This week tech stocks have declined noticeably, particularly Nvidia. But the major US indices still remain near all-time highs set in July. Historically, September has been a challenging month for the market, and although no major correction has occurred yet, investors are closely watching key support levels. If breached, these could signal further declines amid concerns over a weakening economy and looming elections uncertainty. For now, though, the current state of the charts suggests the S&P 500 forecast remains mildly positive, but will that change as we head deeper into September?

Impact of Economic Weakness and Elections Uncertainty on the S&P 500 Forecast

Investors are cautious for various reasons. These include geopolitical risks, such as US elections and potentially more US-China trade tensions. The soft patch in US data is also raising recession alarm bells. Additionally, weakness in China has also impacted global oil and metals prices, adding to the uncertainty in sectors like energy and mining. Despite this, the financial sector has shown resilience, helping balance out the broader market's weaknesses.

This week, it is all about the health of the US labour market. Weakening labour market data has recently dragged down the US dollar, and the response in the equities space hasn’t been great. So far this week, we have had two disappointing employment indicators from the US, namely JOLTS job openings and now ADP private sector payrolls (the latter rising by just 99K instead of 144K expected and prior number was revised lower too). From here, a substantial further decline in the US dollar would require further bearish US economic data this week. Friday's payrolls report is key in this regard. But any data-driven upside should be limited given the Fed’s clear signal that it will cut rates.

Should labour market conditions deteriorate further, as I suspect might be the case, recession fears could become more pronounced, especially as companies face reduced profits, leading to potential downward pressure on stock prices.

The bears would argue that even without these factors, there are no compelling reasons for continued buying without a correction, with companies about to head into their earnings buyback blackout periods.

September: A Historically Tough Month for Stocks

The market has so far remained supported by rising expectations that the Federal Reserve is almost certain to begin a policy easing cycle this month, potentially leading to rate cuts totalling 100 basis points by year-end. When it comes to the stock markets however, even with these expected rate cuts, the optimism may not be enough to sustain market momentum through the latter half of September. Seasonality is not in favour of the bulls, with the final two weeks of September historically being the worst period for the S&P 500.

S&P 500 Technical Analysis: Key Levels to Watch

Source: TradingView.com

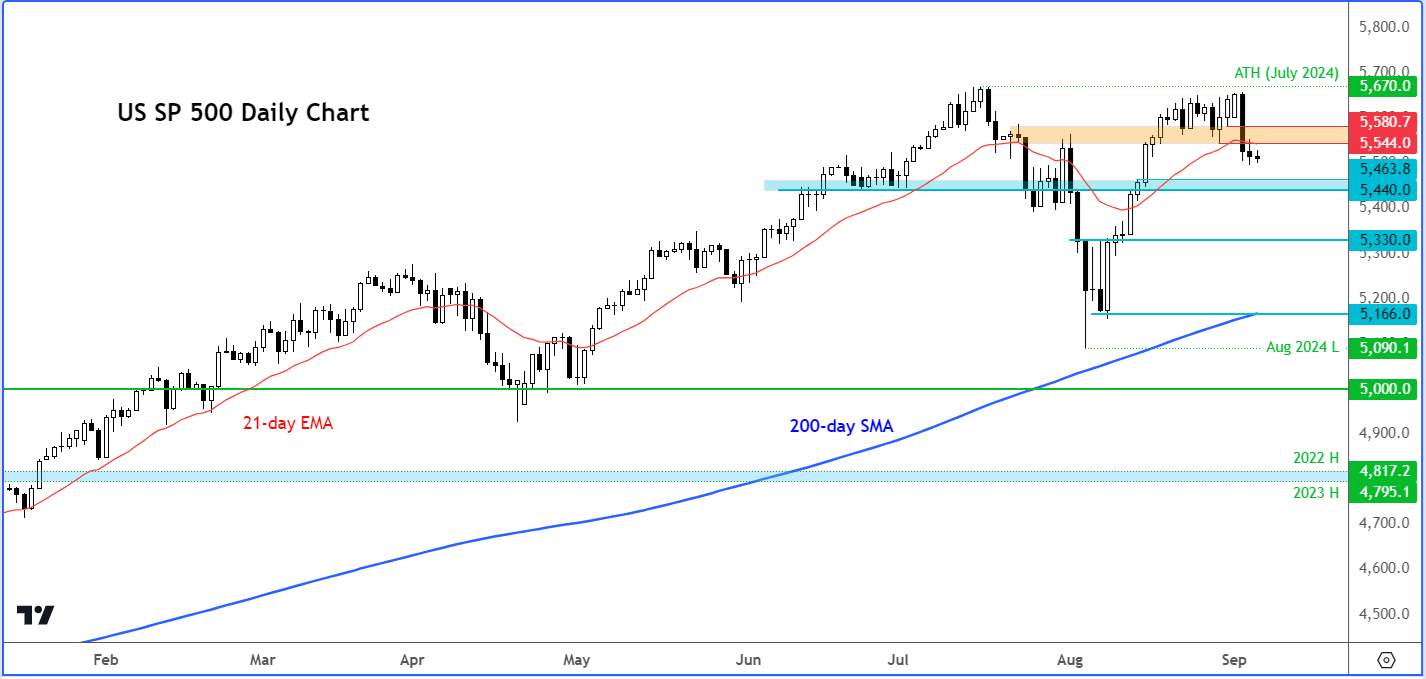

From a technical perspective, the bullish trend for the S&P 500 remains intact for now. A reversal has not yet been confirmed, even though bullish momentum has slowed in recent weeks. The market's performance in August showed resilience, with the S&P 500 recovering its early losses and some, but just falling short of its July record. A rally of only 2.7% from current levels would push the index to new highs.

Traders are watching closely for key technical signals. On the S&P 500 chart, the former support area between 5544 to 5580 is critical; a move back above this zone could spark a fresh bullish momentum. In contrast, if the index continues to slide, the next support zone between 5540 to 5463 should be monitored. A break below this could signal a deeper correction, with next support below this area seen around 5330 and then the 200-day moving average around 5166 being the next potential target for the bears.

In a Nutshell

In summary, while the S&P 500 forecast shows resilience, traders remain cautious, especially as economic indicators weaken. Investors will be closely following upcoming reports like the ISM services PMI survey (later today) and non-farm jobs data (on Friday) to gauge the market’s direction. The upcoming US elections and global geopolitical uncertainties further complicate the outlook. Traders therefore need to be vigilant and take it from one level to the next when it comes to trading in these sorts of conditions.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R