Market positioning from the COT report – 7 January 2025:

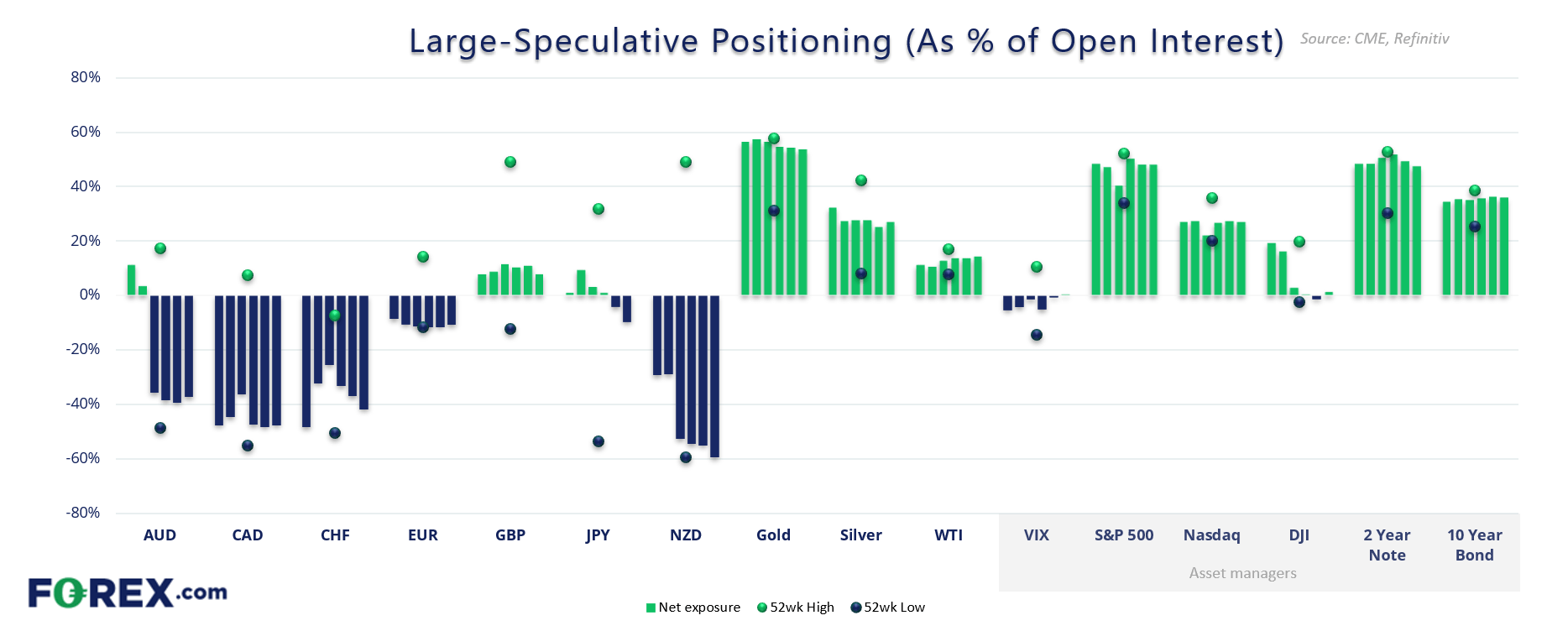

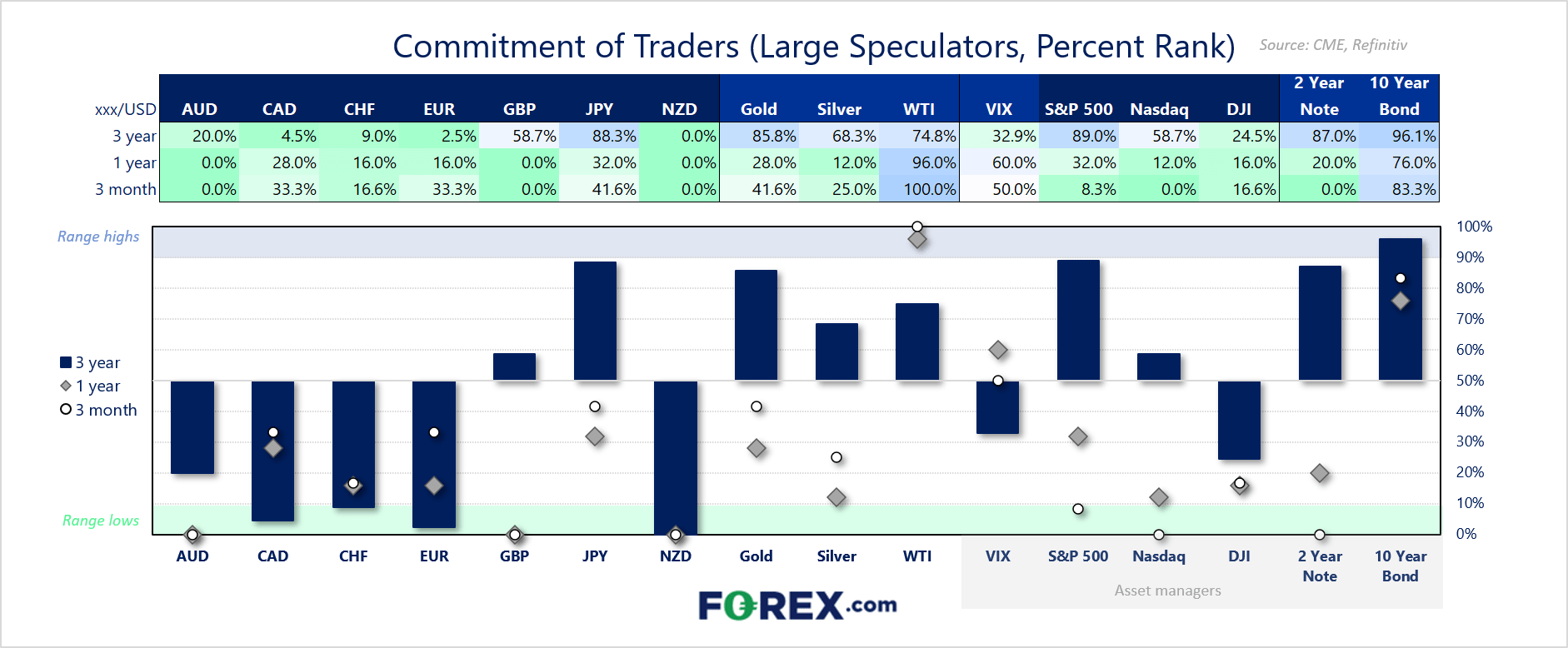

- Asset managers increased their net-long exposure to US dollar index futures to a 14-month high

- Net-long exposure to GBP/USD futures fell to a 9-month low

- While only minor changes were made to EUR/USD futures, there are minor signs that bearish interest could be fading

- Large speculators were net-short yen futures for a second week

- NZD/USD futures reached a record-level of net-short exposure for a fourth consecutive week among large speculators

- While commodity FX land is clearly bearish, there are some early clues of exhaustion

- They also increased net-long exposure to WTI crude oil futures for a fifth week

- Traders got behind metals futures, with net-long exposure for gold, silver and copper all rising

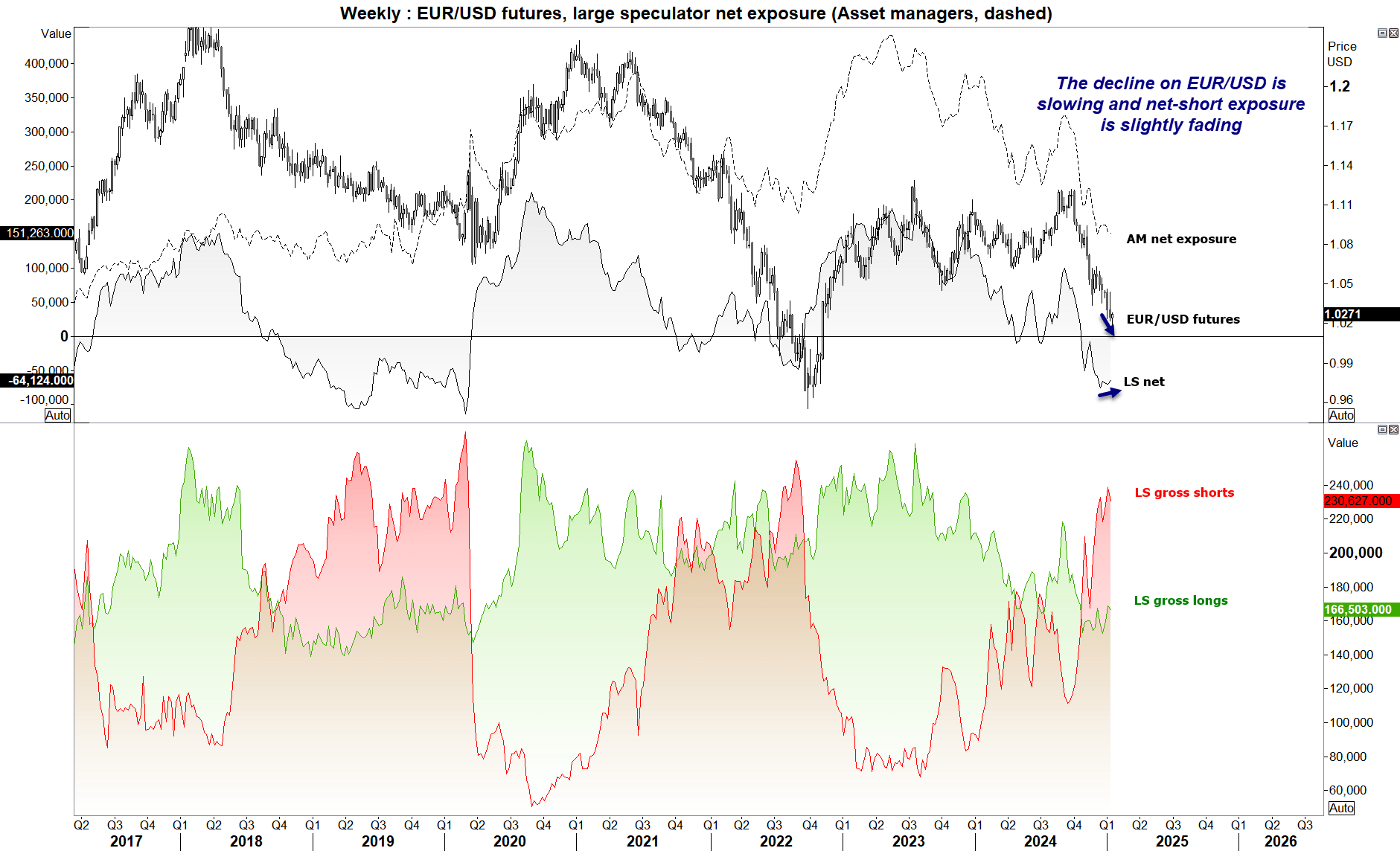

EUR/USD (Euro dollar futures) positioning – COT report:

I am going to tentatively suggest that EUR/USD may be nearing an inflection point, however small. Yes, the USD could continue to perform well for a decent chunk of this year, yet much of its demise in recent weeks has been down to the strong USD on fears of an inflationary Trump. This theme alone runs the risk of diminishing at least a tad when he takes office.

But sticking with prices, the decline on EUR/USD has slowed somewhat and net-short exposure among large speculators is fading. And that is leaving a slight divergence between the two, which is a minor sign of exhaustion. That is not to say EUR/USD won’t break beneath parity this year, but it is a massive level to crack and one that I doubt will happen easily. And with EUR/USD just 271 pips above it, I strongly suspect bearish will grow more nervous and feel tempted to book a profit to fade into rallies further out.

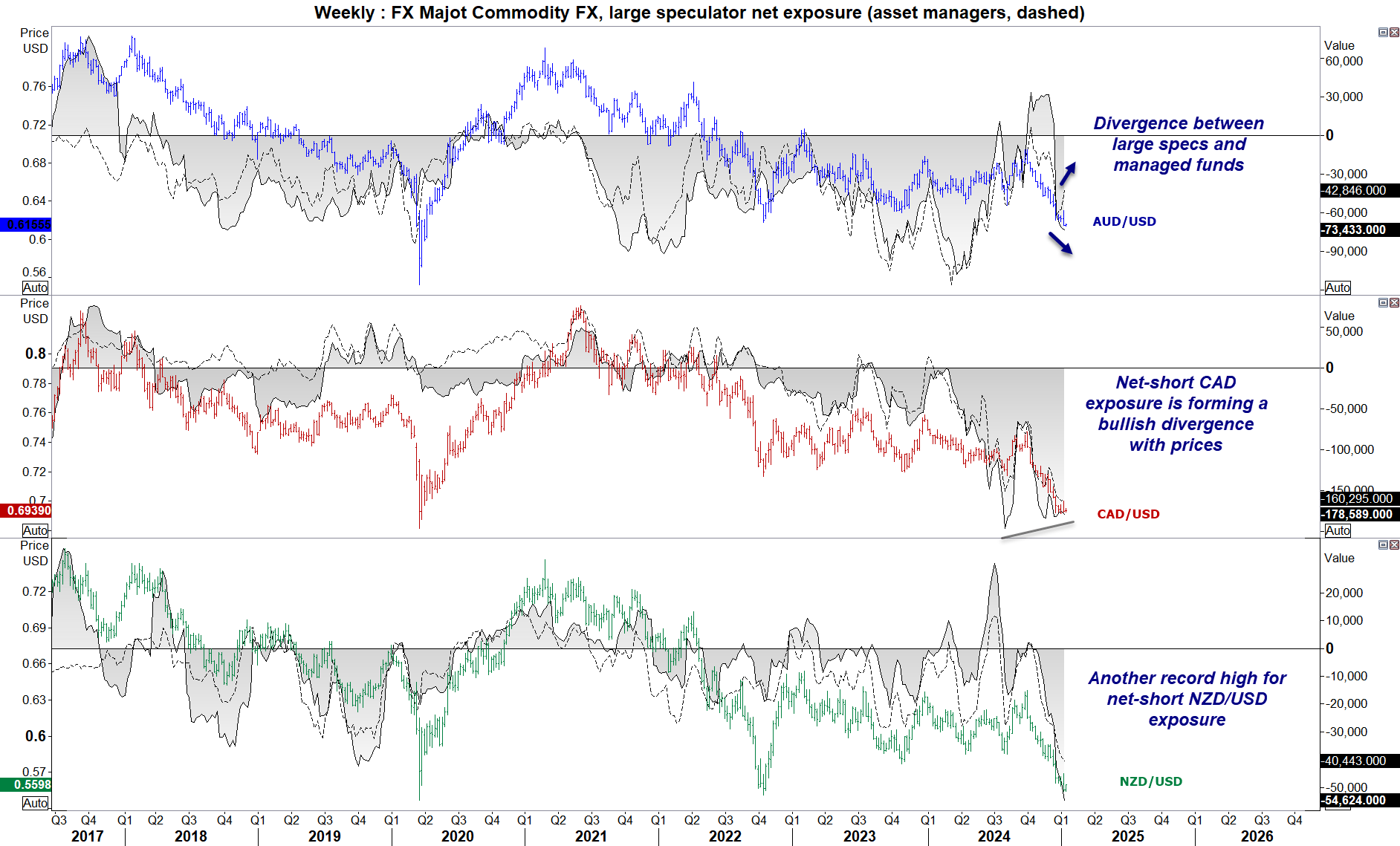

Commodity FX (AUD, CAD, NZD) futures – COT report:

The general theme for commodity FX is twofold: selling these currencies against the USD is not a new idea, and there are early signs of exhaustion of the bearish moves. I must warn that such clues rarely make the best timing tools, and a macro trend can happily remain within oversold conditions for as long as it wishes. So this is merely an observation and not a hot counter-trend idea.

Large speculators were net-short AUD/USD futures for a fourth week, and their increase of bearish exposure slowed for a third. Managed funds reduced their net-short exposure for a third week, which shows a divergence between the two traders.

NZD/USD futures reached a record level of net-short exposure for a fourth week. Clearly this is a very bearish signal, but is it becoming too bearish? History shows that consecutive streaks of record highs or lows rarely last long when it comes to market positioning in general.

There is also a bullish divergence forming between short CAD prices and a reduction of net-short exposure among large speculators. The fact that the divergence stems from a record level of net-short exposure shows a hesitancy for traders to keep attacking the same trade, and could serve as a warning to traders short NZD/USD futures. With that said, prices for both have continued to fall against the mighty US dollar.

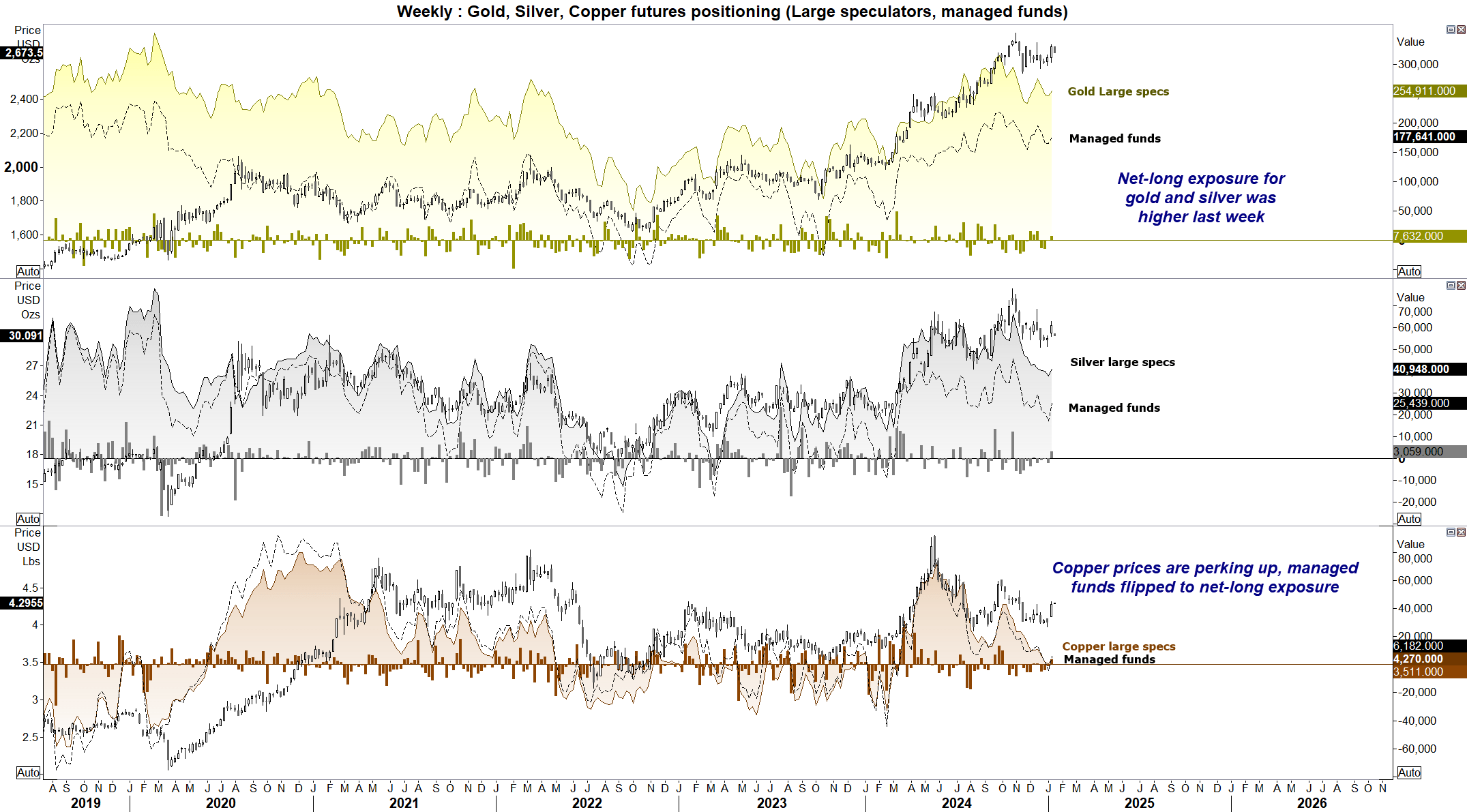

Metals (gold, silver, copper) futures - COT report:

Futures traders got behind key metals last week, with net-long exposure rising for gold, silver and copper among large speculators.

Net-long exposure to gold rose ~19k contracts between both traders, which marked the first increased of combined speculative volumes in four weeks. However, as I warned in a video last week, the early-year-gains seen on gold might turn out to be a sucker punch for bulls. While its rally extended further than I originally thought after NFP, momentum has since turned lower.

As for silver, the rise of net-long exposure was fuelled by a rise of longs and reduction of shorts. Yet the fact that silver futures gapped lower at this week’s open and continued lower underscores my suspicions of these January moves. Ultimately, traders may want to remain nimble.

Managed funds reverted to net-long exposure to copper futures, with prices rising notably from recent lows and out of a small compression range. And it might have been trading higher were it not for a strong US dollar.

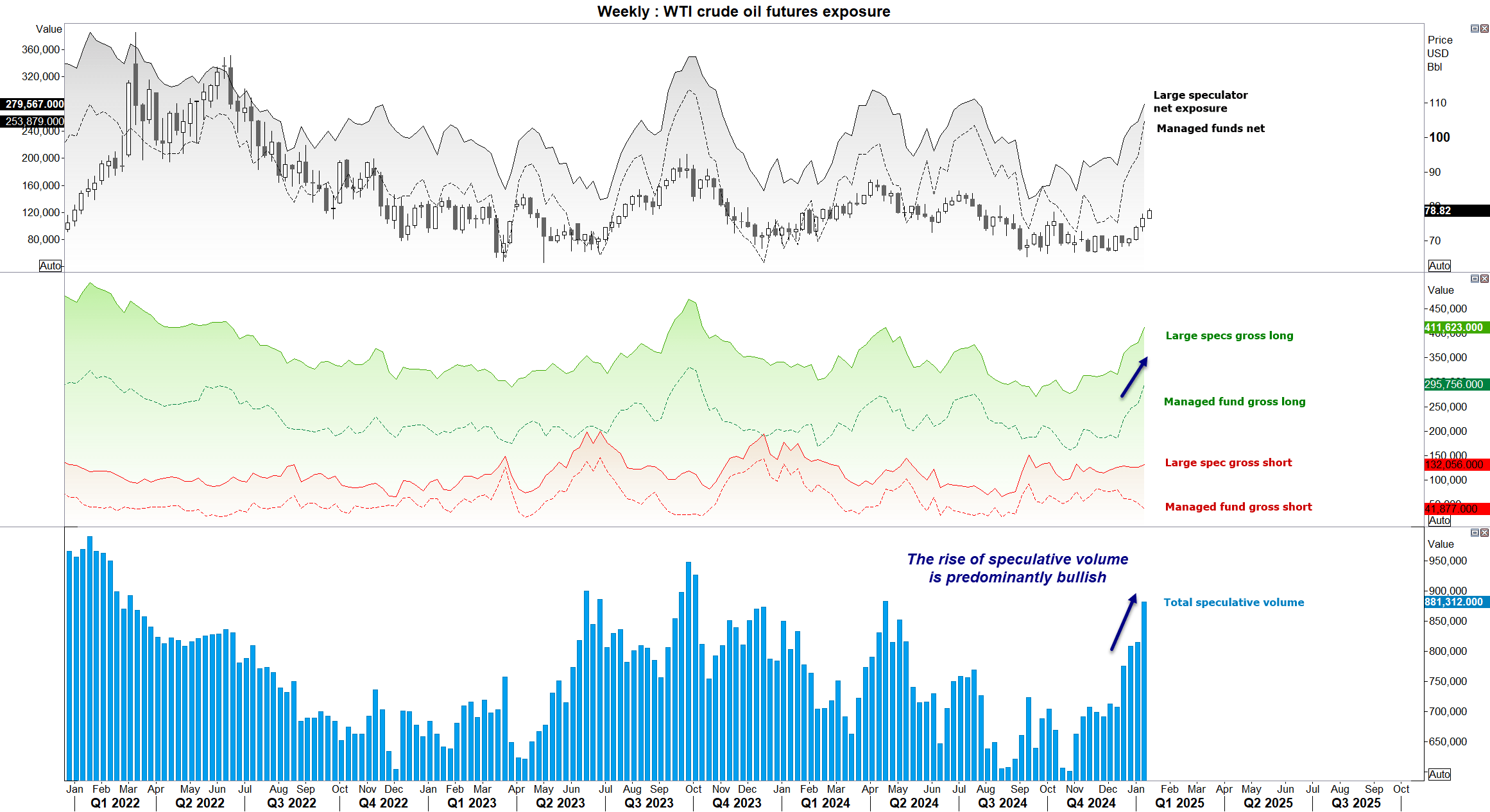

WTI crude oil (CL) positioning – COT report:

Futures traders continued to pile into long WTI crude oil bets last week, with large speculators pushing net-long exposure to a 25-week high and managed funds a 66-week high. A strong US economy and stimulus from China have helped support the move, although oil prices have continued to surge in the four days since data was last compiled. The outgoing Biden administration has increased its sanctions on the Russian oil industry which has left Chia and India scrambling for ways to get around the latest obstacles to try and retain their cheap oil imports from Russia.

Total speculative volume has also risen aggressively alongside prices, which has been predominantly fuelled by longs bets. While net-long exposure is approaching a near-term sentiment extreme, prices remain below their 2024 and 2023 highs and net-long exposure is not high by long-term historical standards.

And if oil prices continue to surge, so will inflation expectations.