US futures

Dow future 0.08% at 43789

S&P futures 0.01% at 5947

Nasdaq futures -0.12% at 20889

In Europe

FTSE -0.64% at 8170

Dax -0.7% at 19359

- Stocks hover around record levels after gains this week

- Fed cut rates by 25 basis points & Trump trade supports stocks

- US CPI data is due next week

- Oil falls but rises across the week

Fed cuts rates by 25 basis point

U.S. stocks are set to open modestly higher on Friday, remaining close to record highs reached this week as the markets digest the Federal Reserve rate cut and look ahead to next week’s inflation data.

The Federal Reserve cut interest rates by 25 basis points in line with expectations, and Federal Reserve chair Jerome Powell said the election would not impact monetary policy in the near term. Instead, he maintained that the Fed would remain data-driven. Understandably, Powell shied away from forward guidance given that it's unknown what policies Trump may implement and to what extent. However, Powell noted that the economy was performing well and that inflation was cooling, which was in line with the outlook.

The market is still pricing in a 75% chance of a 25 basis point cut in December. However, the market has also reined in rate cut expectations for next year, seeing the Fed cut less and the neutral rate higher than previously expected.

The Fed's decision comes after Trump's victory earlier in the week, which sent stock markets to record highs on expectations that Trump would implement business-friendly policies, deregulation, and corporate tax cuts.

Attention now turns to US inflation data next week, which could provide more clues over the Fed’s next steps.

Corporate news

Pinterest falls after forecasting weak sales in the holiday period, raising concerns that the image-sharing platform is struggling to keep pace with larger peers such as Meta and Snap.

Airbnb is falling after mixed quarterly results. While revenue beat forecasts, earnings came in one cent per share short of expectations, sending the share price 7% lower.

Upstart, the AI-focused lending marketplace, surged 20% after its Q3 results came in ahead of Wall Street's expectations. Upstart's last six cents per share in the quarter were much narrower than the 15-cent loss forecast. Revenue is 162 million ahead of the 150 million forecast.

.

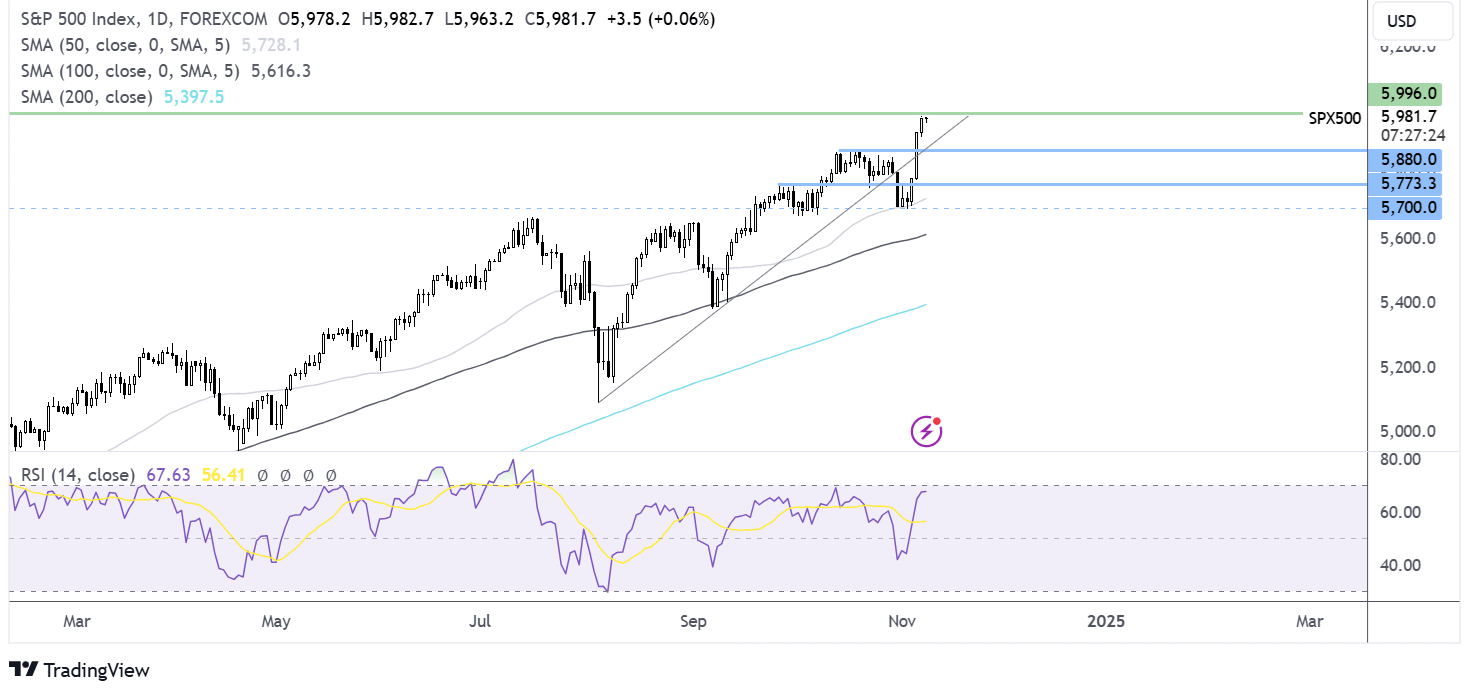

S&P500 forecast – technical analysis.

The S&P 500 rose above 5880 earlier in the week and trades around record highs just shy of 6000. With blue skies above, buyers will look to 6000 and fresh all-time highs. Support is at 5880, the September high, and 5775, the August high.

FX markets – USD rises, EUR/USD falls

The USD is rising recovering some of yesterday's losses after the Federal Reserve cut interest rates, in line with expectations. The US dollar is on track to book gains across the week on expectations that a Trump presidency could see inflationary policies implemented, slowing the pace at which the Fed can cut rates.

EUR/USD is falling and is set to fall throughout the week as the euro continues to weigh up the likely head of trade tariffs, which could impact the already fragile recovery in the economy. Any further weakness could see the ECB cut rates more aggressively, while the Federal Reserve may adopt a slower pace of cutting.

GBP/USD is falling but is still on track chain across the week after the Bank of England cut interest rates by 25 basis points. However, it lowered expectations of rate cuts in 2025 after labour's inflationary budget.

Oil falls but is set for a weekly rise.

Oil prices are falling over 1.5% on Friday as hurricane risks recede; however, oil is still on track to book gains of over 2.3% across the week.

Hurricane Raphael, which has caused just shy of 400,000 barrels per day of US crude oil production to be shut down, is forecast to ease over the coming days and move away from the US Gulf coast and oil fields.

Meanwhile, oil prices are also under pressure after data showed crude imports from China, the world's largest importer, fell 9% in October, marking the sixth straight month of declines. While more China stimulus was announced to shore up the economy ahead of Trump's arrival, the markets were disappointed by the announcement, seeing it as insufficient.

Meanwhile, oil prices are set to rise throughout the week as investors continue to consider how US president-elect Trump's policies could affect oil supply and demand. One possibility is that tighter sanctions on Iran and Venezuela would support the oil price.