S&P 500 Talking Points:

- Stocks continue to grind-higher, very similar to gold albeit with even less pullback along the way.

- As I wrote in the Q4 Forecast, given the Fed’s accommodative stance even despite higher-than-expected inflation, the wealth effect is still a driving factor in US economic policy, and thus it makes little sense to be anything more than ‘tactically bearish’ until that changes. But that also doesn’t mean that chasing and hoping are great strategy drivers.

- To download the full forecast, the link below will set that up.

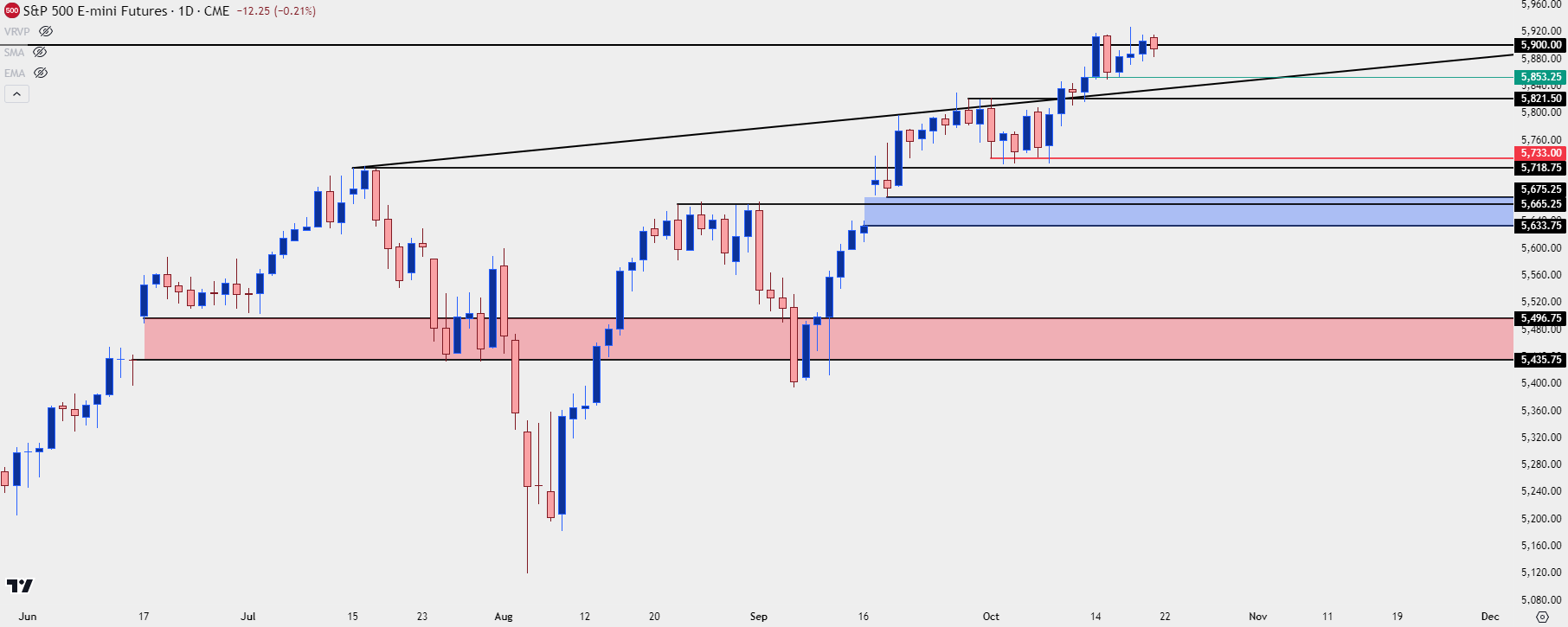

It’s been a dramatic start to Q4 for both currencies and gold. But in US equities, it’s been relatively calm as the grind-higher has continued with a minimum of drama. The quarter opened with a pullback to support, which held for a week, and then bulls drove to another fresh ATH. There was some two-way interplay a week ago, when Monday saw a 1.03% breakout in S&P 500 Futures that pared back a day later with a 0.90% pullback. The remainder of the week saw buyers continue to press forward and as of this writing, the 5900 level remains in-play as buyers haven’t been able to leave it decisively behind.

S&P 500 Futures – Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Pullbacks Going Forward

As I’ve said in the past few quarterly forecasts, the long side of stocks can be difficult to chase given how grindy the moves-higher have been. This leaves little two-way price action with which to manage risk and place stops. But – the aftermath of pullbacks can produce some amenable environments for trend continuation.

In Q2 that pullback showed up at the quarterly open; in Q3 it was near the middle of the quarter. But in both cases there was a noticeable dent in the trend that soon showed a higher-low on the daily charts.

So, at this point, the option set isn’t great: Traders can either try to fade a really strong trend, or they can look to chase the move-higher, with the more attractive alternative trying to be patient and wait for another of those pullback scenarios. In that case, something like 5650 or 5500 could be realistic. But again, there’s no evidence of that yet as buyers have simply continued to push.

For those that are looking to push bullish momentum without a more noticeable pullback, shorter term charts can be used to try to find supports that can be used for risk management.

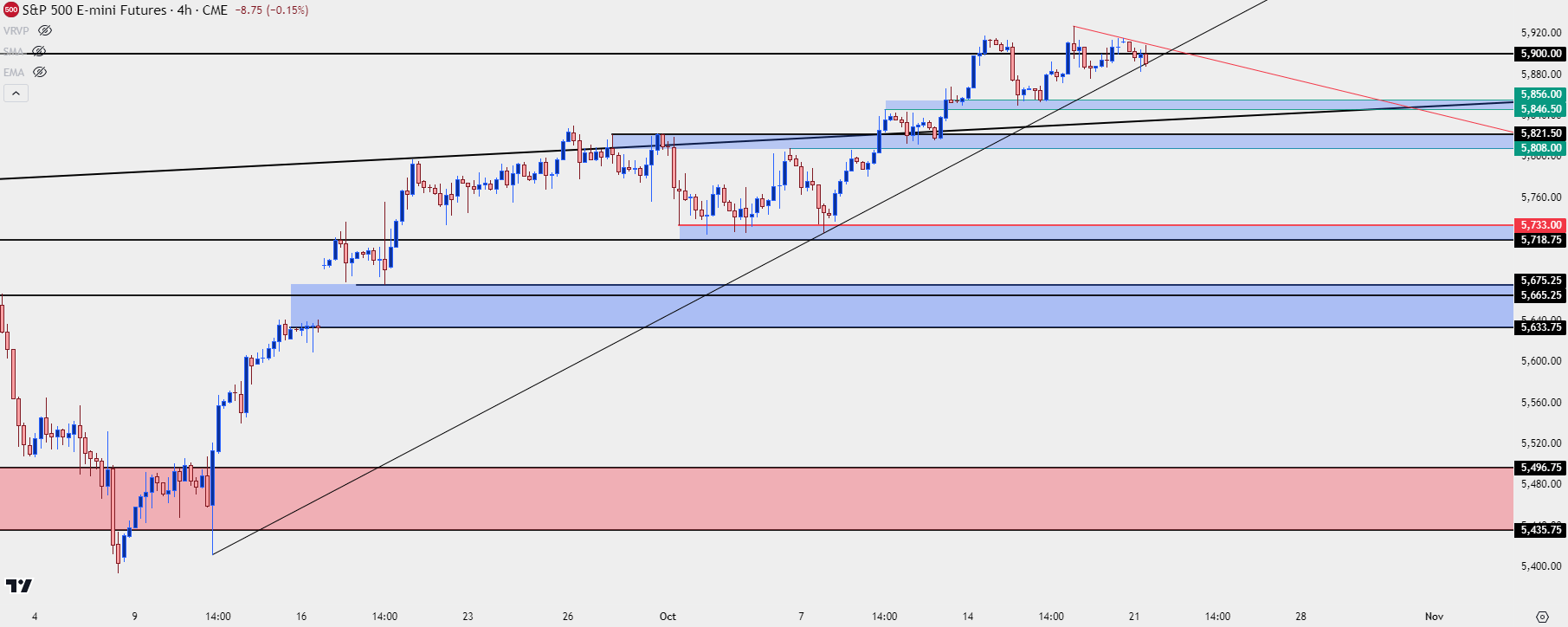

On the below four-hour chart, there’s an aggressive zone taken from resistance-turned-support that held last week’s swing-lows. That plots from 5846.50-5856. Below that, another zone just above the 5800 psychological level, spanning from 5808-5821.50.

If neither of those hold, then pullbacks would face a big test at the same support that held for a week after the Q4 open, running from 5818.75-5733.

For resistance overhead, the 5900 level appears to be what’s paused the move over the past week and there’s even been a build of lower-highs around that, highlighting that lacking acceptance above the big figure. I think a major reason this is happening is proximity to the major psychological level of 6k, which I’m considering to be a major pause-point to the trend if/when it happens during Q4.

If we do see buyers run a breakout without pulling back to support, then 5900 becomes a spot of higher-low support potential.

S&P 500 Futures Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

S&P 500 Talking Points:

- Stocks continue to grind-higher, very similar to gold albeit with even less pullback along the way.

- As I wrote in the Q4 Forecast, given the Fed’s accommodative stance even despite higher-than-expected inflation, the wealth effect is still a driving factor in US economic policy, and thus it makes little sense to be anything more than ‘tactically bearish’ until that changes. But that also doesn’t mean that chasing and hoping are great strategy drivers.

- To download the full forecast, the link below will set that up.

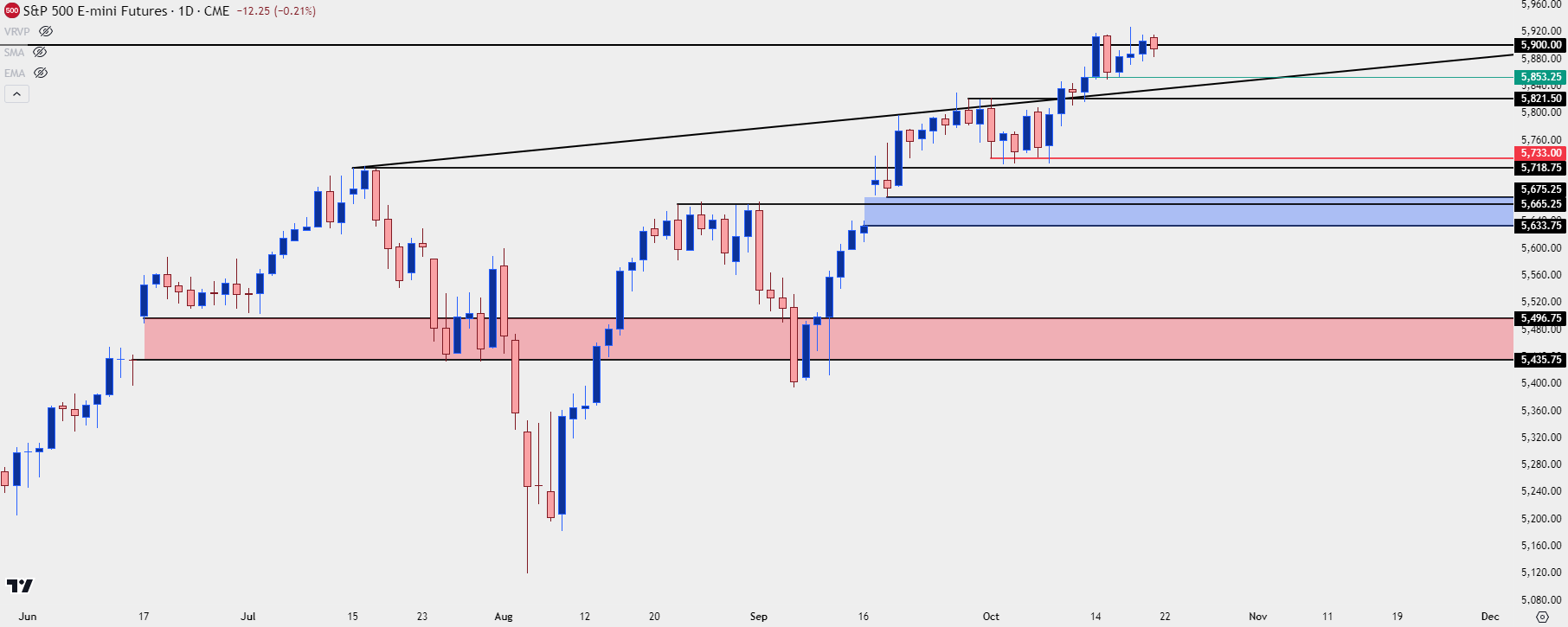

It’s been a dramatic start to Q4 for both currencies and gold. But in US equities, it’s been relatively calm as the grind-higher has continued with a minimum of drama. The quarter opened with a pullback to support, which held for a week, and then bulls drove to another fresh ATH. There was some two-way interplay a week ago, when Monday saw a 1.03% breakout in S&P 500 Futures that pared back a day later with a 0.90% pullback. The remainder of the week saw buyers continue to press forward and as of this writing, the 5900 level remains in-play as buyers haven’t been able to leave it decisively behind.

S&P 500 Futures – Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Pullbacks Going Forward

As I’ve said in the past few quarterly forecasts, the long side of stocks can be difficult to chase given how grindy the moves-higher have been. This leaves little two-way price action with which to manage risk and place stops. But – the aftermath of pullbacks can produce some amenable environments for trend continuation.

In Q2 that pullback showed up at the quarterly open; in Q3 it was near the middle of the quarter. But in both cases there was a noticeable dent in the trend that soon showed a higher-low on the daily charts.

So, at this point, the option set isn’t great: Traders can either try to fade a really strong trend, or they can look to chase the move-higher, with the more attractive alternative trying to be patient and wait for another of those pullback scenarios. In that case, something like 5650 or 5500 could be realistic. But again, there’s no evidence of that yet as buyers have simply continued to push.

For those that are looking to push bullish momentum without a more noticeable pullback, shorter term charts can be used to try to find supports that can be used for risk management.

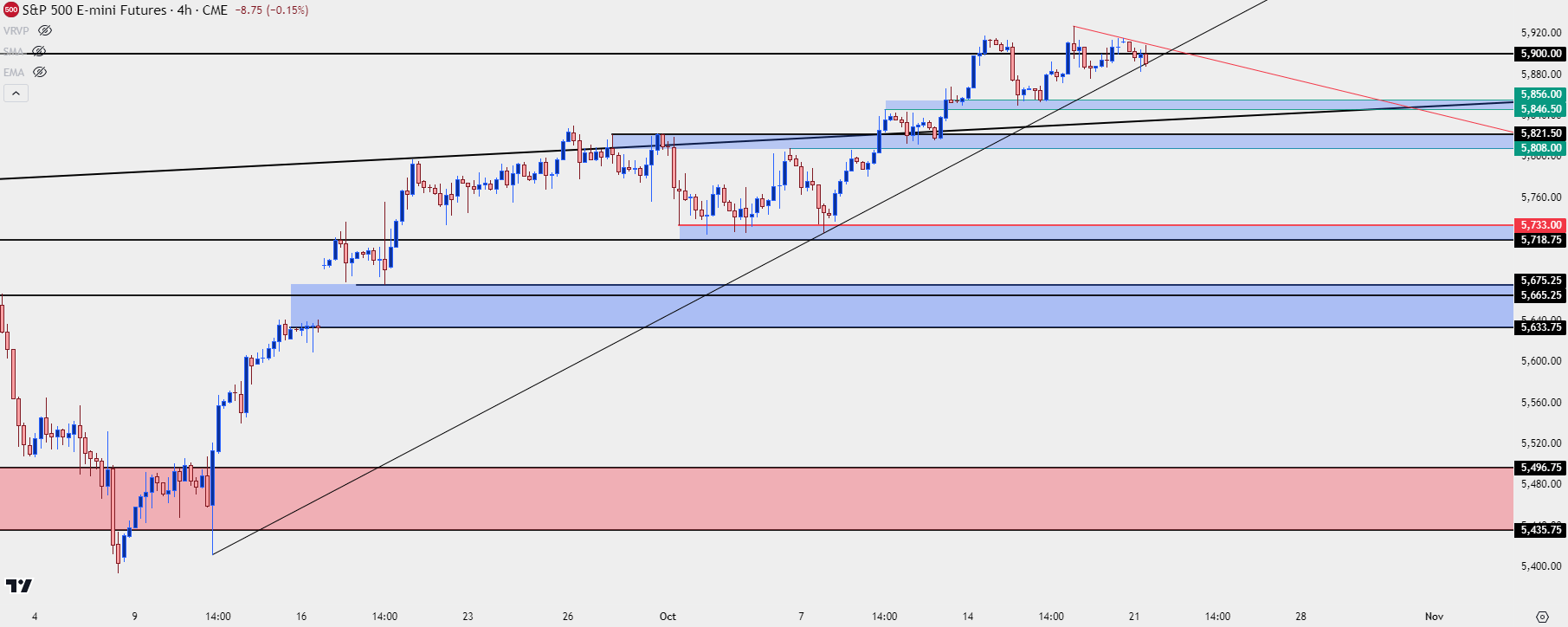

On the below four-hour chart, there’s an aggressive zone taken from resistance-turned-support that held last week’s swing-lows. That plots from 5846.50-5856. Below that, another zone just above the 5800 psychological level, spanning from 5808-5821.50.

If neither of those hold, then pullbacks would face a big test at the same support that held for a week after the Q4 open, running from 5818.75-5733.

For resistance overhead, the 5900 level appears to be what’s paused the move over the past week and there’s even been a build of lower-highs around that, highlighting that lacking acceptance above the big figure. I think a major reason this is happening is proximity to the major psychological level of 6k, which I’m considering to be a major pause-point to the trend if/when it happens during Q4.

If we do see buyers run a breakout without pulling back to support, then 5900 becomes a spot of higher-low support potential.

S&P 500 Futures Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist