US futures

Dow future 0.32% at 42526

S&P futures 0.43% at 5835

Nasdaq futures 0.65% at 20360

In Europe

FTSE 0% at 8273

Dax 0.1% at 19478

- Stocks rise but are set for weekly losses

- Fed rate cut path & US elections weigh on sentiment

- Caution ahead of risk events over the next 2-weeks

- Oil is on track for a 2% weekly rise

Stocks rise but are set for a weekly loss

U.S. stocks point to a higher open on Friday. Treasury yields dip, offering some support to stocks, although the major indices are on course for weekly losses.

The 10-year U.S. Treasury yields are easing after reaching a three-month high of 4.26% this week. At the time of writing, the yield was trading around 4.2%.

All three major indices are on track to snap a six-week winning streak as investors were unrattled by the rapid rise in yields, strong economic data pointing to more gradual fed rate cuts, and uncertainty surrounding the US election.

This week's US jobless claims, services PMI, and durable goods orders data were all stronger than forecast, paving the way for less aggressive rate reductions from the Federal Reserve.

Meanwhile, the polls for the US elections remain close. While some odds markets see Trump in the lead, other polls show a tie. Given that Trump’s core policies are inflationary, a Trump win could impact the Fed’s outlook.

Investors are turning cautious, and the next few weeks are set to be key for sentiment and direction. There will be a raft of earnings reports from Magnificent 7 stocks, the U.S. jobs report, and the US elections on November 5th. Given these risk events, it's unlikely we will see the recent rally push much higher.

Corporate news

Colgate Palmolive fell pre-market despite posting Q3 earnings ahead of expectations and lifting its full-year guidance. The consumer products giant posted an EPS of $0.91, beating analysts' consensus of $0.88, while revenue came in at $5.03 billion ahead of expectations of $5.01 billion.

Apple is set to fall on the open after sales of the iPhone fell 0.3% in Q3 in China, while rival Huawei saw a 42% increase in its devices.

Decker Outdoor stock soared 14% after the shoe maker raised its annual sales forecast and beat second-quarter expectations on resilient demand.

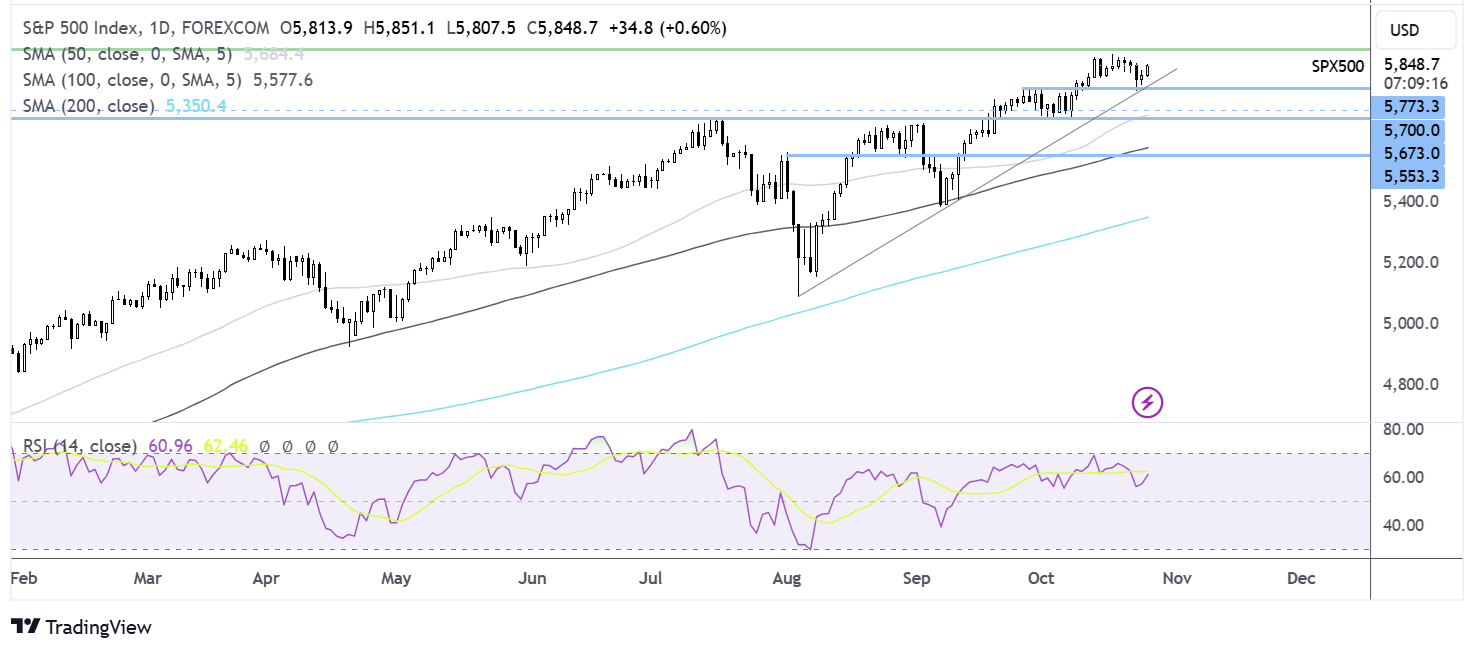

S&P500 forecast – technical analysis.

The S&P500 trades above its rising trendline dating back to August but has eased back from record highs of 5826. Buyers will look to rise above the 5826, to rise towards 5900. Sellers will need to break below 5800, the weekly low, to negate the near-term uptrend. Below her 5660, the October low comes into focus.

FX markets – USD flat, EUR/USD is set for a weekly loss

The USD is unchanged but set to book its fourth straight weekly rise, fueled by expectations of more gradual Fed rate cuts and uncertainties surrounding the US election.

EUR/USD is unchanged after German Ifo business sentiment came in stronger than expected at 86.5, up from 85.4 - a sign that sentiment is starting to improve. EUR/USD is on track for a fourth straight weekly decline on expectations the ECB will be cutting interest rates more aggressively than the Fed.

GBP/USD is rising towards 1.30, although gains could be limited ahead of next week's budget. UK consumer confidence fell to the lowest level since March amid concerns over possible tax hikes and demand sentiment in the lead-up to next week's autumn budget.

Oil is set for a 2% weekly rise.

Oil prices are trading modestly higher but are set for a weekly gain of around 2% as the market keeps an eye on tensions in the Middle East.

Uncertainties around the Middle East continue to keep oil markets on edge. Any escalation could prompt fears of supply disruption.

Investors are also waiting for more clarity on China's stimulus package, which was initially announced a month ago. The lack of details in some areas has left the market questioning whether it's enough to boost growth sufficiently.

Goldman Sachs left its oil price forecasts unchanged at between $70.00 and $85 a barrel for Brent in 2025. It expects the Middle East to be a bigger driver of oil prices than the possible impact of Chinese stimulus.