US futures

Dow futures +0.05% at 34667

S&P futures +0.07% at 4465

Nasdaq futures -0.01% at 15297

In Europe

FTSE +0.01% at 7527

Dax -0.55% at 15647

- US CPI rises 3.7% YoY vs 3.6% expected

- Oil prices rising keep another Fed hike in play

- USD edges higher

- Oil rises on supply deficit expectations

Rising inflation keeps another Fed hike in play

US stocks are pointing to a flat start as investors digest the latest inflation data and what it means for the future path of interest rates.

This week's key highlight, US inflation data showed that CPI rose by 3.7% YoY in August, up from 3.2% in July and ahead of the 3.6% forecast. Meanwhile, core CPI cooled in line with forecasts to 4.3% from 4.7%.

The rise in headline inflation comes hand in hand with the rising oil prices. Oil has rallied over 10% across the past three weeks amid tight supply concerns as Saudi Arabia and Russia extended voluntary supply cuts. Higher oil price lifts prices at the pumps. While this is impacting headline CPI now, as we know, this can seep into core CPI going forward.

The data comes as the Federal Reserve is not expected to raise interest rates in the September meeting. The market is pricing in a 95% probability that the Fed will leave rates unchanged.

However, the data supports the potential for another hike in the November meeting. The market is currently pricing in a 58% probability that the Fed will leave rates on hold in November. Although there is still plenty of data to be digested before this meeting.

Corporate news

Apple will be in focus as investors continue to digest the rather underwhelming “wanderlust” product launch event. Interestingly, it didn't raise the prices amid a sluggish market. Comments from China that it has not issued a ban on the purchase and use of phone brands could support Apple. These comments came in response to reports that some government agencies and firms had told staff that they could no longer use Apple iPhones at work.

Ford rises 1.5% premarket after the automobile maker announced plans to double production of its F-150 pickup truck in the coming year. This accelerates the move towards gas-electric vehicles amid a reluctance of US truck buyers to go all-electric.

BP is rising after CEO Bernard Looney resigned after spending less than four years as the head of the oil major. He is stepping down after failing to disclose previous relationships with colleagues.

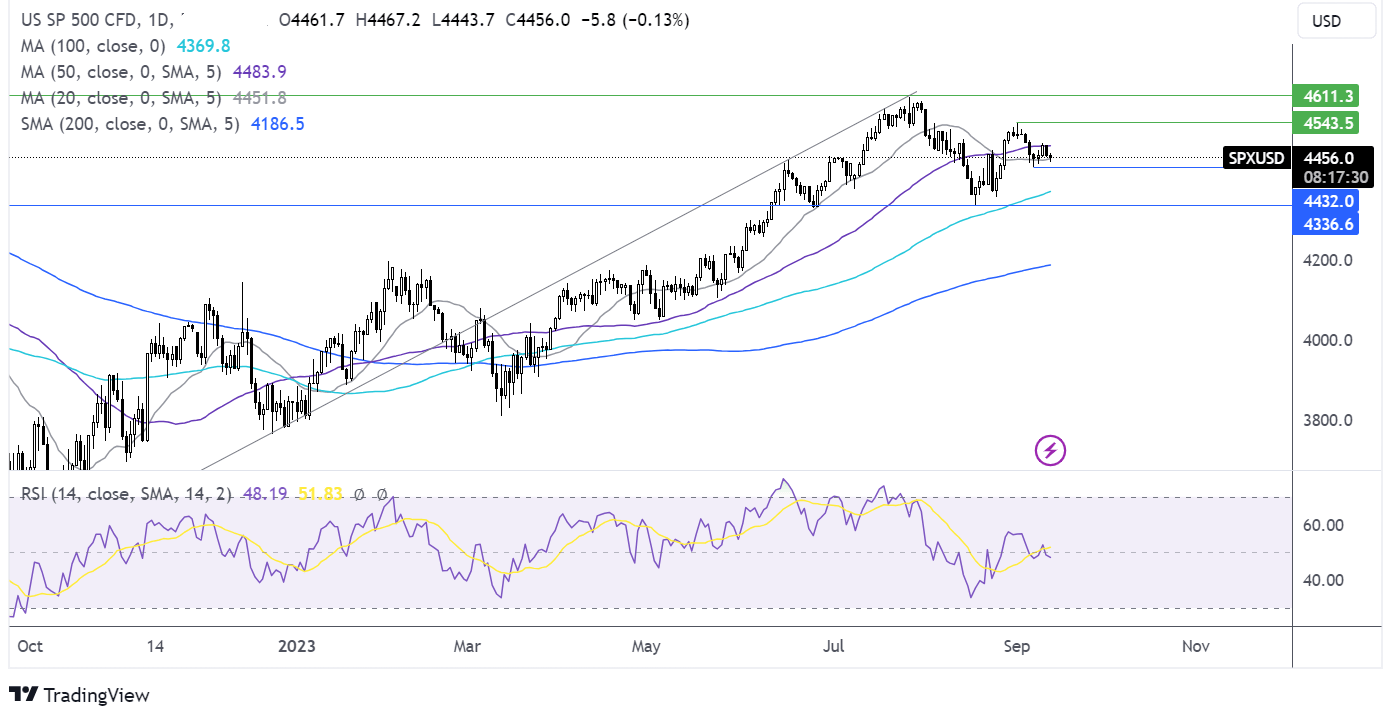

S&P 500 forecast – technical analysis.

After failing to rise above the 50 sma earlier in the week, the S&P 500 trades lower but remains in a tight range, caught between 4430 on the downside, the September low, and the 50 sma at 4480 on the upside. A breakout trade will see sellers look to break below 4430, exposing the 100 sma at 4365. Meanwhile, buyers could look for a rise above 4480 to extend gains to 4540 the September high.

FX markets – USD rises, GBP falls

The USD is rising, following inflation data. Whilst inflation ticked higher, the Federal Reserve is not expected to hike rates in September but could hike again in November.

EUR/USD is falling but holds above 1.0725 after eurozone industrial production fell by more than expected in July, adding to evidence that the region's economy is slowing. Industrial output fell 1.1% after rising 0.4% in June. Expectations had been for a fall of 0.7%. The euro has found some support after rumors yesterday that the ECB will upwardly revise its inflation forecast for the coming year to 3%, raising expectations of another rate hike at the meeting tomorrow.

GBP/USD is falling after data showed that the UK economy contracted at the fastest pace in seven months in July. UK GDP found 0.5% MoM in July after rising 0.5% in June. Economists had expected a contraction of 0.2%. The data adds to evidence that the UK economy is slowing as the sharp increase in borrowing costs by the BoE takes effect. While the Bank of England is expected to hike interest rates by 25 basis points next week, it's increasingly likely that that could be the last hike in this cycle.

EUR/USD -0.05% at 1.0713

GBP/USD -0.05% at 1.2469

Oil rises on supply deficit expectations

Oil prices are rising, adding to 2% gains in the previous session, boosted by reports that forecast Saudi Arabia and Russia's extended oil production cuts will mean a substantial oil deficit through the the fourth quarter.

OPEC+ began cutting supplies in 2022 to support the market. However, oil prices have rallied over 10% in the past three weeks after Saudi Arabia and Russia extended voluntary oil production cuts until the end of this year.

According to the latest International Energy Agency (IEA) report, these output curbs are expected to create a significant supply shortfall in the latter part of the year.

Meanwhile, both the IEA and OPEC, in their monthly reports were optimistic around Chinese demand across the rest of 2023, leaving their global demand estimates for this year and next largely unchanged.

Attention is now turning to the EIA stockpile data, which is expected to show at 26 million barrel draw. However, this comes after API data yesterday, which showed a 1.3 million barrel increase, defying expectations of a drawdown

WTI crude trades +0.6% at $88.80

Brent trades +0.6% at $92.90

Looking ahead

15:30 EIA US crude oil stockpiles