S&P 500 Talking Points:

- The early-portion of yesterday’s US session showed grinding price action in S&P 500 Futures.

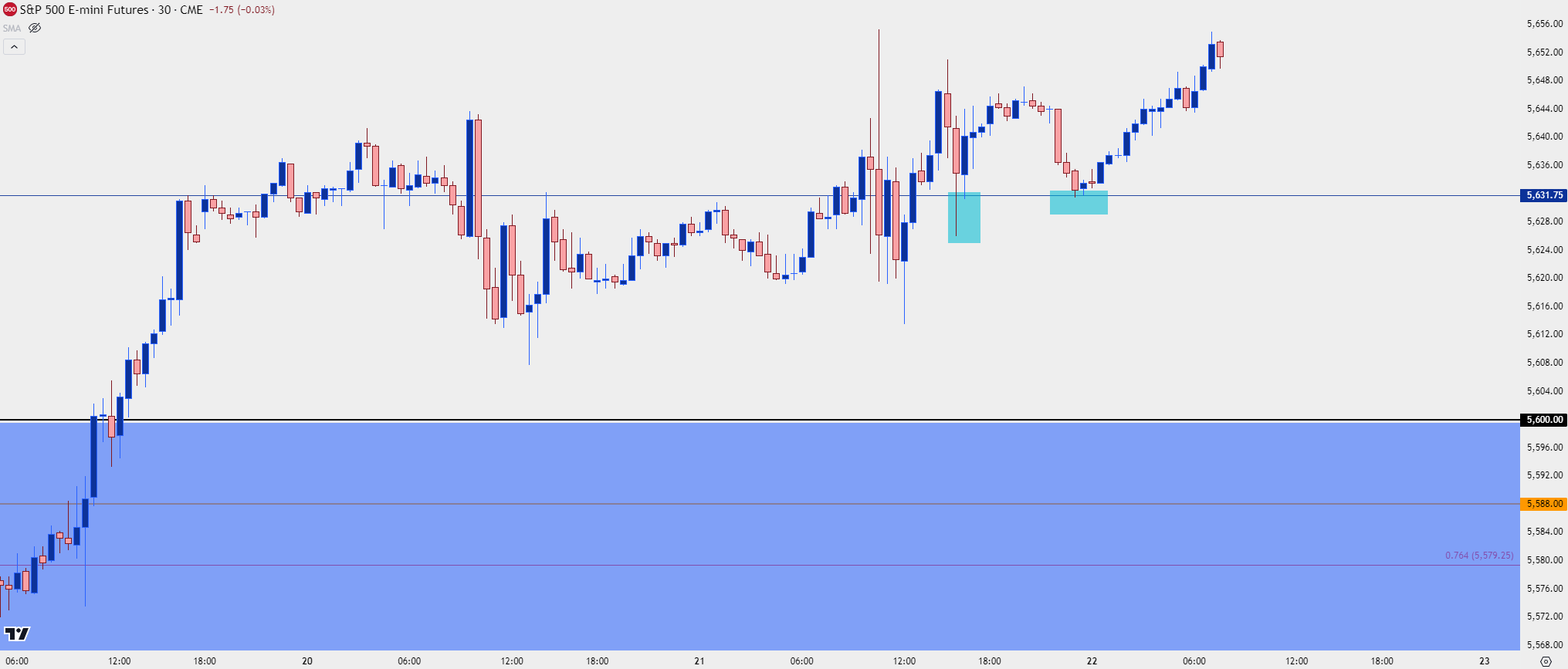

- A pullback showed after the release of FOMC minutes, but support was able to hold the resistance level looked at in yesterday’s piece, plotted at 5631.75. That price was back in-play overnight to hold the low in the Asian trading session, and buyers have pushed a consistent rally since.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

S&P 500 Futures were back in the green yesterday following their first red day in nine sessions. It wasn’t an aggressive move during the U.S. session, however, as there was considerable grind around the cash equity open that largely hung around until after the release of FOMC minutes. Initially stocks pushed-higher following the release but pulled back about 30 minutes later. The same 5631.75 level remained in-play, helping to bring a bounce.

That price was in-play again during the Asian trading session, helping to hold the overnight low before a clean rally developed with price making a run towards next resistance at 5,666.

This gives a bit of extra validation to 5,631.75 but it also highlights that price as a key level for bulls to hold in today’s session.

S&P 500 Futures: 30-Minute Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

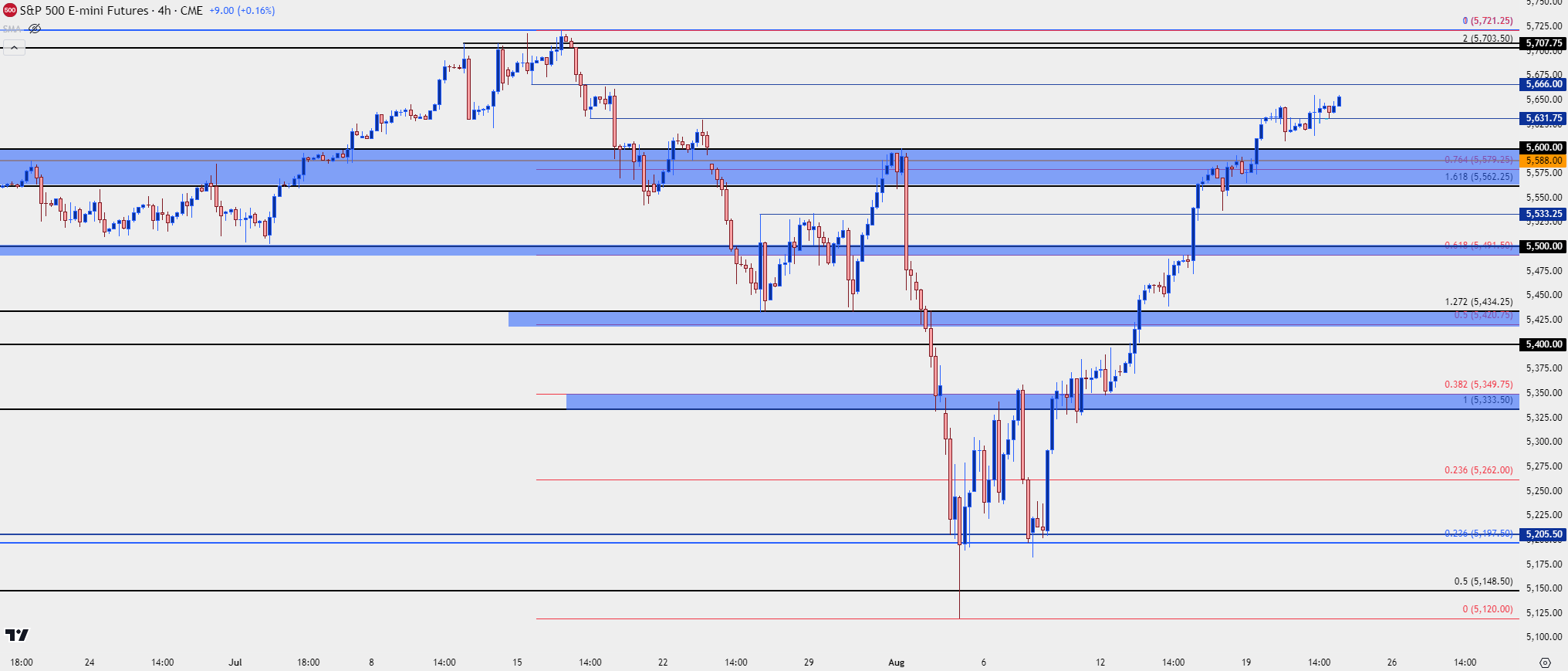

S&P 500 Strategy

At this point bulls remain in-control of ES and there’s been a continuation of higher-highs and lows which provides some structure for reference. I had highlighted the importance of 5,631.75 in Monday’s piece and that price remains key today, as that level is now resistance-turned-support. The next level that I’m tracking above current price is 5,666 which is then followed by the 5,700 area and there’s a lot going on there.

FOMC Chair Powell’s speech is tomorrow morning, and it would not surprise me to see that zone in-play at or around the time that he begins speaking.

There could soon be concerns around risk-reward as price pushes towards those highs, however, as there hasn’t been much for pullbacks in the rally that started two weeks ago now following the support grind at 5205.50. That could provide complication as S&P 500 Futures push towards that 5700 area.

For support, there’s considerable structure in-play given the grind-higher, and the key zone that I’m tracking below 5631 runs from 5562.26 up to the 5600 psychological level. This would be the area that I would want to see bears take-out in order to begin taking control of near-term price action.

ES Levels

Support:

S1: 5631.75

S2: 5600

S3: 5562.26

Resistance:

R1: 5666

R2: 5700

R3: 5721.25

S&P 500 Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist