S&P 500 Talking Points:

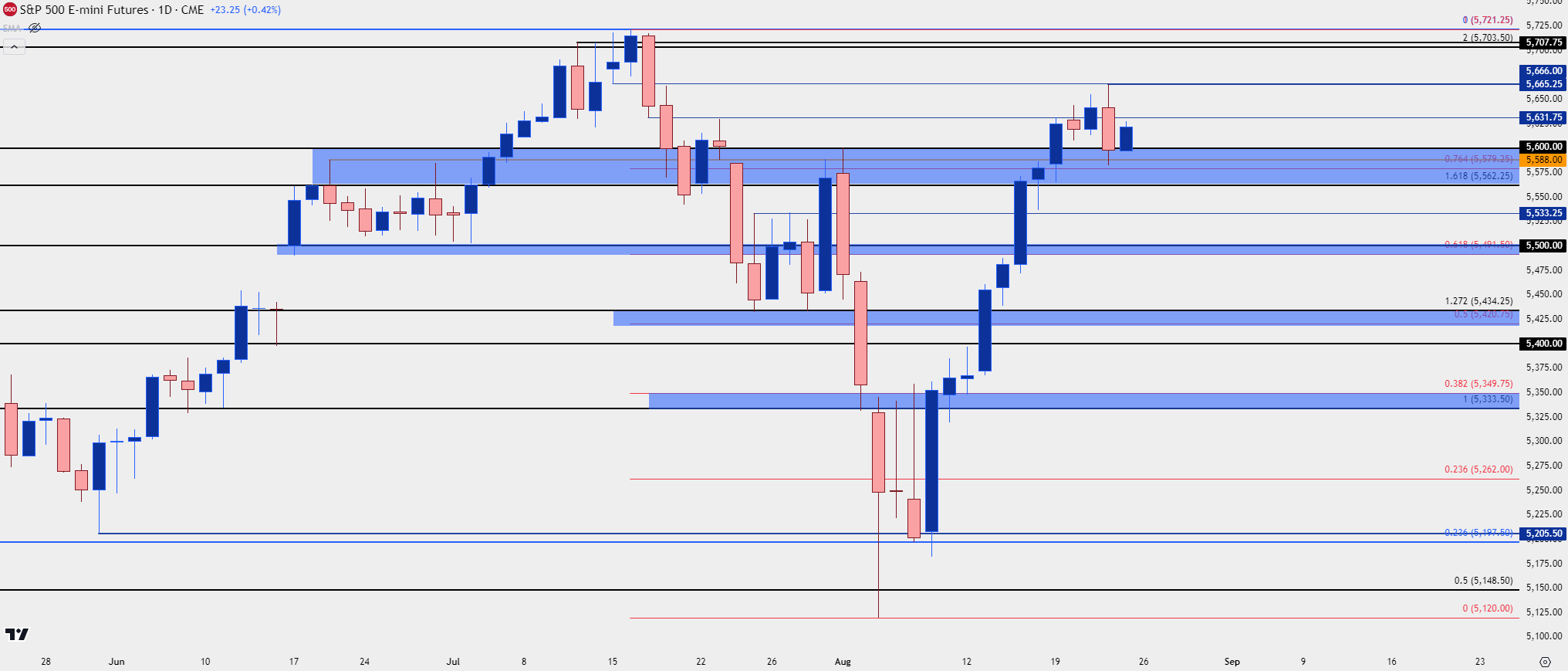

- Yesterday was a change of pace in stocks as S&P 500 Futures printed a bearish engulfing pattern on the daily chart.

- The key support that I’ve been tracking from the 5562-5600 zone came into play and has so far held the lows. That’s the spot that bulls need to hold to retain control and we have a major driver on the horizon with FOMC Chair Jerome Powell’s speech later today.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

S&P 500 Futures broke their streak of consecutive gains earlier in the week, so there wasn’t really much for pullbacks since equities began their rally two weeks ago. While the sell-off was pushed by both recession fears and carry unwind from USD/JPY, the latter theme has remained in-effect with USD/JPY bears continuing to push. The former, however, with recession fears had seemed to take a significant step back and that allowed for stocks to pose a massive rally, with S&P 500 Futures pushing up to within one percent of the all-time-high yesterday.

Yesterday’s resistance showed three ticks inside of the 5666 resistance level that I’ve been following and that printed shortly after the cash open. Sellers took over after and took out the prior day’s low, making for a bearish engulfing pattern on the daily chart.

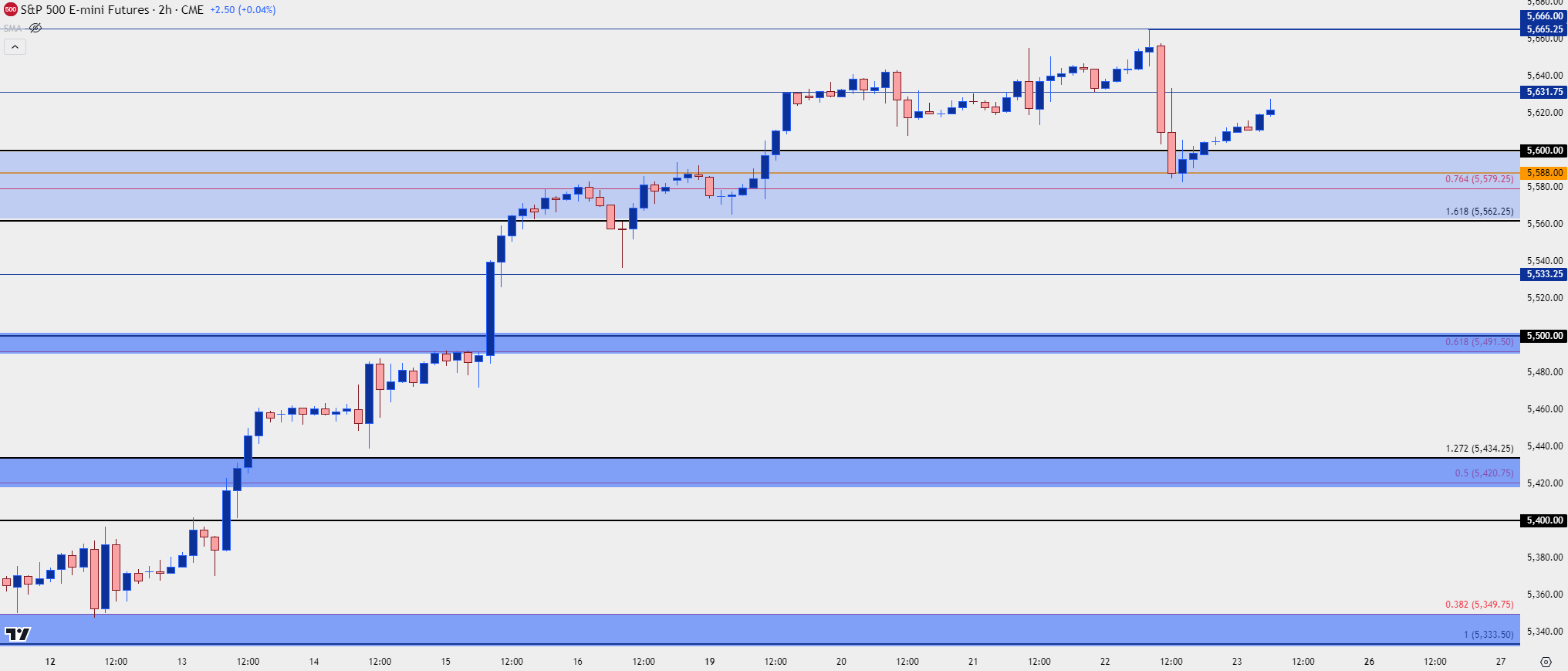

The low yesterday showed right around the 5588 level and that has since prodded a bounce in the overnight session. But, for the first time in a couple of weeks after the display of that bearish engulfing pattern, there could be widening scope for sellers. This puts even more emphasis on Chair Powell’s speech this morning.

S&P 500 Futures Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

S&P 500 Strategy

Given current price structure, along with the amount of focus being paid to Powell’s speech later today, and I’m inclined to retain the same levels that I had looked at yesterday.

The 5631.75 level remains of interest and is very nearby as of this writing. This offered a quick resistance check yesterday before the sell-off really took over and it remains in-play today. Above that, the 5666 level was three ticks away from yesterday’s high, so I’m considering that a tight zone; and above that the 5700 zone looms large as this is near the spot of the recently-established all-time-high. That area gave bulls heartache for about a week, and it spans from the big figure up to the 5721.25 swing high.

For support, I’m continuing to track key support in the 5562.25-5600 zone and this is the spot that bears would need to take out to take control of intermediate-term price action, which could open the door for a deeper sell-off next week. Within that zone, there are minor levels at 5588 and 5580. Below that, I’m tracking a level at 5533.25 and then another key zone spanning from 5491.50-5500.

Support:

S1: 5600

S2: 5562.26

S3: 5533.25

S4: 5491.50-5500

Resistance:

R1: 5666

R2: 5700

R3: 5721

S&P 500 Futures – Two Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist