US futures

Dow futures +0.6% at 33780

S&P futures +0.7% at 4330

Nasdaq futures +0.97% at 14849

In Europe

FTSE +0.7% at 7656

Dax +1.2% at 15500

- US PCE rises but core PCE cools

- US stocks are set book the worst monthly performance this year

- USD eases from a 10-month high

- Oil is set to rise 2.5% this week

US PCE rises & core PCE cools

US indices are pointing to a higher start, extending gains from the previous session although equities are still on track to fall across September and across the quarter.

A pullback in US treasury yields from a 16-year high helped Wall Street end yesterday higher, with the tech-heavy NASDAQ rising 0.8%.

However, heading into the final day of trading of the week, month, and quarter the Nasdaq and the S&P500 are on track for their worst monthly performance so far this year and on track for the first quarterly decline in 2023.

Concerns over the resilient U.S. economy, rising oil prices, and sticky inflation have raised bets of the Federal Reserve keeping interest rates high for longer.

Today's PCE data supports the view that PCE is accelerating modestly, rising 0.5% MoM, up from 0.2% and rising to 3.5% YoY from 3.3% as inflationary pressures remain. However, core PCE cooled to 3.9% YoY, down from 4.2%, in line with forecasts, which is helping to boost stocks and pull on the USD.

The Federal Reserve will be paying case attention to the core PCE, its preferred measure of inflation, as it decides whether to raise borrowing costs again or not this year. At the September FOMC the central bank indicated that it supports another 25 basis point rate hike before the end of the year.

The market is less convinced that the Fed will hike interest rates again in the November or December meeting, pricing in a 65% probability that rates will still be at their current level of 5.25 to 5.5% at the end of the year.

Corporate news

Nike is sprinting higher in the premarket, up around 9.5% after the sportswear group reported better than expected fiscal Q1 earnings of $0.94 ahead of the $0.75 expected which overshadowed amiss on revenue due to weakness in North America.

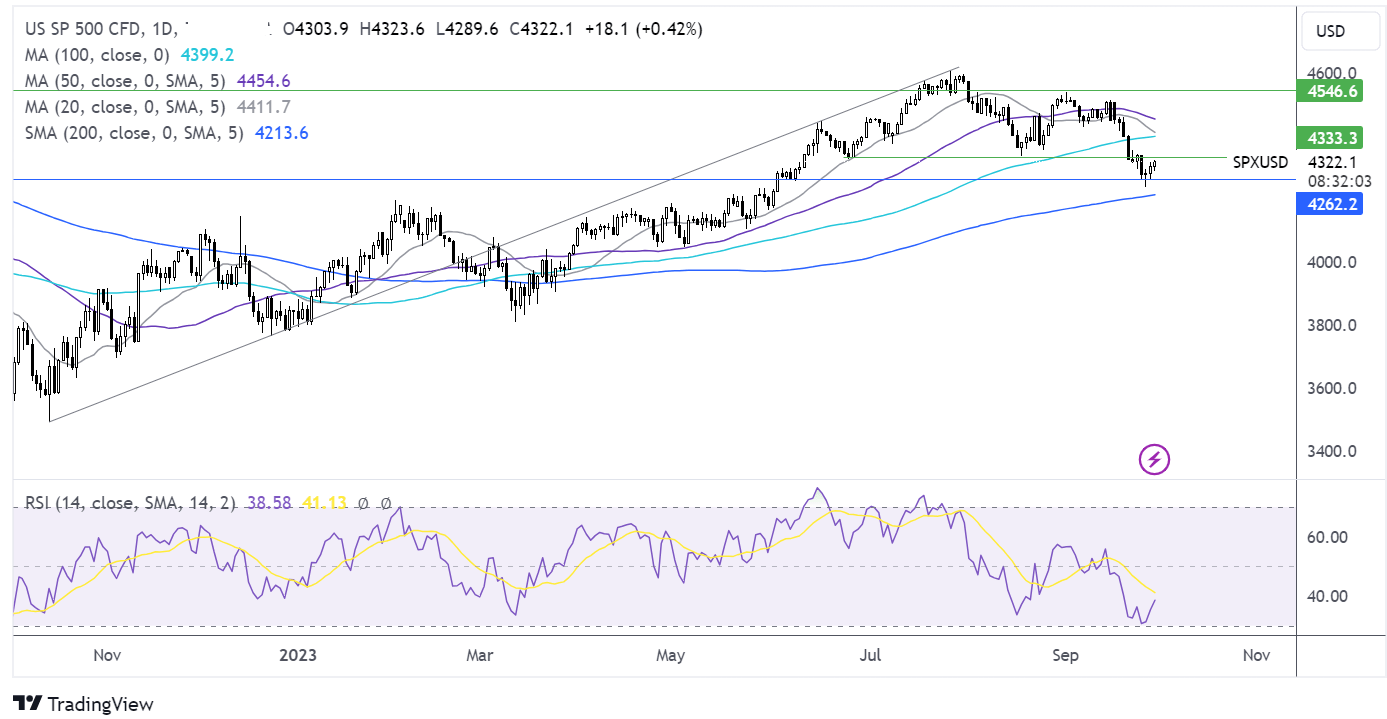

S&P500 forecast – technical analysis.

S&P500 has recovered from 4237 the September low and is testing resistance at 4335, the August low. Buyers, will need to retake this level to extend the recovery towards 4400 the 100 sma, and last Thursday’s high. Failure to retake 4335 could see the price fall back towards 4237 the monthly low, with a break below here exposing the 200 sma at 4215.

FX markets –USD falls, GBP rises

The USD is falling, but it's still set to book gains across the week, an 11th straight week of gains a rally of this length was last seen almost a decade ago. The US dollar is also on track to book gains across the month and the quarter, driven higher by resilient economic data, rising oil prices, and a hawkish-sounding Fed.

EUR/USD is rising for a second straight day, pushing towards 1.06 amid profit-taking in the USD and despite cooling eurozone inflation. Inflation in the region fell to 4.3% YoY, down from 5.2% in August. This was lower than the 4.5% forecast. Core inflation was also lower than expected at 4.5%, down from 5.3%. The data should give the ECB confidence that no more rate hikes are needed.

GBP/USD Is rising, capitalising on the weaker USD and pushing up towards 1.2250, a weekly high. UK GDP data confirmed 0.2% growth QoQ in Q2 and was upwardly revised from last year to 4.3% growth. The outlook for growth in the current quarter is less encouraging with the potential of a contraction in Q3.

EUR/USD +0.3% at 1.06

GBP/USD +0.44% at 1.2250

Oil is set for weekly gains

Oil prices are rising on Friday and are headed for weekly gains of over 2.5%, boosted by tight US supply and expectations of strong demand from China across the upcoming Golden Week holiday

This week, data showed that inventories in the US were notably tight, with storage at Cushing Oklahoma, at its lowest level since July 2022. The tight supply stems from a reduction in OPEC oil output in recent months, which is expected to continue until the end of the year.

Meanwhile international travel is expected to ramp up in the Golden Week holiday in China which will lift oil demand. Domestic travel is also expected to be on the rise with the number of domestic flights booked already a fifth higher than in the Golden Week pre COVID.

WTI crude trades +1.35% at $92.28

Brent trades +1% at $93.98

Looking ahead

15:00 US Michigan consumer sentiment