Commodities have been on the rise this year, which is a serious threat to central banks looking to cut interest rates. If commodities are higher, it is only a matter of time before they get passed along the supply chain to the consumer. And that means odds of a second round of inflation are increasing.

Today I’ll focus on metals, as it appears they have been shaken at their highs. I should add that last week’s selloff across gold, silver and copper is not an attempt to pick a major high. Far from it. But if we look at the gains since their October lows, a pullback was arguably due.

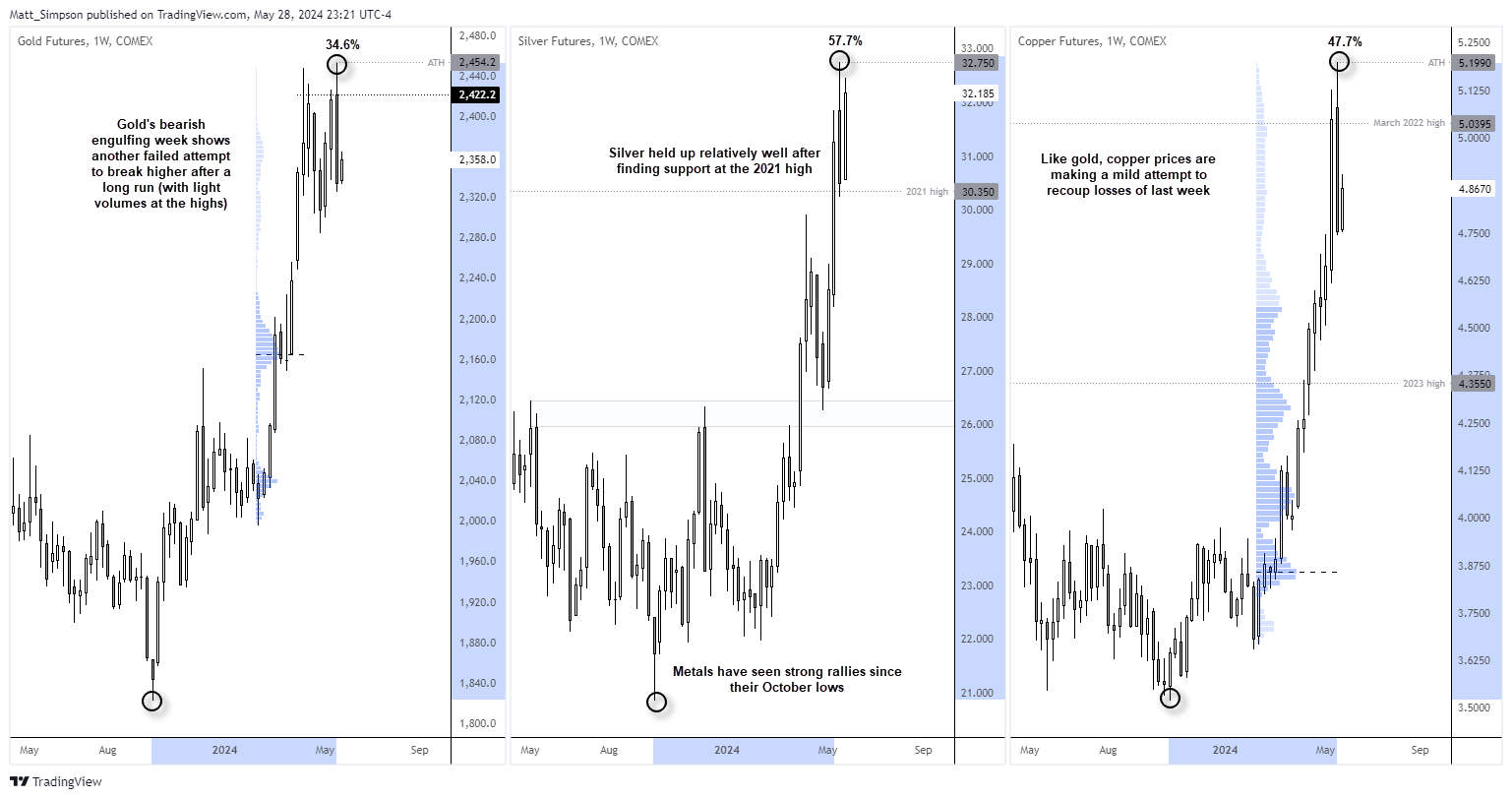

Performance between October lows to last week’s high:

- Gold futures 34.6%

- Silver futures 57.7%

- Copper futures: 47.7%

On Monday, May 21st, gold reached a record high during quiet trading, which was assumed to have been speculative buying as they tracked China's metals markets higher from the open. Not wanting to miss out, copper futures also reached a record high, and silver made do with a 13-year high of its own.

That is all very well, but to see such moves during a Monday Asian session without an apparent catalyst struck me as odd at the time. And I cannot say I was surprised to see gold prices retrace from its record high. This is what I told Reuters that day.

“Gold prices sneaked in a cheeky record high ahead of China's open on Monday. Yet as the move has not been confirmed with by a weaker US dollar, it seems have been caught a tailwind from higher metals futures on China's exchanges.

Already we're seeing prices retreat and meander around the previous record high set in April, so the earlier breakout might end of being a false start.”

And what a ‘false start’ it turned out to be. Gold went on to fall over 5% from the day’s high until support was found and copper futures were down a cool -8.7%. And having looked at the positioning of traders, the breakouts do appear to have been a speculative-driven bull trap.

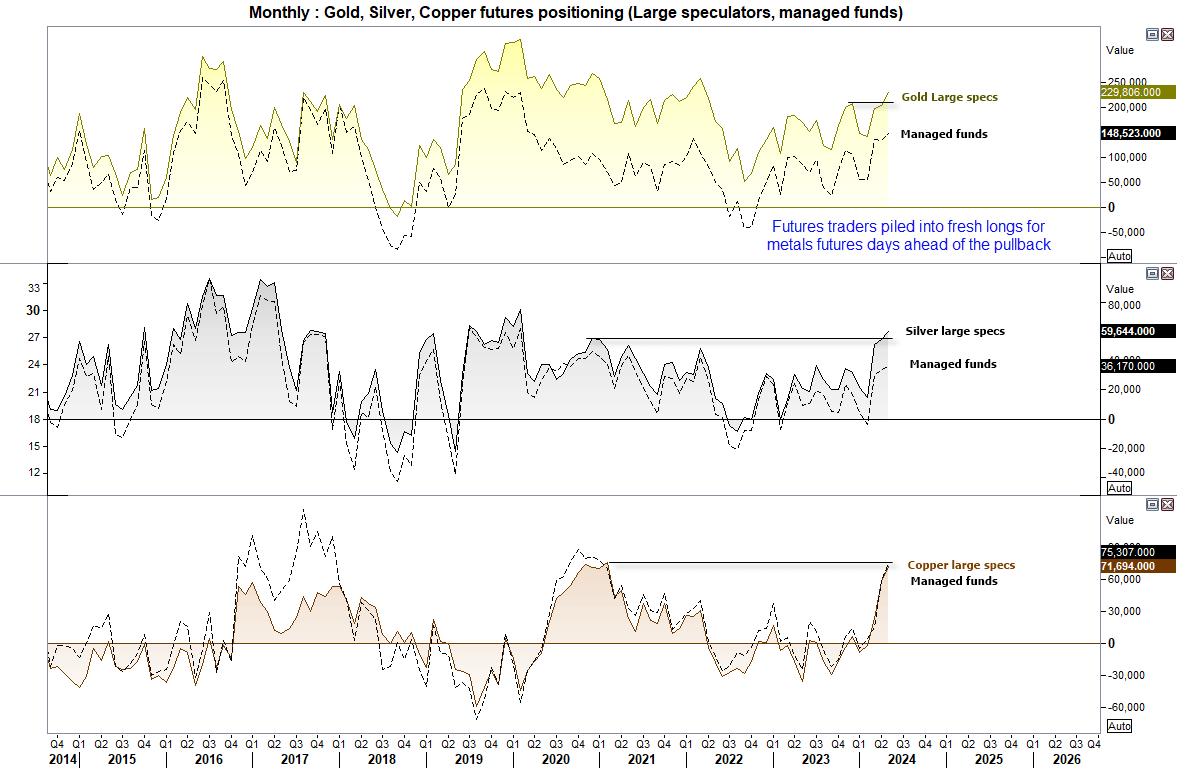

Gold, silver, copper futures positioning – COT report:

Data from the commitment of traders (COT) report shows that bulls piled into these metals ahead of the selloff, which was triggered by a hot PMI report alongside relatively hawkish Fed comments. As the COT data only shows net-long exposure up to Tuesday 21st May, it reveals market positioning before momentum turned lower for these markets.

- Large speculators pushed net-long exposure to gold futures to a 2-year high with an increase of longs and slight reduction of shorts

- Net-long exposure to silver futures reached a 4-year high

- Copper futures net-long exposure reached a 4-year high

And the rebound of PMI data alongside Fed members pushing back on rate cuts saw the US dollar rebound, and metals fell alongside Wall Street indices. Given the surge of bullish bets ahead of the selloff, it seems plausible that many of these last-minute bullish trades were closed, or even reversed, as speculators switched to the short side. It also seems likely that gold bets were unwound to cover losses in the stock market.

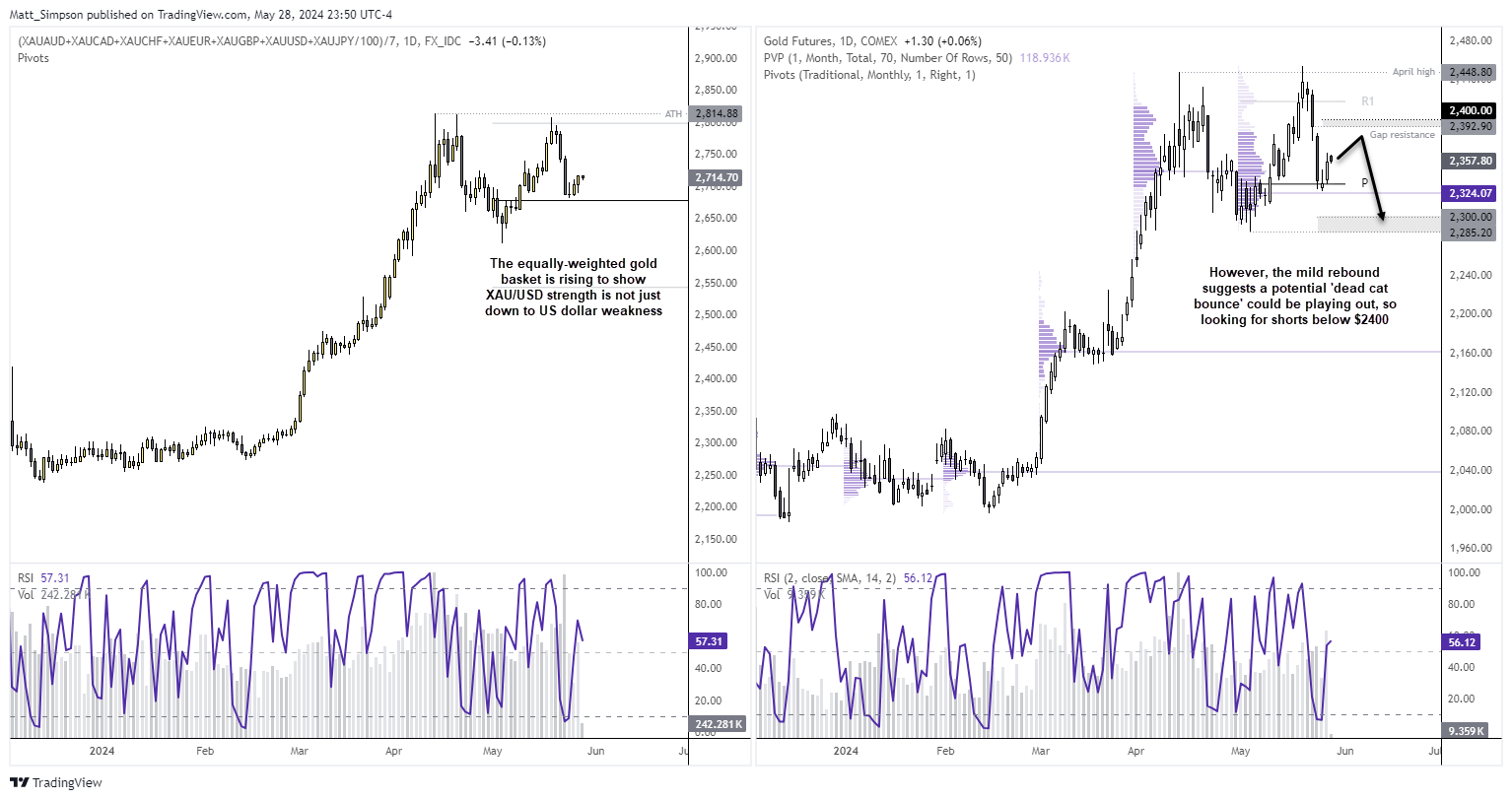

Gold futures daily chart:

Traders are cautiously returning to the gold market, with my equally-weighted gold basket (left) rising for a second day to show the move is not simply USD weakness. Yet the ground covered on Monday and Tuesday lacks bullish conviction, when compared to the selloff of last Wednesday and Thursday.

The gold futures chart (against the USD, on the right) shows support was found around the monthly VPOC (volume point of control) and monthly pivot point, after the daily RSI reached oversold. Ultimately, gold has risen in line with my bias, but I am now looking for an opportunity to short should evidence of a cycle high materialise.

- For now, my bias remains bearish below gap resistance / $2400, so seeking to fade into minor rallies towards the $2392- $2400 resistance zone

- A break of last week’s low brings the $2285 - $2300 support zone into focus

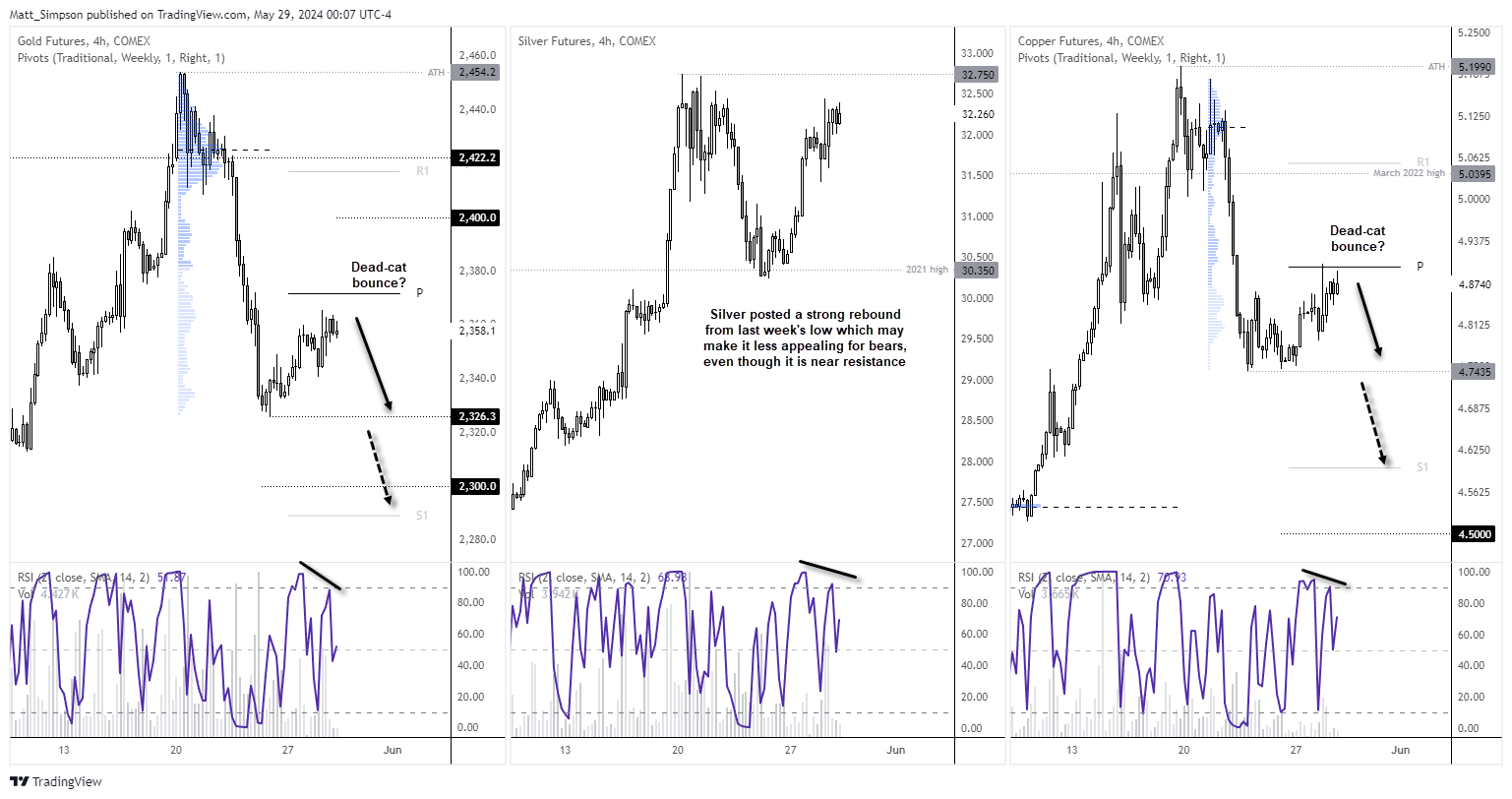

Gold, silver, copper 4-hour chart:

Silver has been the clear outperformer since last Thursday’s low, having recouped most of last week’s losses this week. Given it trades so close to last week’s high makes it less appealing to bulls as the reward to risk ratio seems unfavourable. It is also debatable as to whether bears want to fade silver, given its rebound this week. And if metals rise, it risks a bullish breakout.

Yet price action on the 4-hour chart of gold and copper appear to be classic ‘dead-cat bounces’ in the making. Both gold and copper have made hard work of this week’s gains and price action appears to be corrective due to the overlapping nature of the 4-hour candles. And with a bearish RSI divergence forming with the weekly pivot point hovering nearby, both gold and copper look tempting for a cheeky short to at least retest their cycle lows, a break of which brings the daily S1 pivot into focus.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge