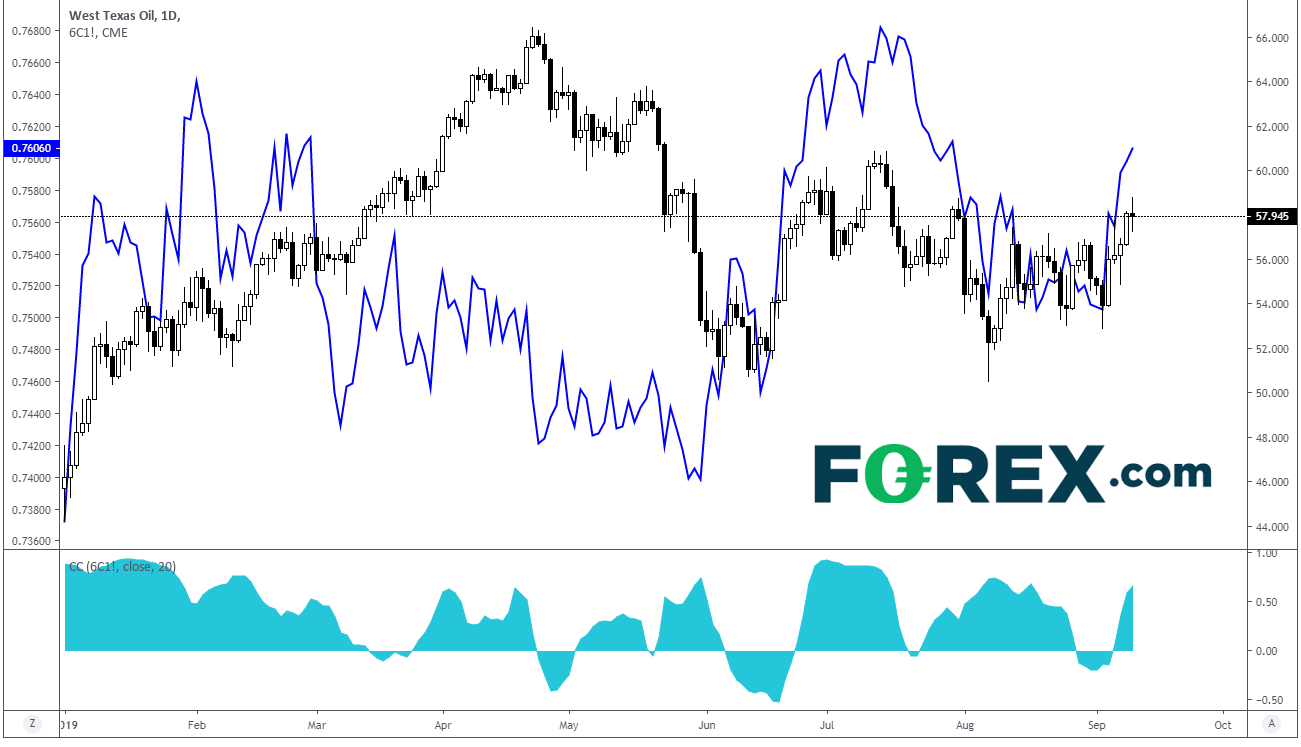

Crude and CAD typically move together, that is, when crude trades lower, USD/CAD trades higher (CAD lower). However today, as Crude reversed lower, CAD did not. To better illustrate this, below is a chart of WTI Crude and Canadian Dollar Futures (the futures trade in the same direction as Crude, as opposed to USD/CAD which trades inversely to crude). The correlation coefficient for the two assets is currently +.62.

Source: Tradingview, FOREX.com

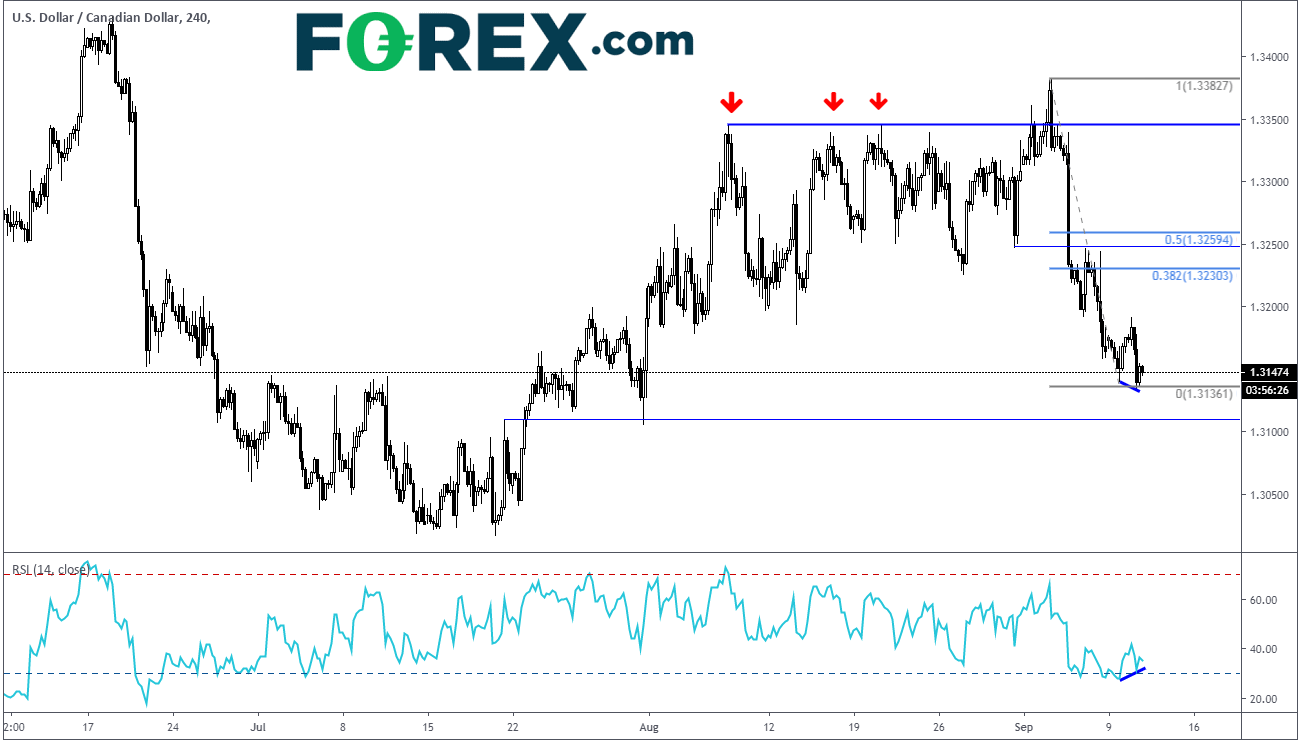

What happens tomorrow if Crude reverses its recent move higher and trades lower back into the triangle? The Canadian Dollar may trade lower with it (USD/CAD trade higher). On a 240-minute chart, price is diverging from the RSI, which is typically a signal of a potential reversal. Horizontal resistance and Fibonacci retracements come in between 1.3230 and 1.3260. As mentioned on the daily chart, support is near 1.3100.

Source: Tradingview, FOREX.com