S&P 500, Nasdaq, Dow Jones Talking Points:

- Stocks came into Q2 holding on to strong bullish move that had started five months earlier, pushed by the FOMC press conference on November the 1st.

- At the source of that move was a dovish FOMC highlighting that rate hikes were likely over and rate cuts would be on the way. Since then, however, data has remained fairly strong and that brings question to when rate cuts may actually begin.

- In the Q2 Forecast, I highlighted pullback potential in the S&P 500 and Nasdaq, but I also retained a bullish read as driven by the expectation for the FOMC to remain dovish while keeping the door open for cuts to begin in the second-half of this year.

Was that the pullback?

Equities shook in the first week of Q2 trade. Initially, it was a pullback to support from prior resistance in S&P 500 futures, with the 5250 level helping to hold the lows on Tuesday and Wednesday. Along the way, we heard from Chair Powell, where he opined that he still thought it would be appropriate to begin cutting rates at some point this year and that helped to bring a bid to stocks on Wednesday, although that strength was in question a day later after another comment from another Fed member.

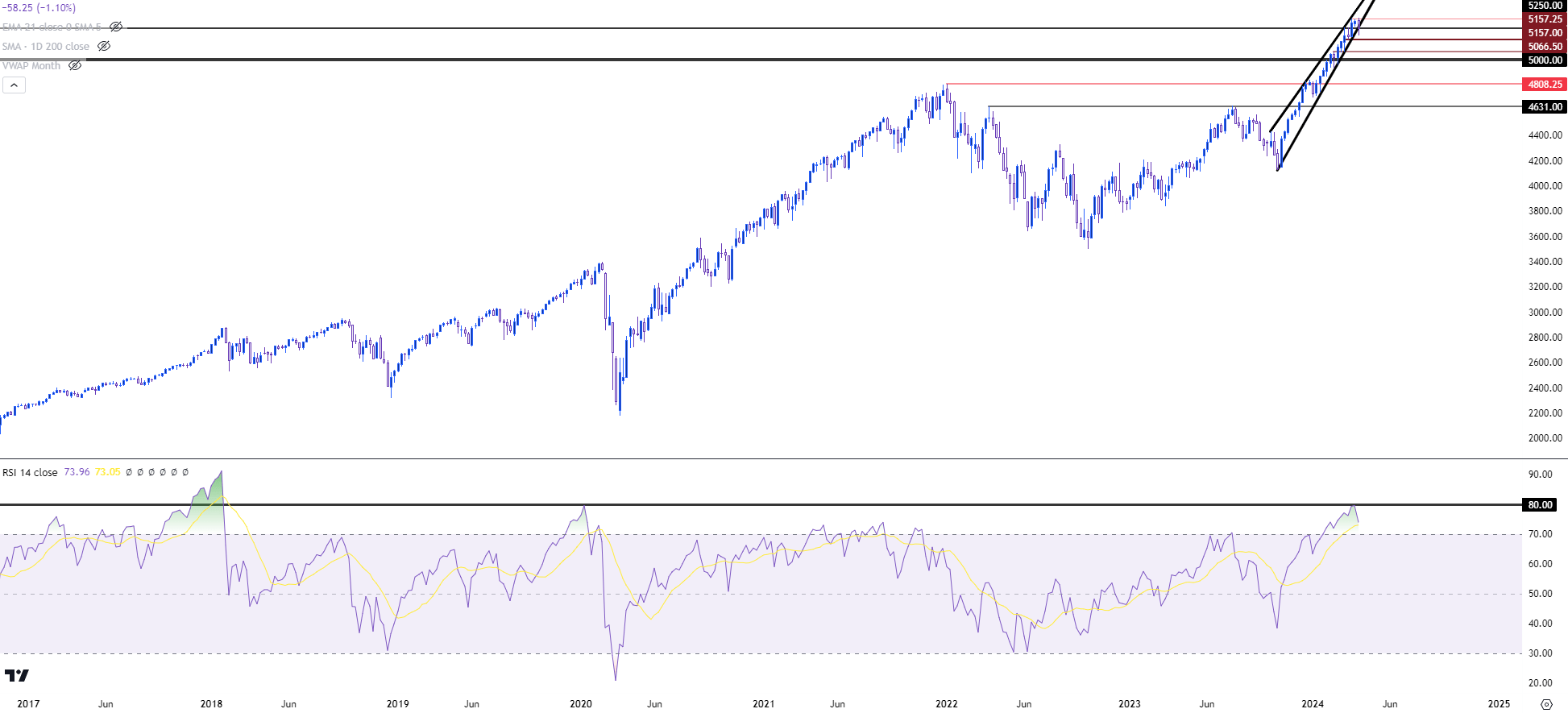

As I had looked at on Monday, stocks were stretched with S&P 500 futures showing extreme overbought conditions on the weekly chart. Last week’s pullback has calmed matters a bit but, the weekly chart continues to see RSI remain in overbought territory.

S&P 500 Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

The big move in stocks this week emanated from a comment on Thursday from Minneapolis Fed President, Neel Kashkari. He said that rate cuts were in jeopardy given how strong U.S. data had remained and the prospect of no rate cuts was enough to elicit a downside break in equities, but as highlighted in the Q2 forecast, with a trend as strong as what’s been seen over the past five months with the S&P rising by almost 30%, there was a backdrop for possible profit taking.

Stocks pulled back from those lows on Friday despite a very strong NFP report, but the question remains as to whether that bounce was the pullback that I was referring to, or whether there’s more room to go before bulls regain control.

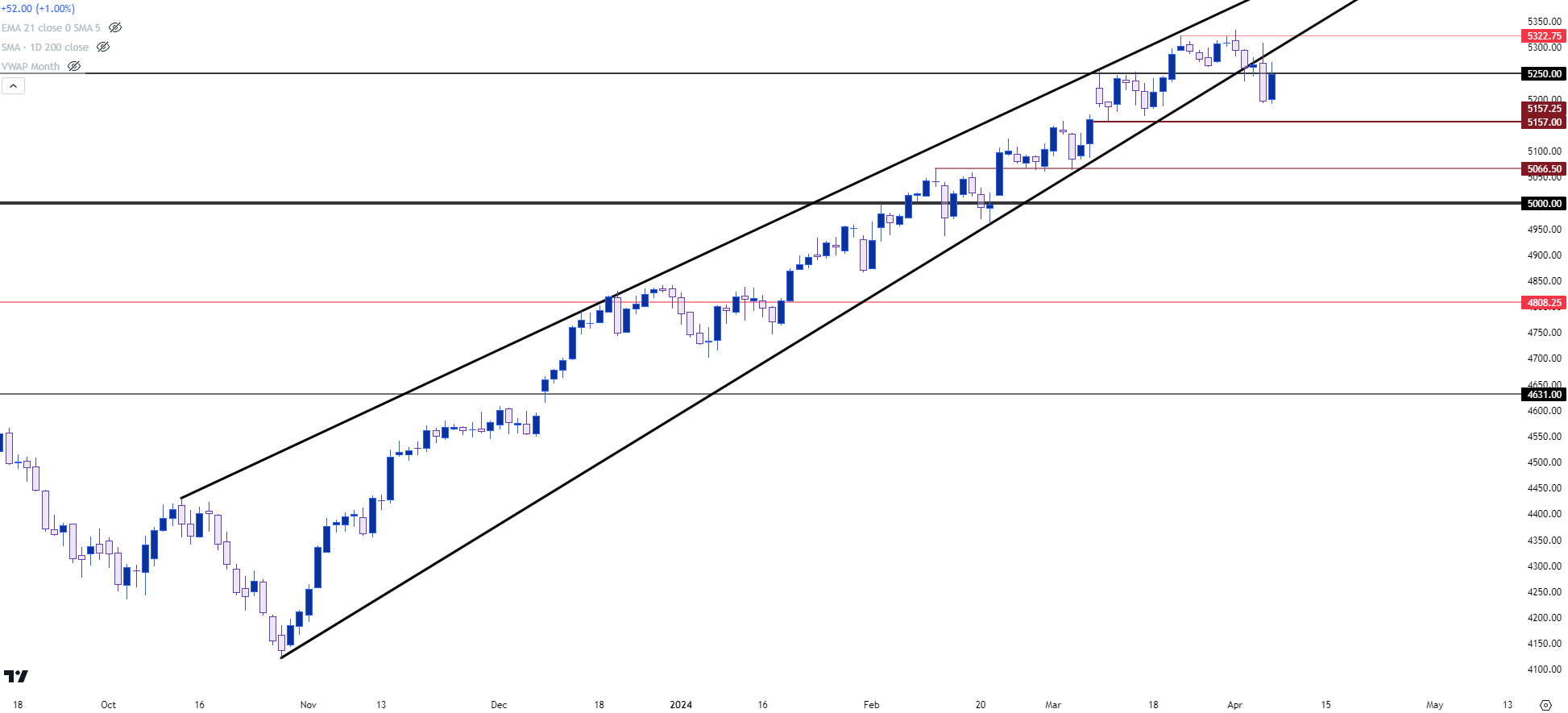

In S&P 500 futures, we can see that Thursday sell-off breaking below the rising wedge formation that’s built for the duration of the bullish trend. The 5250 level of prior resistance remains important, as that had helped to hold support until that Thursday sell-off but, as of this writing, it’s back in the picture as possible resistance.

S&P 500 Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

S&P 500 Shorter-Term

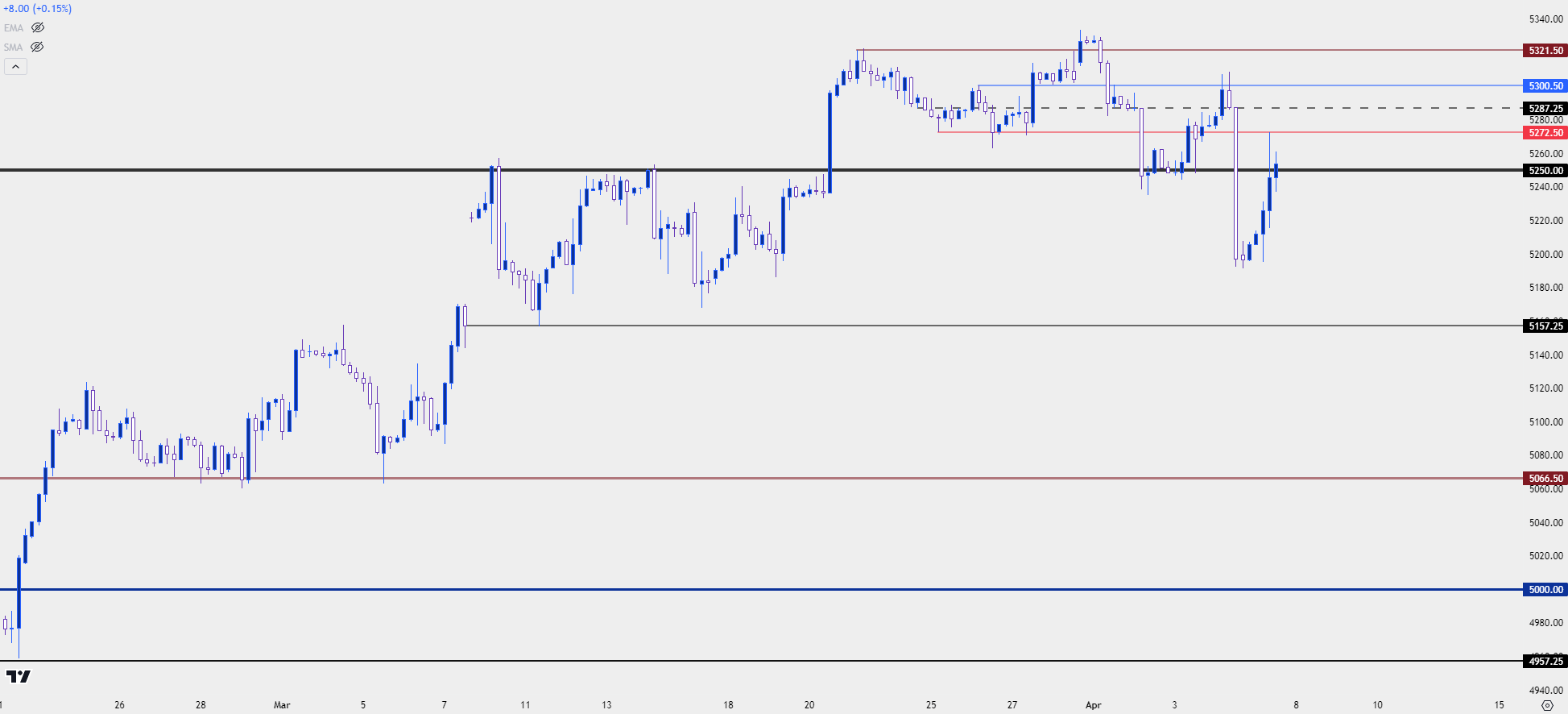

From the four-hour chart, we can see that fresh low leading into a bounce back up to the 5250 level. Helping to hold the Friday high is a prior swing-low that plots at 5273. The prior lower-high held resistance around the 5,300 level, and if bears can hold below that, the potential for a deeper sell-off remains.

The question at that point, however, is whether the best venue for bearish equity approaches is in the S&P 500, or perhaps elsewhere, such as the Nasdaq 100 which I’ll look at below.

S&P 500 Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Nasdaq

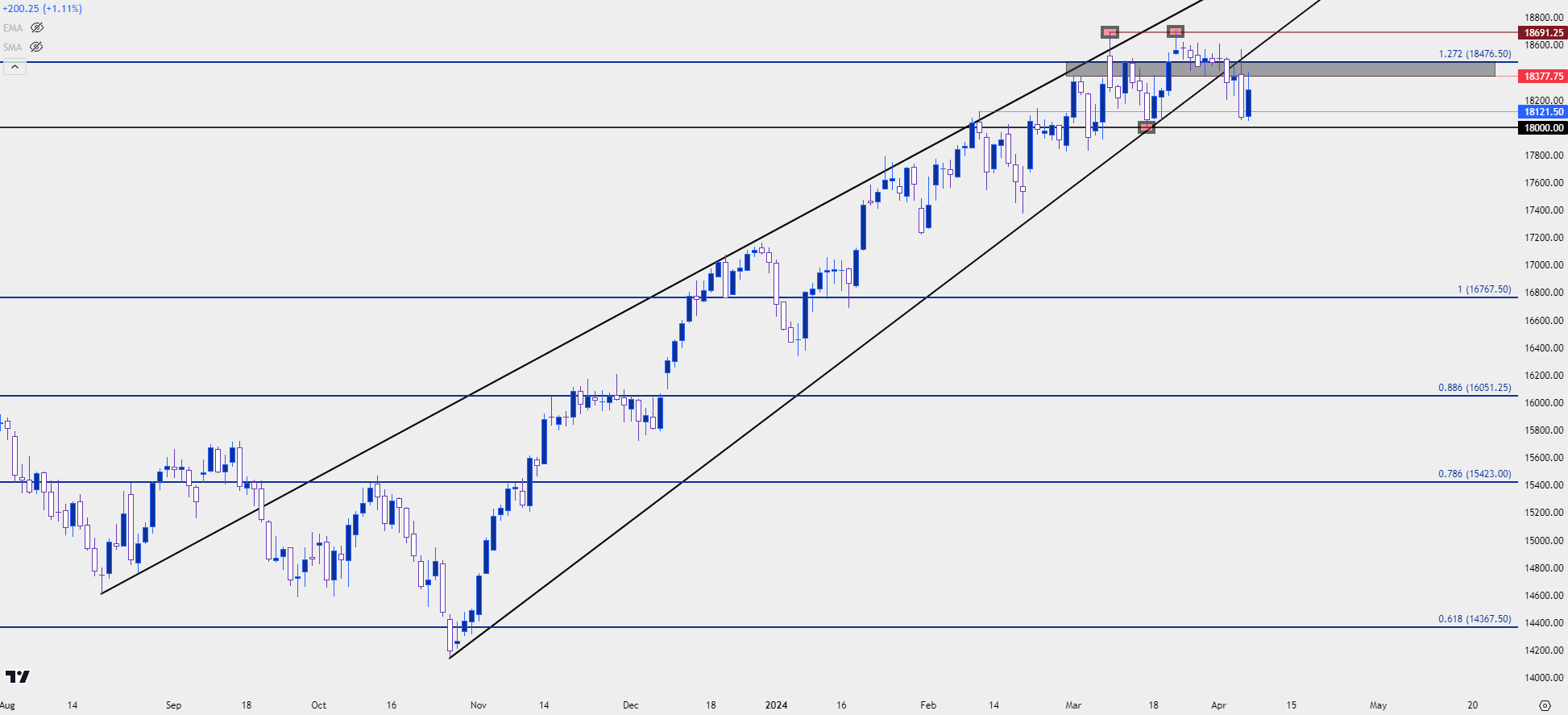

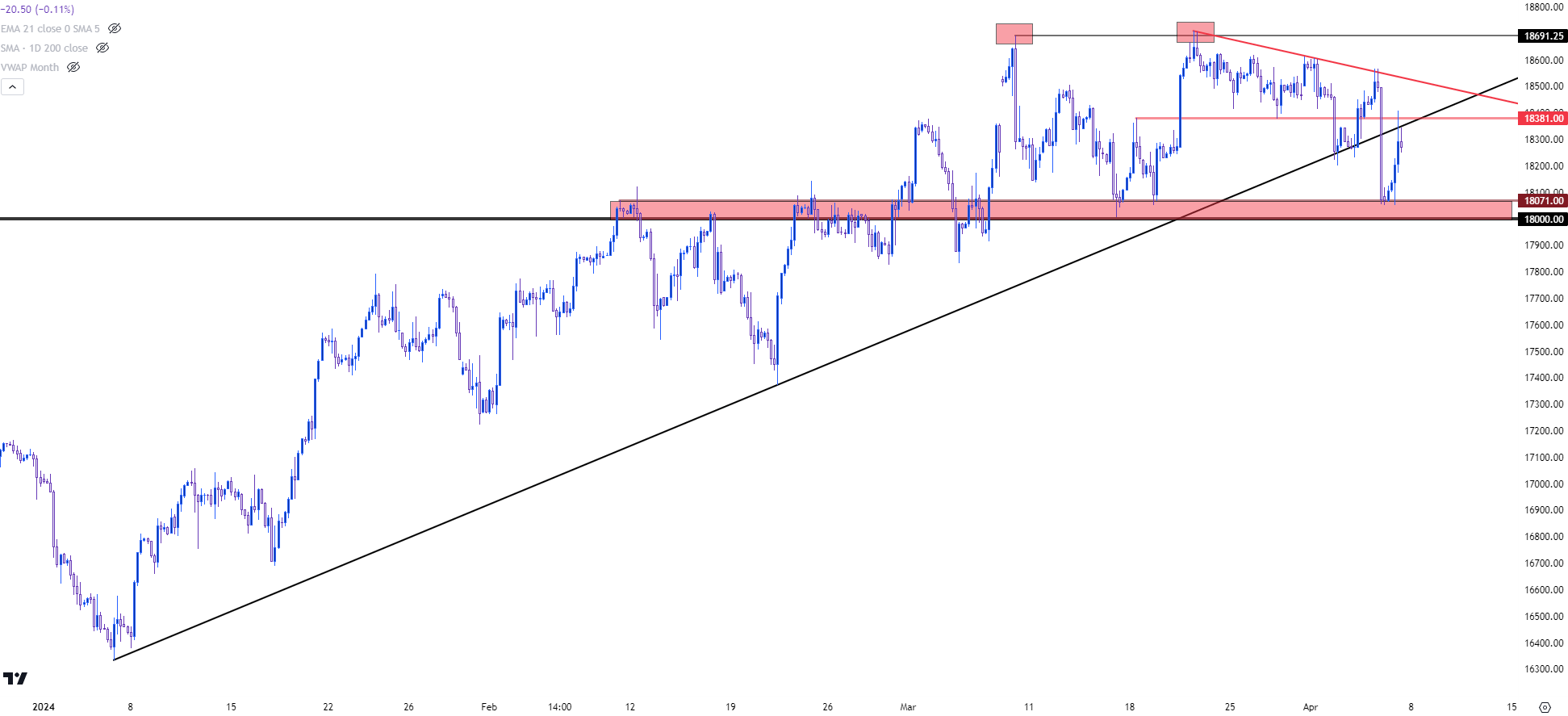

While S&P 500 futures set a fresh all-time-high on the first day of Q2 trade, the Nasdaq 100 did not; and this highlights a deviation that started to show in late-March trade as the Nasdaq held resistance at 18,691 on two separate occasions while the second test at that level on March 21st was taking place as the S&P was pushing a fresh high.

In the Nasdaq, this sets up a possible double top formation with a neckline at the 18k level. The neckline hasn’t been tested through, which is a requirement for the formation to trigger. But there’s another bearish formation and this one is quite similar to the rising wedge looked at above in the S&P. Prices began to test below the lower trendline of that formation on Tuesday, and the bounce that followed found resistance at a familiar spot, around the 18,477 Fibonacci extension.

Nasdaq 100 Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

On a shorter-term basis, we can see that breach to a fresh low pulling back and finding resistance around prior support and that comes in a couple of different forms: There’s the rising trendline taken January and late-February swing lows. And there’s also the prior price swing around 18,381 which held the lows in late-Q1 trade.

The support zone of interest spans from the 18k level looked at above, which sets the neckline of the double top, up to the 18,071 prior swing that came back in the picture last week to help set the lows.

For those looking at bearish equity plays in U.S. equities, this could provide a bit more attraction than what was looked at above.

Nasdaq 100 Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

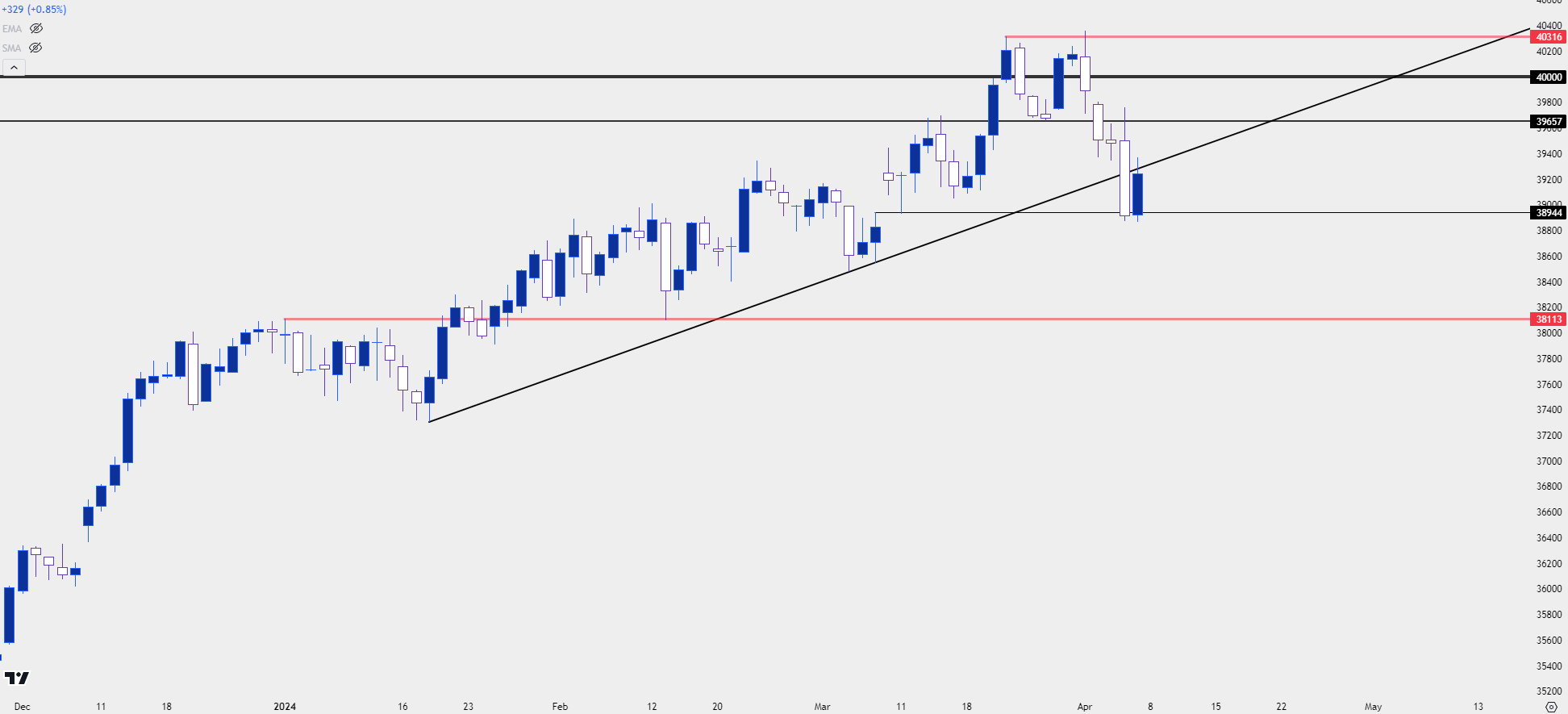

Dow Jones

Dow futures put in a test at a significant spot of resistance in late-Q1 trade at the 40k psychological level. Bulls set a fresh high on the first day of Q2 trade but similarly were unable to hold above the big figure, and that led to a fast sell-off in the early portion of the week.

The Friday bounce in Dow futures showed around a prior swing of resistance-turned-support, and the bounce from that level is testing resistance at a trendline spanning from January and late-February swing-lows. This similarly sets up the index in a somewhat bearish position, although the setup here may not be quite as attractive as what’s looked at above in the Nasdaq.

For Dow futures, the big question is whether bulls can mount back above the 40k level in the event that equity strength comes back near-term. There is another spot of resistance overhead before that 40k level comes back into play, however, and that plots at a prior resistance-turned-support-turned-resistance level of 39,657.

Dow Jones Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist