US futures

Dow future 0.65% at 40205

S&P futures 0.9% at 5440

Nasdaq futures 1% at 19030

In Europe

FTSE 0.90% at 8263

Dax 0.3% at 18350

- Stocks rebound as mega-caps recover

- Core PCE remains at 2.6% vs 2.5% expected

- Personal spending remains solid

- Oil falls for a third straight week

USD core PCE holds at 2.6% & mega-caps rebound

U.S. stocks point to a higher start as they recover from the weakness over the past few sessions, which saw the S&P 500 fall to a six-month low. An improved market mood and optimism of a soft landing helped lift stocks even as inflation was stickier than expected.

US core PCE was hotter than forecast at 2.6% annually, defying expectations of a tick lower to 2.5%. Meanwhile, on a monthly basis, core PCE rose 0.2%, up from 0.1% and ahead of expectations of 0.1%. Consumer spending remained healthy at 0.2%, and May's increase was revised higher to 0.4%, suggesting that consumers continued spending—a key factor to growth in the US economy.

Treasuries rose, and stock futures remained high after the inflation data on optimism that the Federal Reserve is managing to cool inflation without causing too much damage to the economy.

The data comes after yesterday's GDP data showed that the US GDP grew 2.8% in the second quarter, stronger than the 2% forecast and up from the previous 1.4% growth in Q1.

The data supports the view that the Federal Reserve will leave interest rates unchanged in next week's meeting but is likely to signal a September rate cut. This could be through Federal Reserve chair Jerome Powell's press conference, the policy statement, or potentially a mix of both.

Corporate news

3M is set to open 6% higher after the industrial giant lifted the low end of its full-year profit forecasts, raising the outlook on expectations that it would benefit from restructuring measures.

Apple has risen 1% premarket, lifted by the positive overall tone toward tech stocks despite shipments in China falling 6.7% in Q2.

Deckers are set to rise over 12% after the athletic shoe and apparel retailer lifted its annual forecast after best-than-expected Q1 numbers.

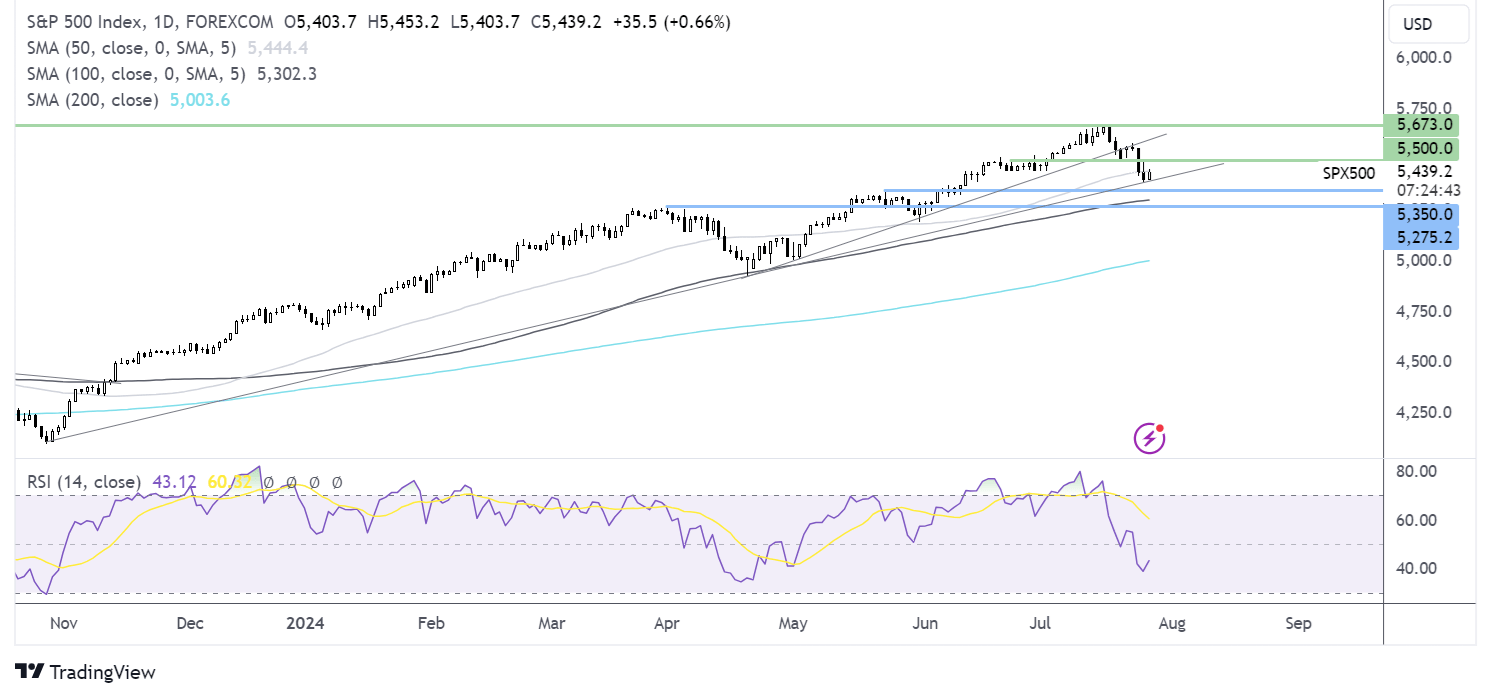

S&P 500 forecast – technical analysis.

The S&P500 found support on the rising trendline dating back to November last year. Buyers will look to retake the 50 SMA and 5500 to extend gains towards 5600, the near-term rising trendline. Meanwhile, sellers will need to break below 5390 and the rising trendline to test 5350, the May high, and 5275, the March peak.

FX markets – USD falls, EUR/USD rises

The USD trades flat following the core PCE data and is set to end the week at roughly where it started after a choppy week of trade. Amid expectations that the Fed will start to cut rates in September, the upside in USD could be limited

EUR is rising, but it's on track to fall across the week after more evidence that the economic recovery in the region is sluggish at best. PMI data this week showed business activity stalled and German manufacturing activity contracted sharply. Next week, attention will be paid to eurozone inflation data and GDP figures.

USD/JPY has recovered from a three-month low reached overnight, but it's still set to fall 1.8% this week, marking the fourth straight weekly decline. The move lower comes as the carry trade unwinds and ahead of both the Bank of Japan and Federal Reserve interest rate meetings next week, where the BoJ could hike rates by 0.1%

Oil falls for a third straight week.

Oil prices are holding steady but are set to decline over 2.5% this week, marking the third straight weekly decline. They are down over 4% so far in July amid concerns over the demand outlook in China and expectations of a Gaza ceasefire deal, which could see tensions in the Middle East ease and the risk premium on oil fade.

Data this week showed that China's oil demand fell by 8.1% to 13.66 million barrels a day, prompting concerns about the outlook for demand. Some of this weakness could be driven by falling gasoline demand as EV vehicles become more popular.

Meanwhile, in the Middle East, optimism surrounding a ceasefire in Gaza has been gaining momentum as the leaders of Australia, Canada, and New Zealand call for an immediate ceasefire. Meanwhile, US Vice President Kamala Harris has been adopting a tougher tone towards Israel Prime Minister Netanyahu.

Losses have been capped amid ongoing threats to production in Canada due to wildfires and after a large draw in US crude oil inventories.